Reviews (US)

Bank of America® Travel Rewards for Students card review

The Bank of America® Travel Rewards for Students card simplifies reward programs with few drawbacks to its members. Check our Bank of America® Travel Rewards for Students card review to learn more!

Bank of America® Travel Rewards for Students card: save money with unlimited benefits and no annual fees

The Bank of America® Travel Rewards for Students card offers a wide range of travel benefits for those wanting to start their financial future, all with very few drawbacks. Providing limitless 1.5 points for every dollar spent on all purchases, it allows for a great option for those who want a decent reward program with a very straightforward approach. Check our detailed Bank of America® Travel Rewards for Students card review below!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | From 14.24% to 24.24%. Variable APR. |

| Welcome bonus* | There is a 25,000 bonus online points, provided you make $1,000 in purchases during the first 90 days of subscription. These can be redeemed for statement credit amounting to $250 for travel expenses. *Terms apply. |

| Rewards* | An unlimited reward system that provides 1.5 points for every dollar spent on all purchases, at all times and everywhere. Reward points do not expire. Free access to your FICO® Score so you can track your credit score responsibly. *Terms apply. |

How to get the Bank of America® Travel Students?

If you are in search of limitless rewards and no annual fees, the Bank of America® Travel Students card might be a good option for you! Check our post and apply!

How does the Bank of America® Travel Rewards for Students card work?

The number of new responsibilities being presented during late school and college years can be daunting. With this in mind, the Bank of America® Travel Students card is a very simple option. With this, you will collect 1.5 points for every dollar spent everywhere, anytime. These don’t expire and have no blackout dates. Additionally, the card has no annual fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Bank of America® Travel Rewards for Students card benefits

This card has an excellent sign-up bonus if you plan to spend $1,000 in the first 90 days. It also has a plan for responsibly building your credit score and provides free FICO® Score awareness through its mobile app.

Pros

- Limitless 1.5x points for each dollar spent on every purchase, anywhere and at any time. No expiry or blackout dates.

- No annual fees.

- Access to your credit score free of charge.

Cons

- Rewards cannot be transferred.

- It has a 3% (or $10, whichever is higher) balance transfer fee.

- No special category for bonus points.

How good does your credit score need to be?

You need to have a good to excellent credit score to get access to the Bank of America® Travel Students card, making it a not very accessible option. However, remember that applying to any such credit card program directly impacts your credit score due to the resulting search conducted. Keep it in mind before applying.

How to apply for Bank of America® Travel Rewards for Students card?

You can do so simply and easily through Bank of America’s website by filling out their application! You can check our detailed explanation of how to get your Bank of America® Travel Students card in the following post!

How to get the Bank of America® Travel Students?

The Bank of America® Travel Rewards for Students card application offers great reward options with no annual fees! Check our post and apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

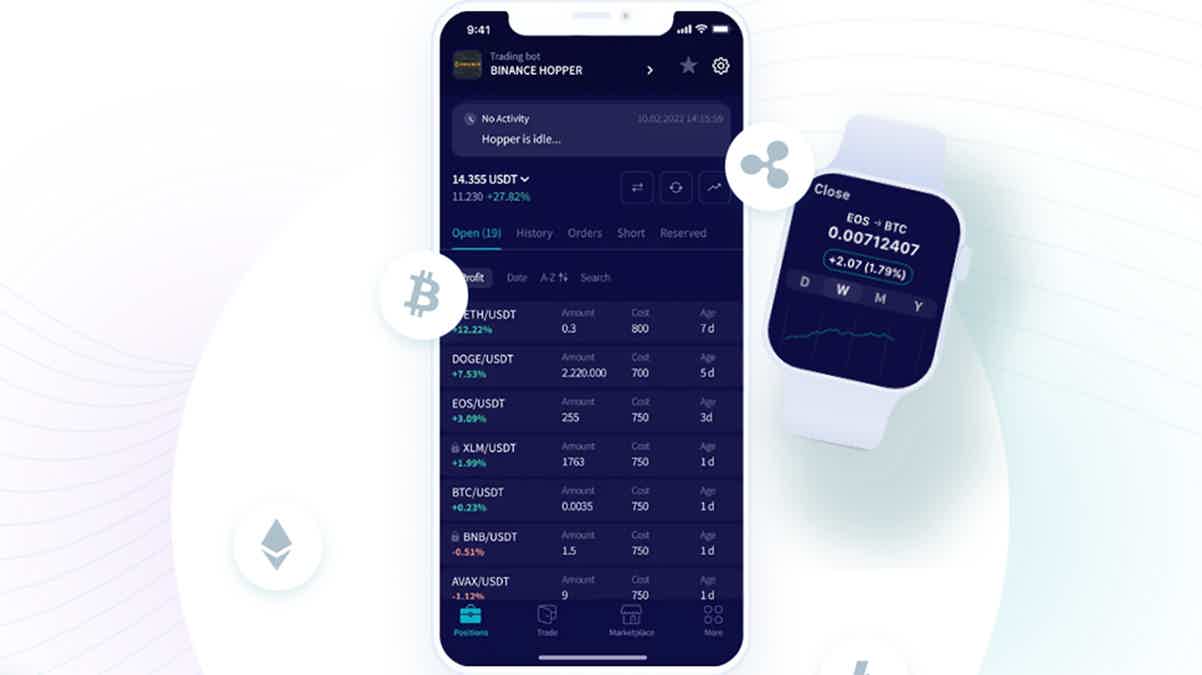

Cryptohopper review: The Most Powerful Crypto Trading Bot

Check out Cryptohopper review. Learn how the most powerful crypto trading bot works and start investing in digital coins with less effort.

Keep Reading

How to apply for NetCredit?

Looking for a lender to give you flexible loan options and up to $10,000? If so, read on to learn how to apply for NetCredit!

Keep Reading

College Ave Student Loans review

Read this College Ave Student Loans review and learn more about loans at low costs that fit the budget and goals of students and parents!

Keep ReadingYou may also like

Hawaiian Airlines: Follow this guide to track the best prices!

Are you in the market to buy cheap Hawaiian Airlines flights? Discover where to find low prices to enjoy paradise. Read on!

Keep Reading

Low Income Home Energy Assistance Program (LIHEAP)

Learn about the Low Income Home Energy Assistance Program. Uncover eligibility requirements and find out how you can apply for assistance today!

Keep Reading

Learn to apply easily for CashUSA.com

Find out how to apply easily for CashUSA.com. This quick and easy guide will how to ensure up to $10,000 for multiple purposes! Read on!

Keep Reading