CA

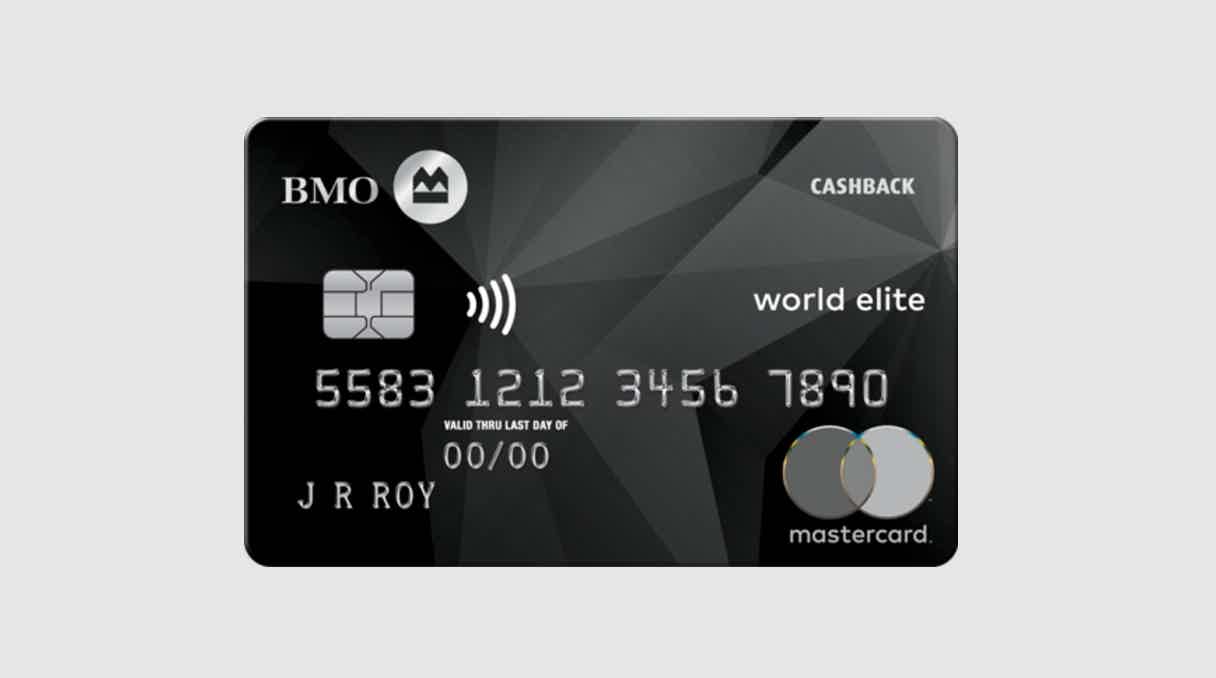

BMO CashBack® World Elite® Mastercard® card full review

A strong insurance and protection, a great tier of rewards, a good welcome offer, and more. Read our BMO CashBack® World Elite® Mastercard® review to learn more about it!

BMO CashBack® World Elite® Mastercard® card

Hello, Canadians! Are you ready to meet a new credit card featured by BMO? Because the content is pretty good! Then, check out our BMO CashBack® World Elite® Mastercard® review!

So, everyone searches for cashback, right? But not all cards offer that, and even those that offer it don’t give you the high tier you deserve.

Well, that’s not the case with BMO CashBack® World Elite® Mastercard®. You can earn up to 5% cashback on all purchases, plus up to 10% as a welcome bonus.

Keep reading to learn how it works!

| Credit Score | Good – Excellent |

| Annual Fee | $120 |

| Regular APR | From 20.99% to 22.99% (21.99% for Quebec residents) |

| Welcome bonus | Up to 10% cashback in the first 3 months, and no annual fee in the first year |

| Rewards | Up to 5% cashback on all purchases |

How to get BMO CashBack® World Elite® Mastercard®?

Earn up to 5% cashback with the BMO CashBack® World Elite® Mastercard® card! Learn now how to apply for one!

How does the BMO CashBack® World Elite® Mastercard® credit card work?

Let’s get started with the unboxing. First of all, by signing up for this card, you will be received with a welcome offer of up to 10% cashback in the first three months, plus the annual fee of $120 will be waived.

Second of all, it offers the best tier of rewards for groceries, in which you can earn 5% cashback on this category.

Then, you earn 4% on gas and transit, 2% on recurring bills, and 1% on all other purchases.

Plus, these rewards can be redeemed as you wish, with no limit and minimum amount.

Also, it offers roadside assistance, travel, and medical protection (see terms and conditions at BMO website).

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

BMO CashBack® World Elite® Mastercard® benefits

A Mastercard is always a great deal. It is a worldwide accepted flag that delivers convenience and assistance when needed.

And the BMO CashBack® World Elite® card follows it. Besides the cashback, this credit card provides you with some privileges and benefits that other cards don’t.

As a result, you will feel peace of mind to know that you are assisted all the time.

But before applying for one, check out the list of pros and cons right below!

Pros

- A great welcome offer with cashback and annual fee waived

- A strong insurance package

- Unlimited cashback with no minimum amount to redeem

- Mastercard convenience and acceptance

- Discounts for exclusive events

Cons

- Annual fee

- It requires a good credit score

- It requires a minimum individual $80,000 or $150,000 (household) annual income

How good does your credit score need to be?

This card is great, but it requires a minimum 740-credit score and a minimum individual $80,000 or $150,000 (household) annual income in Canada.

How to apply for a BMO CashBack® World Elite® Mastercard®?

If you meet the requirements above, you may ask for a BMO CashBack® World Elite®. Learn now how to apply for it by reading our next post!

How to get BMO CashBack® World Elite® Mastercard®?

Earn up to 5% cashback with the BMO CashBack® World Elite® Mastercard® card! Learn now how to apply for one!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Tangerine Money-Back credit card?

Get up to 2% money-back with no annual fee featured by the Tangerine Money-Back credit card. Learn how to apply for it today!

Keep Reading

The complete guide on how to fix bad credit in Canada

If you have a poor credit score, you may face challenges along your financial path. Today, we will teach you how to fix bad credit in Canada!

Keep Reading

Capital One Aspire Travel™ Platinum Mastercard® credit card: How to apply?

Capital One Aspire Travel™ Platinum Mastercard® credit card offers unlimited rewards and convenient benefits with no annual fee. Apply now!

Keep ReadingYou may also like

FIT™ Platinum Mastercard® credit card review: easy to get, efficient to build credit

Are you trying to rebuild your credit history, but no credit card issuers are willing to give you this chance. Don't worry. FIT™ Platinum Mastercard® will help you with a $400 credit limit.

Keep Reading

Costco Anywhere Visa® Card by Citi application: how does it work?

Do you want a credit Card to help you earn cash back at Costco? Read on to learn how you can make the application for the Costco Anywhere Visa® Card by Citi.

Keep Reading

Application for the Freedom Gold card: how does it work?

In this article, we'll walk you through how to apply for the Freedom Gold card and tell you about its benefits. Please, read this content to see how you can get one.

Keep Reading