Reviews (US)

Axos Rewards Checking Account review

Check out this Axos Rewards Checking account review article to find out all the benefits you get by joining the club, such as free mobile deposits and no monthly maintenance fees!

Axos Rewards Checking Account: high APY and unlimited domestic ATM fee reimbursements!

Axos Bank elevates the banking experience to a whole new level. It features excellent financial products and services that include solutions for personal and business. In this Axos Rewards Checking Account review, we’ll show you all about it.

You can bank, borrow, and invest through Axos.

There are checking accounts, savings, certificates of deposit, mortgage, personal loans, auto loans, self-directed trading, retirement plans, and more.

If you are looking for a bank that offers low-cost products and high earnings, let me introduce you to Axos.

| Intro Balance Transfer APR | N/A |

| Regular Balance Transfer APR | N/A |

| Balance Transfer Fee | N/A |

How to apply for an Axos Rewards Checking account?

High APY with an Axos Rewards Checking account! Learn how to apply!

How does the Axos Rewards Checking account work?

Among all checking accounts available in the market, this one is one of the best!

There are no monthly maintenance fees, zero overdraft or NSF fees, no minimum monthly balance requirements, and unlimited domestic ATM fee reimbursements.

Also, you can manage your debit card online through an innovative banking platform. Plus, direct deposits are easy to make with only a three-step process.

Furthermore, direct deposits unlock interest-earning options. For example, if you receive monthly direct deposits totaling $1,500 or more, you will earn a rate of 0.4%.

If you use your Axos Visa Debit Card for a total of 10 transactions per month with a minimum of $3 per transaction, you will earn 0.3%.

You can also sign up for Personal Finance Manager (PFM) to earn it.

In addition, you can unlock other rates by managing Axos Invest Managed Portfolios Account, maintaining an average balance in an Axos Invest Self Directed Trading Account, or using your checking account to make Axos Bank consumer loan payments.

This account guarantees security features like encryption, double-check authentication, anti-virus, malware protection, and more.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Axos Rewards Checking account benefits

Besides the fact you can earn a high-interest rate on this checking account, it features some other benefits, such as unlimited domestic ATM fee reimbursements and unlimited free mobile deposits.

Furthermore, there is no minimum balance required, and it is FDIC insured.

Pros

- You can earn up to 1.25% APY;

- It doesn’t require a minimum mothly balance;

- It offers unlimited domestic ATM fee reimbursements;

- There are no monthly maintenance fees;

- It provides you with security features;

- You can manage your card online;

- There are no overdraft or NSF fees;

- It is FDIC insured;

- There’s a simple and easy 3-step process for direct deposits;

- You only need $50 to open an account.

Cons

- It could improve the fact that it features minimum requirements to access the highest APY.

How good does your credit score need to be?

All credit types are considered when you apply for an Axos account.

How to apply for an Axos Rewards Checking account?

If you are looking for a checking account that features high-interest rates, check out how to apply for an Axos Rewards Checking account!

How to apply for an Axos Rewards Checking account?

High APY with an Axos Rewards Checking account! Learn how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

