Credit Cards (US)

Bank of America® Customized Cash Rewards Secured Credit Card review

The Bank of America® Customized Cash Rewards Secured Credit Card is one of the few secured cards that offer all cardholders an opportunity to get more value for their money! Read our review to learn more.

Bank of America® Customized Cash Rewards Secured Credit Card: Build a solid score while earning cash back!

If you’re looking to improve your credit score while still earning rewards, Bank of America® Customized Cash Rewards Secured Credit Card is the right choice for you.

It gives cardholders access to Bank of America’s popular cash-back program and allows them to customize their rewards depending on their lifestyle and spending habits.

Cardholders can earn up to 3% cash back on purchases and they will also receive a security deposit equal to the amount of their credit line.

The card makes it easier than ever to start building better credit. The Customized Cash Rewards Secured Credit Card is an excellent option for those who want more control over their credit cards and rewards.

| Credit Score | Poor or limited. |

| Annual Fee | No annual fee. |

| Regular APR | 27.74% variable. |

| Welcome bonus | N/A. |

| Rewards* | Get 3% cash back in one category of your choice: home upgrades, online purchases, dining, gas, and drug stores. Earn 2% cash back for purchases at grocery stores and wholesale clubs. Earn 1% cash back on every other purchase. *Terms apply |

How to apply for the BoFa Customized Secure Card?

Check out how you can apply for the Bank of America® Customized Cash Rewards Secured Credit Card to help you strenghten your score and get rewards on your purchases!

How does Bank of America® Customized Cash Rewards Secured Credit Card work?

The BofA Customized Cash Rewards Secured Credit Card is a money management tool offered to Bank of America customers. With this card, you can build credit while receiving cash rewards.

Unlike traditional credit cards, this secured card requires you to deposit a cash amount into a Bank of America account to secure the line of credit. That amount can vary from $200 up to $5,000.

Bank of America® allows customers to earn unlimited 1% cash back on every purchase, with 2% cash back at grocery stores and wholesale clubs, and 3% cash back on the category of your choice for the first $2,500 combined each quarter.

Bank of America also offers fraud protection and mobile wallet access for extra convenience. With Bank of America® Customized Cash Rewards Secured Credit Card, taking control over your financial future has never been easier!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What are the benefits to this card?

Pros

- Get zero liability coverage on unauthorized charges made on your card.

- 3% cash back in a category of your choice.

- 2% cash back for purchases made at groceries and wholesale clubs.

- Also, there is 1% cash back for any other purchase you make.

- This credit card sends your monthly reports to all three major credit bureaus.

- There is no annual fee.

Cons

- There is a foreign transaction fee of 3% charged by this card.

- To get this card, you will need to make a deposit that ranges from $300 to $4,900, depending on your application context.

Should you get a Customized Cash Rewards Secured Credit Card?

This Bank of America secured card can be very useful for those who want to build credit and like to deal with cashback rewards.

Moreover, you can access your credit score and get your monthly payments sent to all three major credit bureaus. So, if you fit this profile, and you need a credit card that can accept not-so-good scores, this can be a great card for you.

How good does your credit score need to be?

To get this credit card, you do not need a very high credit score. So, you can have a score ranging from poor to limited. However, this will affect some of the fees charged by this credit card.

How to apply for a Bank of America® Customized Cash Rewards Secured Credit Card?

To complete your application process to get this credit card, you can go to Bank of America’s website and do it all online.

So, if you want to know more about how this process works, check out our post below with more information about how to apply!

How to apply for the BoFa Customized Secure Card?

Check out how you can apply for the Bank of America® Customized Cash Rewards Secured Credit Card to help you strenghten your score and get rewards on your purchases!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the BankAmericard® Credit Card?

See how to apply for a BankAmericard® Credit Card and enjoy low costs at a 0% introductory APR period for purchases and balance transfers.

Keep Reading

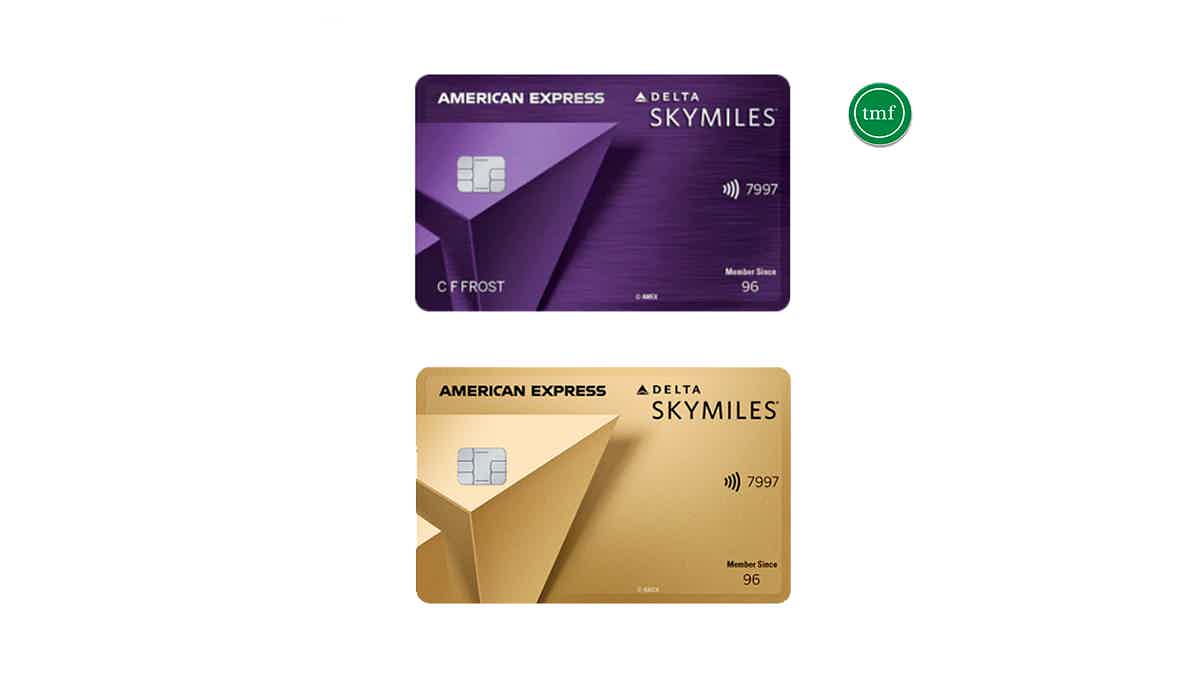

Delta SkyMiles® Gold American Express Card vs Delta SkyMiles Reserve: card comparison

Which is the best for you: Delta SkyMiles® Gold American Express card or Delta SkyMiles Reserve? Check out the comparison and decide today!

Keep Reading

How to join Accepted Merchandise Credit Account?

Looking for an account that offers a card for purchases at an outlet? Read on to learn how to join the Accepted Merchandise Credit Account!

Keep ReadingYou may also like

6 Best Online Checking Accounts: Maximize Your Money Management

Feeling overwhelmed by online checking options? Our guide simplifies your search! Compare features, rates, and fees to find the best online checking accounts for your finances. Start saving now!

Keep Reading

Learn to apply easily for the Bank of America Mortgage

Do you need a guide to apply for the Bank of America Mortgage? Then read on! Learn how to qualify for personalized rates in no time!

Keep Reading

Sallie Mae Student Loan review: how does it work and is it good?

If you’re looking for a solid student loan option, the Sallie Mae Student Loan should certainly worth checking out.

Keep Reading