Credit Cards (US)

Discover it® Student Chrome credit card full review

Are you a student and need to start thinking about your financial life planning? The Discover it® Student Chrome credit card can help you with it. Check out the full review!

A great start with Discover it® Student Chrome credit card

The Discover it® Student Chrome credit card is an option for students who do not have a credit score and want to build it.

The card doesn’t require a credit history. As well as it offers a $0 annual fee and a package of benefits and rewards, including a welcome bonus.

Then, take a look at the review we have prepared for you, so you can focus on your future.

| Credit Score | Fair (and no credit history required) |

| Annual Fee | $0 |

| Regular APR | From 12.99% to 21.99% |

| Welcome bonus | Cashback Match program in the first year |

| Rewards | From 1% to 2% cashback |

How to apply Discover it® Student Chrome card

The Discover it® Student Chrome credit card is a good choice for students who need a start in financial planning. See how to apply for it now!

No annual fee, 0% Intro APR, Cashback Match and more

Are you looking for a credit card that helps you with building your credit history? The Discover it® Student Chrome delivers that and more.

First of all, there is no annual fee. Also, there is a 0% Intro APR on purchases in the first 6 months.

Second, there is a welcome bonus in the first year, which Discover matches the cashback you earned. For example, if you earn $50 cashback, Discover will add $50, summing $100 cashback.

Third of all, it offers a flexible cashback reward program, from 1% on all purchases and 2% on purchases at gas stations and restaurants, combined up to $1,000 in each quarter.

Finally, this cashback can be redeemed as a statement credit, purchases on specific stores, or transfers to a bank account. And there is no expiration date or limit whatsoever.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

All benefits you need by Discover it® Student Chrome card

The Discover it® Student Chrome credit card offers a good reward program, even with an average rate from 1% to 2%. Also, you may find it is difficult to understand the 2% tier, as it requires combined purchases on specific categories each quarter, up to $1,000.

However, it provides you with the chance of building credit history with no annual fee and an intro APR of 0.

That is why it is an option for students who are beginning to think of their financial life planning.

And thinking of it, Discover offers two programs:

- Good Grade Reward: you can earn $20 each school year your GPA is at least 3.0, up to 5 years;

- Refer-a-friend program: as a cardmember, you can get a statement credit when you refer a friend, and they get approved.

Plus, you can download the Discover Mobile App and stay 24/7 tuned to monitor your financial activity.

Furthermore, you can choose the card design that fits your profile. And those designs are beautiful.

Pros

- No annual fee

- 0% Intro APR on purchases

- Helps to build credit history

- Welcome bonus

- Refer-a-friend feature

- Discover Mobile App

- Reward program

Cons

- Average cash back rate

- Limited categories and amount on the 2% cash back tier each quarter

Credit score recommended for the application

The good thing about this student card is that you don’t need a credit history to apply for it. So, you can build a credit score using it.

Learn how to apply for a Discover it® Student Chrome credit card

The Discover it® Student Chrome card is designed to help students begin their financial life planning. Then, check out now how to apply for it!

How to apply Discover it® Student Chrome card

The Discover it® Student Chrome credit card is a good choice for students who need a start in financial planning. See how to apply for it now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

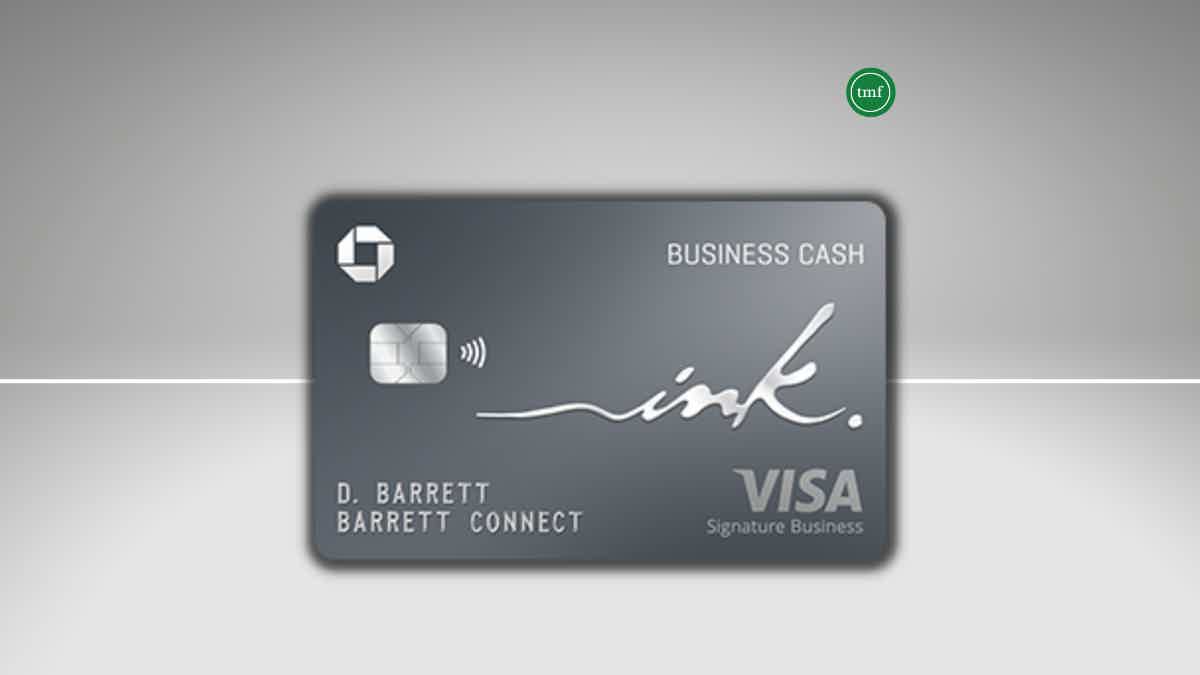

How to apply for an Ink Business Cash® Credit Card?

Learn how to apply for an Ink Business Cash® Credit Card and start earning unlimited cash back on office supply purchases, among other perks.

Keep Reading

What stores give credit easily?

Do you know what stores give credit easily? Find out which stores let you access amazing credit cards with a few eligibility requirements.

Keep Reading

10 best credit cards for travelling!

If you want to explore new places or simply need a hand with traveling expenses, here are the 10 best credit cards for travelling!

Keep ReadingYou may also like

Apply for the PNC points® Visa® Credit Card: $0 annual fee

Follow simple steps to apply for the PNC points® Visa® Credit Card online and unlock rewards and a 0% APR promotion. Stay tuned!

Keep Reading

Learn to apply easily for Auto Credit Express

Getting an auto loan with bad credit doesn't have to be difficult. Learn how easy it is to apply with Auto Credit Express, and get started on the road to driving your dream car today! Read on!

Keep Reading

NASB Mortgage review: how does it work and is it good?

Shopping around for a mortgage? Here's a lender that considers nonstandard audiences: NASB Mortgage! Keep reading!

Keep Reading