Credit Cards (US)

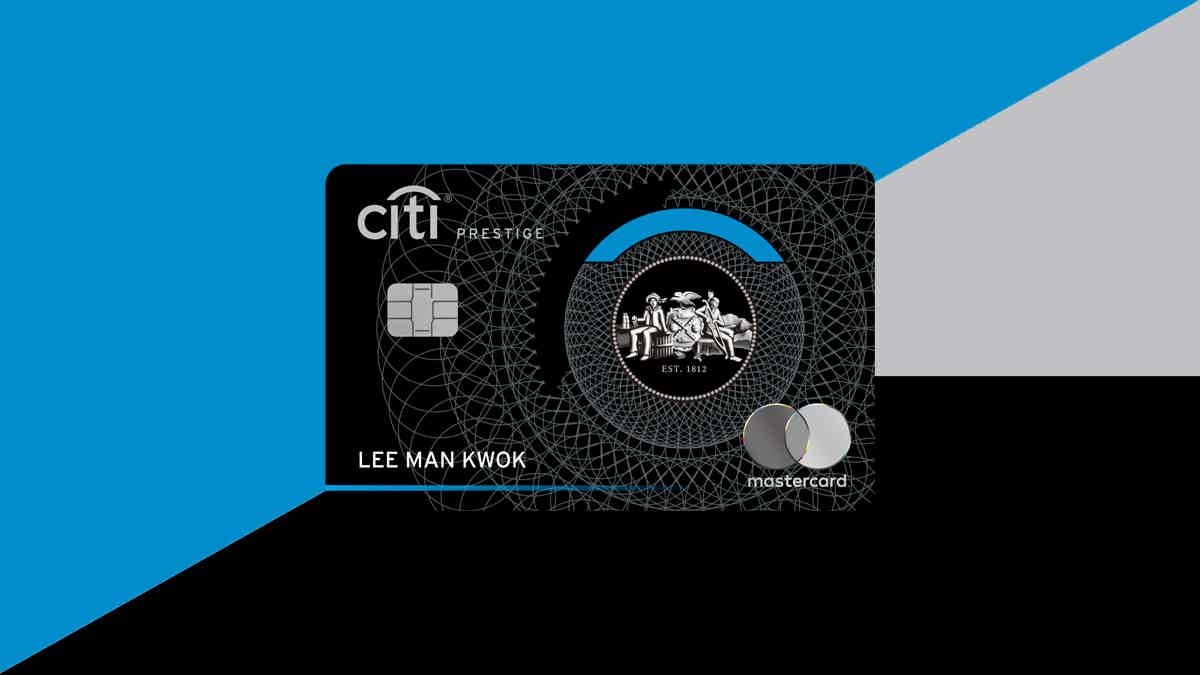

Citi Prestige Card Overview: Citi Prestige card.

The Prestige card from Citibank ranks among the most prestigious and globalized black cards of the world. Check out this Citi Prestige card overview to learn about its key features.

Citi Prestige Card: The best credit card for travelers.

Are you looking for a high-end credit card that comes with great rewards? The Citi Prestige card might be just what you’re looking for! In this Citi Prestige Card overview, we’ll take a closer look at the benefits and features of this product, so you can decide if it’s the right fit for you.

Citi Prestige is a high-end credit card that offers a variety of benefits, such as airline lounge access, free hotel stays, and an interesting annual travel credit. However, the card also has some drawbacks, such as a high annual fee and limits on earnings potential. So, is Citi Prestige worth it? Read on to find out!

How to apply for a Citi Prestige Card credit card

The Citi Prestige card from Citibank offers great welcome bonuses, in addition to having a simple signup process. Discover how to apply!

| Credit Score | Excellent |

| Annual Fee | $495 |

| Regular APR | 16.99% to 23.99% variable APR on purchases and balance transfers |

| Welcome Bonus* | 62,500 Citi ThankYouSM Points (25,000 Miles) Gadget Welcome Gift *Terms apply |

| Rewards* | Up to $100 every five years toward Global Entry or TSA Pre✓® 4th night free annual hotel stay Transfer points to a number of travel loyalty programs 5X points on air travel and dining 3X points on hotels and cruises 1X points on purchases and more *Terms apply |

What is special about this card?

In this Citi Prestige card overview, we want to highlight why Citi Prestige is so special. First, it differs from other ultra-exclusive cards from other brands.

For one thing, despite the costly fees, its high-earning rewards and other benefits might help you easily offset these costs over the years.

So, supposing you feel like this may be interesting for you, next we show you the conditions to qualify.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Who qualifies for the Citi Prestige credit card?

It is quite easy and simple to verify whether you can or cannot apply for the Citi Prestige. And this is due to Citibank’s user-friendly website.

In short, here is what you need: a score from 750 to 850; a minimum annual income of $120,000; and, also, to be 21 or older.

Now that you’ve read our Citi Prestige card overview, how about checking its full review? Follow the link below!

Citi Prestige credit card review

Despite being expensive, the amazing benefits of the Citi Prestige credit card from Citibank offeset its costly fees year after year.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

About the author / Thais Daou

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Sable Account?

Sable Account offers both debit and credit cards and has no monthly fees. Learn how to open an account today and enjoy all its benefits!

Keep Reading

How to get started with iSoftpull?

Check out how easy it is to get started with iSoftpull and join over 500 companies that have been achieving marketing and sales success.

Keep Reading

Should you consider a mortgage broker? Find out!

Mortgage brokers can be a huge help when trying to get your new home. But should you consider a mortgage broker? Read on to find out!

Keep ReadingYou may also like

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

Looking to apply for the Navy Federal cashRewards Credit Card? We'll guide you through an easy online application. $0 annual fee and $250 bonus cash back!

Keep Reading

Cheap WestJet flights: low fares from $49.99

Keep reading and learn how to save big on your next flight with Westjet airlines! Enjoy the Lower Fare finder and save a lot on your next trip!

Keep Reading

Chime Credit Builder Visa card review: get your credit score back in shape!

No fees and no security deposit, but also no APR and no credit check. That's how amazing your Chime credit card will be. This review will tell you if this credit card is legit.

Keep Reading