Credit Cards (US)

Dubai First Royale credit card full review

The Dubai First Royale credit card is an international card. It is made for luxurious people and it has exclusive benefits. Find out more about this card.

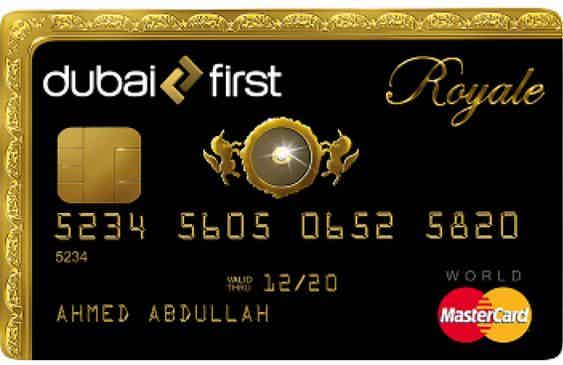

Dubai First Royale credit card

The Dubai First Royale credit card is an international card with no credit limit. This card is made for the most exclusive people in the world. Even though the card is from the United Arab Emirates, cardholders can use it in any part of the world.

The approximately 200 cardholders have access to dedicated customer service. It includes a 24/7 relationship manager and a lifestyle manager, who can get you anything from simple airplane tickets to seats for the Oscars.

This is an exclusive credit card for multi-millionaires who live in the United Arab Emirates. But to qualify for this luxurious card, you have to be more than just a multi-millionaire because you will need an invitation straight from Dubai First. So keep reading to see a full review of this luxurious card.

How do you get the Dubai First Royale credit card?

Here is all you have to know If you want to get the Dubai First Royale card.

How does the Dubai First Royale credit card work?

The premise of this credit card card is that you have to be an exclusive potential client and you need to have an extremely high cost of living to get this card. Even if you are a multi-millionaire, you might not be able to get it because it is invite-only.

Dubai first is a company that wants to give its clients the best treatment. So if you have this card, the company will give you personalized benefits. Also, the company adjusts the interest rate according to your spending habits.

In addition, the credit card company prefers to keep some undisclosed information about client benefits and related subjects. But you can find the available information here, so we recommend you read our other posts about this card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Dubai First Royale Credit card benefits

Pros

This is an exclusive card for few select clients. It has no credit limits and no spending restrictions. Also, you can have personalized card benefits and access to a relationship manager and a lifestyle manager.

Cons

You have to be invited by Dubai First and be at least a multi-millionaire to get this card. And there is little information about how the card works unless you are qualified to get invited.

Should you get Dubai First Royale card?

By this point, you should know that to get this card you have to be very rich already or get extremely rich somehow.

If you are a multi-millionaire that would like to have unlimited exclusive benefits and one of the best customer services for cardholders, then you should definitely get this card.

How good does your credit score need to be?

To get this card, Dubai First has to send you an invitation and you have to be qualified to be one of their exclusive clients. Therefore, there is no credit score requirement, but you should probably have a very good one as this card only invites the richest of the rich.

How to apply for Dubai First Royale credit card?

Probably one of the only downsides of this card is that there is no way to apply for it. To get this card, Dubai First has to invite you.

How do you get the Dubai First Royale credit card?

Here is all you have to know If you want to get the Dubai First Royale card.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Stratus Rewards Visa Credit Card review

Check out our Stratus Rewards Visa Credit Card review and learn how you can reach prestige and luxury on a global scale!

Keep Reading

What are the four types of welfare?

Do you know what the four types of welfare are? Read this post to find out everything you need about the types of government aid programs.

Keep Reading

Chase Ink Business Preferred® Credit Card review

Are you looking for a card to earn points for your business? Read our Chase Ink Business Preferred® Credit Card review to learn more!

Keep ReadingYou may also like

Marriott Bonvoy Boundless® Credit Card review

Are you looking for a hotel credit card with great rewards? Check out the Marriott Bonvoy Boundless® Credit Card review! You can earn free night awards and bonus points on everyday purchases. Read on!

Keep Reading

Earn back: Bank of America® Unlimited Cash Rewards Secured review

Bank of America® Unlimited Cash Rewards Secured is the credit builder card with unlimited cash back and no annual fee! Read on and learn more!

Keep Reading

Chase Secure Banking℠ application: how does it work?

Are you looking for a simple and budget-friendly way of managing your finances? Check out Chase Secure Banking℠! This simple guide will help set up your financial future. Read on!

Keep Reading