Credit Cards (US)

Upgrade Triple Cash Rewards Visa® Card application

The Upgrade Triple Cash Rewards Visa® is a hybrid credit card and personal loan at low costs. It offers rewards and zero fees. Learn how to apply for it!

Learn how to apply and get your Upgrade Triple Cash Rewards Visa® Card.

The Upgrade Triple Cash Rewards Visa® card is featured by the fintech company Upgrade that promises to deliver a new banking experience to its customers.

The credit card works as a hybrid credit card and personal loan, but it doesn’t cost a fortune. There is no annual, activation, or maintenance fees charged.

Plus, the credit lines range from $500 to $25,000, and it offers a $0 fraud liability.

Furthermore, you get unlimited cash back on all payments, starting at 3% on some categories and 1% on all others.

Finally, check out how to apply for it!

Apply online

Access the Upgrade’s website and choose the Triple Cash Rewards Visa®.

Then, click on Get Started.

Note that it requires a good credit score for the application process. On the other hand, it checks the credit line for free and does not impact your score.

After that, fill in the forms with your personal information, individual annual income, and additional annual income. And submit it.

It’s important to note that the card is not available for residents from the following states: DC, IA, WV, and WI.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After getting approved in the process, you can download the Upgrade mobile banking app to manage your card information.

Upgrade Triple Cash Rewards Visa® vs. Bank of America® Unlimited Cash Rewards

Both of them are excellent credit cards. Although the Bank of America® Unlimited Cash Rewards offers a good welcome bonus, the Upgrade Triple Cash Rewards Visa® has a higher tier of cash back.

So, check out the comparison chart below to make a wise decision.

| Upgrade Triple Cash Rewards Visa® card | Bank of America® Unlimited Cash Rewards credit card | |

| Credit Score | Average – Excellent | Good – Excellent |

| Annual Fee | $0 | $0 |

| Regular APR | 14.99% – 29.99% variable. | From 13.99% to 23.99% |

| Welcome bonus | $200 bonus after opening a Rewards Checking account and making 3 debit card transactions. | $200 |

| Rewards | Up to 3% cash back on payments. | 1.5% cash back on all purchases |

How to apply for a Bank of America® Unlimited card

Bank of America® Unlimited Cash Rewards credit card gives you cash back on all purchases. See how to apply for it!

Disclaimer: To qualify for the welcome bonus, you must open and fund a new Rewards Checking account and make 3 qualifying debit card transactions from your Rewards Checking account within 60 days of the date the Upgrade Card account is opened. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade VISA® Debit Card Agreement and Disclosures for more information. Your Upgrade Card and Rewards Checking account must be open and in good standing to receive a bonus. If you have previously opened a Rewards Checking account or do not open one as part of this application process, you are not eligible for this welcome bonus offer. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking account as a one-time payout credit within 60 days after the 3rd qualifying card purchase.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to get NYCM Home Insurance?

Check out how the NYCM Home Insurance application works and how to access premium coverage products with competitive prices and discounts.

Keep Reading

Discover it® Student Chrome credit card full review

No annual fee with a chance to build a credit score? Check the Discover it® Student Chrome credit card full review out! Read more.

Keep Reading

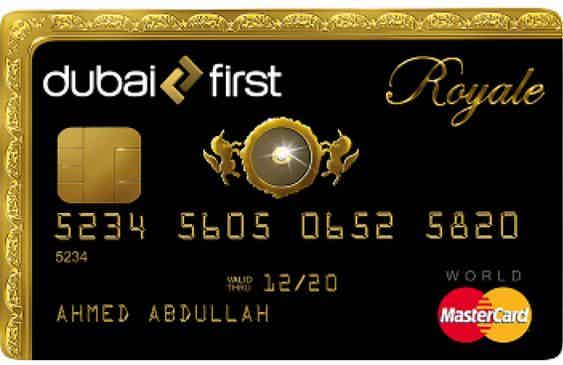

Dubai First Royale credit card full review

The Dubai First Royale credit card is made for the most exclusive people in the world. Learn more about this luxurious card.

Keep ReadingYou may also like

Chase Freedom Unlimited® review: is it worth it?

Chase Freedom Unlimited® is a simple, straightforward product. Its 1.5% cash back on all purchases makes it easy to earn rewards no matter where you shop. And, there's no annual fee! Read our review to learn about its features.

Keep Reading

Learn to apply easily for CashUSA.com

Find out how to apply easily for CashUSA.com. This quick and easy guide will how to ensure up to $10,000 for multiple purposes! Read on!

Keep Reading

HSBC Cash Rewards Mastercard® credit card review: is it worth it?

Would you like to have a card with no annual fee that gives you rewards every time you use it? Your wish has been granted. The HSBC Cash Rewards Mastercard® will give you this and more. Please, keep reading this article to find out more about its benefits!

Keep Reading