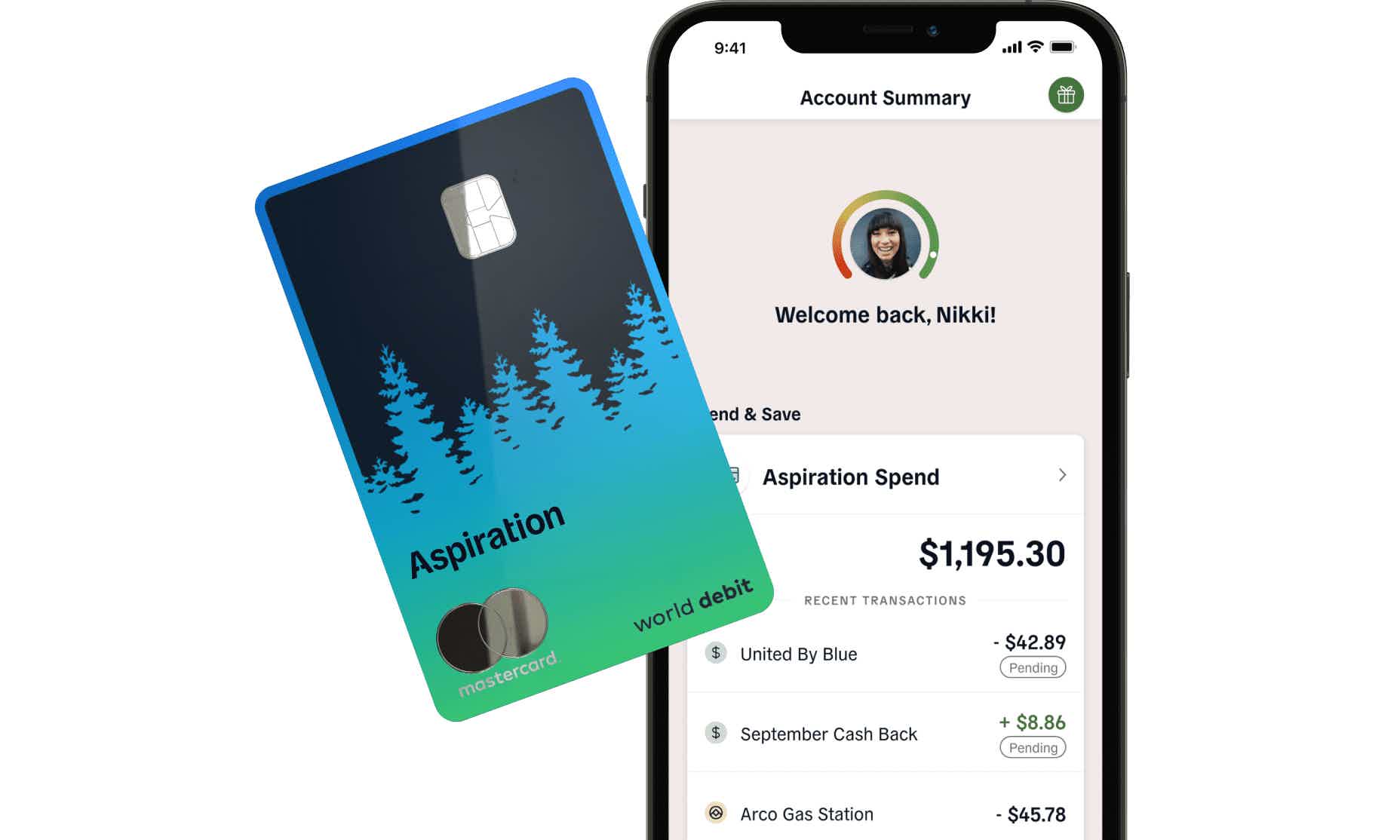

How to apply for the Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

Keep Reading

Types of credit card fraud and how to avoid them!

Do you even think about credit card fraud and how to stay safe from it? If so, read on to learn the types of credit card fraud!

Keep Reading

Food Distribution Program on Indian Reservations (FDPIR) review

Check out the Food Distribution Program on Indian Reservations (FDPIR) review article and learn how it works and the qualification process.

Keep ReadingYou may also like

Learn to apply easily for Next Day Personal Loan

Are you in a bind and want to get some extra cash? Next Day Personal Loan can help. They are the ideal go-to site for connecting borrowers and lenders. So what are you waiting for? Apply now!

Keep Reading

Competitive rates: Apply for Marshland Credit Union Mortgage

Discover how to apply for the Marshland Credit Union Mortgage - quick process and flexible conditions! Read on!

Keep Reading

Tomo Credit Card review: Build Credit with no interest

Accessible to all credit types, Tomo Credit Card offers 0% purchase APR, and benefits on popular brands. Keep reading and learn more!

Keep Reading