CA

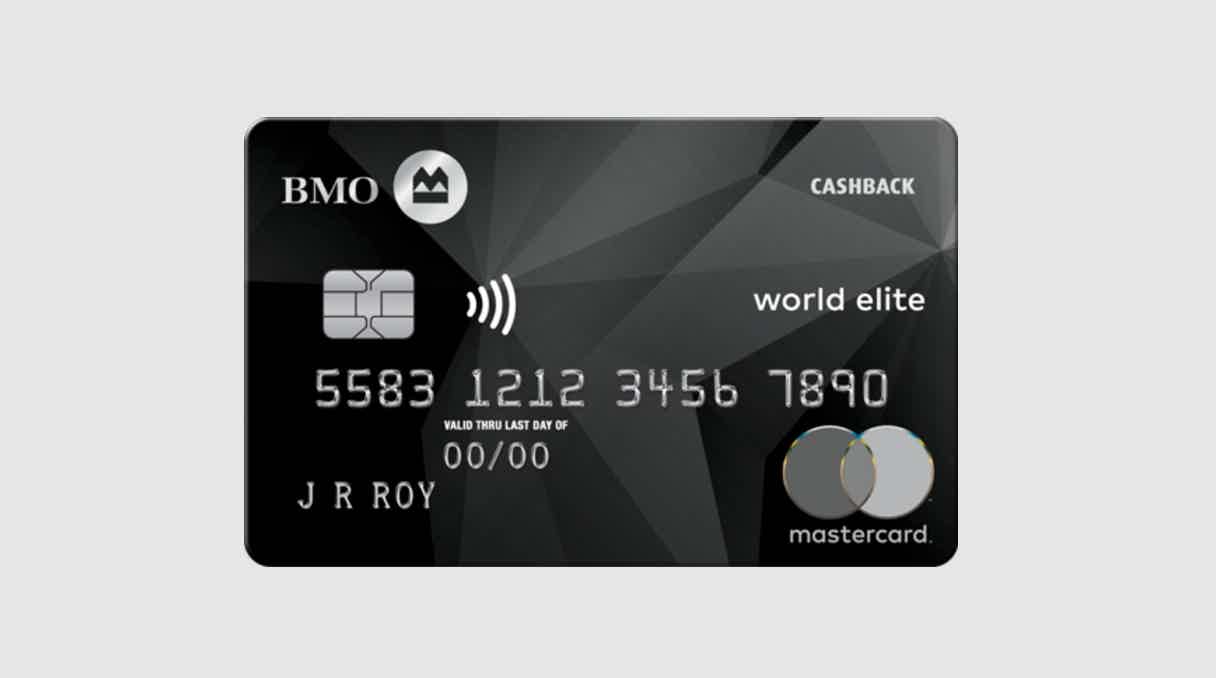

How to apply for the BMO CashBack® World Elite® Mastercard® credit card?

The BMO CashBack® World Elite® Mastercard® card will perfectly fit into your wallet. And you can earn a good package of rewards by signing up for it today. So, check out how to apply!

BMO CashBack® World Elite® Mastercard® credit card application

BMO features a credit card with a strong insurance package, the BMO CashBack® World Elite® Mastercard® card. But it is not only that. The best tier of cashback for groceries is here!

I know that you love spending your money buying at grocery stores in Canada. So, what’s the problem with making some cash while spending it, right?

With this Mastercard, you will be satisfied to know that you are protected and assured, at the same time as you are being rewarded with unlimited cashback on all purchases and a great welcome bonus.

However, before applying for one, note that it requires at least a good credit score and a minimum individual $80,000 or $150,000 (household) annual income.

Apply online

Access the BMO website at https://www.bmo.com/ and go to the Personal tab right on the left corner. Then, select Credit Cards and choose the BMO CashBack® World Elite® Mastercard®.

After that, click on Apply Now.

Also, it requires that you haven’t declared bankruptcy in the last seven years.

Fill in the forms with the following information:

- Personal

- Contact

- Address (needs to be a Canadian resident)

- SIN

- Employment

- Features you want

Finally, submit it and wait for the approval.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After getting approved, download the BMO mobile banking app to check your credit card and financial information.

BMO CashBack® World Elite® Mastercard® vs. BMO CashBack® Mastercard®

If you got a good credit score, you may find the BMO CashBack® World Elite® Mastercard® better since it features a higher tier of rewards.

However, if you don’t have a good credit score, you can apply for a BMO CashBack® Mastercard®, which does not charge an annual fee and gives you a welcome offer, too.

| BMO CashBack® World Elite® Mastercard® | BMO CashBack® Mastercard® | |

| Credit Score | Good – Excellent | Fair – Good – Excellent |

| Annual Fee | $120 | $0 |

| Regular APR | From 20.99% to 22.99% (21.99% for Quebec residents) | From 19.99% to 22.99% |

| Welcome bonus | Up to 10% cashback in the first 3 months, and no annual fee in the first year | Up to 5% cashback in the first 3 months |

| Rewards | Up to 5% cashback on all purchases | From 0.5% to 3% cashback |

How to apply for a BMO CashBack® Mastercard® card?

BMO CashBack® Mastercard® credit card features cashback, welcome bonus, and more. See how to apply for one now and enjoy its benefits!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Wealthsimple Trade full review

Low costs, a great online platform, mobile app, and promotion available: check out now the Wealthsimple Trade full review!

Keep Reading

How to apply for the Syncro Mastercard® credit card?

Learn how to apply for a Syncro Mastercard® credit card and start getting one of the lowest interest rates available on the market nowadays.

Keep Reading

Mycredit Mastercard® credit card review

Check out the Mycredit Mastercard® credit card review in this blog to learn how it works and decide if it is suitable for your daily routine.

Keep ReadingYou may also like

Red Arrow Loans review: how does it work and is it good?

Do you need extra cash and are considering a Payday Loan? If so, check out our Red Arrow Loans review, and understand how you can get some money quickly and safely. Read on!

Keep Reading

3 Best student credit cards: choose yours!

In this article we point out the most important factors you should consider when choosing a student credit card, and give you 3 recommendations.

Keep Reading

Learn to easily apply for the Upgrade Personal Loan

Do you need personal loans for an emergency? If so, you can read on to learn how to apply for Upgrade Personal Loan and get up to $50,000!

Keep Reading