Credit Cards (US)

How do you get the Old Navy credit card?

The Old navy card has unique perks for people who like to buy basic clothing at brands like Gap Inc. So, check out how to apply for this card in our post!

Old Navy credit card

If you read our other posts about the Old Navy card, you probably know if this is a good fit for your lifestyle. So, if you want to know how to apply for this card that has unique rewards related to Gap Inc. and its family of brands, just keep reading our post. Here, we will also give you a comparison with another affordable card, so you can check the other options available in the credit card market.

THIS CARD HAS BEEN DISCONTINUED AND REPLACED WITH A NEWER PRODUCT. SEE THE LINK BELOW TO LEARN HOW TO APPLY FOR IT.

How to apply for the Navyist Rewards Mastercard®?

Learn how to apply for the Navyist Rewards Mastercard® how to get discounts and points on your preferred in-store or online brands.

Apply online

It can be easy to make an online application for Old Navy. You can go to the Old Navy website, check out the card options and choose this one. After that, you can provide your personal information. You can also read their privacy policy and terms and conditions before applying. And then, you can get a relatively quick response about your application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Old Navy has a mobile app for its cardholders, but you can only make your application to get the card through the online option. So, only if you already are a cardmember, you can enjoy the features of the Old Navy mobile app

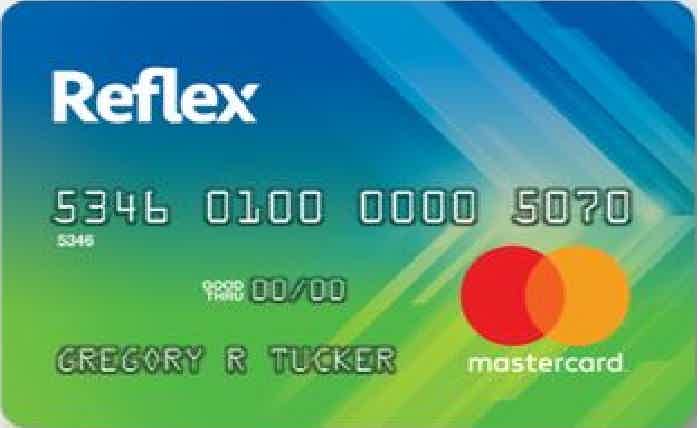

Old Navy credit card vs. Reflex Mastercard card

If you want to just check out some other options of affordable cards in the market, or if you just need a card that requires less credit score to get it, check out our comparison. We have prepared a comparison between the Old Navy and the Reflex Mastercard credit card.

| Old Navy | Reflex Mastercard | |

| Credit Score | Average to excellent | Every kind of credit score |

| Annual Fee | $0 | $75 to $99 |

| Regular APR | 25.99% variable APR | 24.99% to 29.99% variable APR |

| Welcome bonus | Get 20% off your first purchase | This card does not have a welcome offer available for cardholders |

| Rewards | For each $1 spent in Gap In., get 5 points For each $1 you spend anywhere else where Visa is accepted, get 1 point At every 500 points, you can get a $5 reward | This card does not offer any rewards |

How do you get the Reflex Mastercard Card?

Maybe the Reflex Mastercard card can be good for you to rebuild your credit history. So, check out how to get this credit rebuilding card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to exchange online with TradeStation wallet?

Are you looking for the best crypto wallet for experienced users? Check out our post to know all about how to buy TradeStation wallet!

Keep Reading

What is the meaning of a mortgage loan?

What is the meaning of a mortgage loan? Learn what it is, how it works, and the types available so you can decide wisely in case you need it.

Keep Reading

Acorns Checking Account review: No hidden fees!

If you need an account to invest and get bonuses, read our Acorns Checking Account review to learn more about it!

Keep ReadingYou may also like

Application for the U.S. Bank Cash+™ Visa Signature® card: how does it work?

Learn how to apply for the U.S. Bank Cash+™ Visa Signature® card and get cashback on every purchase. It has many bonus categories you can choose to get even more cashback.

Keep Reading

A small glossary of investment terms: a guide for starters!

Do you know what a bond is? And what about stocks or IPO? These are investment terms, and we'll talk more about them in this content.

Keep Reading

Learn to apply easily for Sallie Mae Student Loan

Here’s a quick and easy-to-follow step-by-step guide for you to get your Sallie Mae Student Loan.

Keep Reading