Loans (US)

Fundbox Business Loans review: quick and easy!

Are you looking for a loan to help your business now? If so, read our Fundbox Business Loans review to see if it's the right lender for you!

Fundbox Business Loans: find a solution for your business!

If you’re a business owner needing a loan, you may wonder if Fundbox is the right solution for you. In this article, you’ll see a Fundbox Business Loans review to learn more about this option!

How to apply for Fundbox Business Loans?

If you're a business owner looking for a loan to help you out, read our post to learn how to apply for Fundbox Business Loans!

| APR | It depends on the loan type and terms. |

| Loan Purpose | Business lines of credit. |

| Loan Amounts | It depends on the loan type and terms, but you can borrow up to $150,000, depending on your financial situation. |

| Credit Needed | Not informed. |

| Terms | It depends on the loan type and amount. |

| Origination Fee | It depends on the loan type and terms. |

| Late Fee | Not disclosed. |

| Early Payoff Penalty | There are no prepayment penalty fees. |

In this post, we’ll look closely at Fundbox and see what it offers business owners. Also, with Fundbox, you’ll be able to get high loan amounts with good terms.

So, if you’re ready to learn more about Fundbox, keep reading our Fundbox Business Loans review to see the pros and cons and more!

How does Fundbox Business Loans work?

With Fundbox, you can get business lines of credit to help your business grow like never before. Also, you can get fast access to your funds in as little as the next business day after approval.

Moreover, you can get up to $150,000 as a line of credit for your business, depending on your financial situation and business analysis.

Also, you can get flexible repayment terms. This way, you’ll only choose your loan repayment plan when you draw your funds. Moreover, there are no prepayment penalties.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Fundbox Business Loans benefits

As you can see, Fundbox Business Loans offers businesses an incredible line of credit of up to $150,000 for your business to grow even more! Also, you can get access to flexible loan repayment terms.

Moreover, you won’t have to pay a prepayment penalty fee. And the application process can be completed in as little as three minutes!

However, Fundbox Business Loans also has some downsides. So, you can read our pros and cons list below to learn more!

Pros

- You can apply with no harm to your credit score;

- There are no application fees;

- Easy and fast application process available.

Cons

- The rates can be higher than with traditional banks;

- You’ll get better rates with a higher credit score;

- There are only short-term payment options.

How good does your credit score need to be?

There is not much information about the credit score required to get a loan with Fundbox Business Loans. However, you don’t need to worry about the application process impacting your credit.

Fundbox informs you that you can apply without harming your credit score! But we recommend you have a high credit score if you want the best rates and terms for your line of credit.

How to apply for Fundbox Business Loans?

You can easily apply for Fundbox Business Loans online and whenever you are. Also, you can learn how to apply online and from their incredible mobile app!

How to apply for Fundbox Business Loans?

If you're a business owner looking for a loan to help you out, read our post to learn how to apply for Fundbox Business Loans!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Flare Account® by Pathward, N.A. full review

Check out our Flare Account® full review! It features rewards, APY on funds, and a mobile app where you can manage it all.

Keep Reading

How to join TIAA Bank: No monthly fees!

With TIAA Bank, you can access your high-yield account 24/7, and there are no monthly fees! Read more to learn how to join TIAA Bank!

Keep Reading

How to join J.P. Morgan Self-Directed Investing?

With J.P. Morgan Self-Directed Investing, you can start investing with a free commission and no account minimum required. Apply now!

Keep ReadingYou may also like

How to buy a second home with no down payment

Becoming a homeowner just got easier! Discover how to buy a second home with no down payment. Keep reading and learn more!

Keep Reading

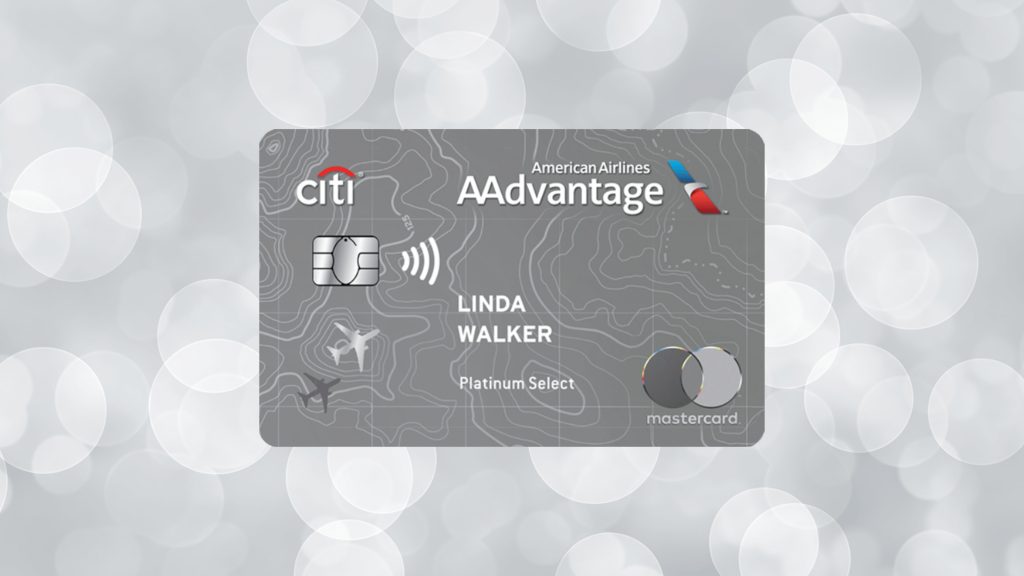

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® review

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® review will tell you everything you need to know about how this card works, what are its pros and cons and more. Check it out!

Keep Reading

Discover it® Cash Back Credit Card application: how does it work?

Applying for the Discover it® Cash Back Credit Card is easy! Enjoy 0% APR for 15 months and no annual fee! Read on and learn how to get your card!

Keep Reading