Credit Cards (US)

How to apply for the First Digital Mastercard® Card?

Do you need a card that does not require a perfect credit score? The First Digital Mastercard® Card has arrived to help you build up your credit score. So, take a look at the card’s application process!

First Digital Mastercard® Card application: Easy and online!

Even though the First Digital Mastercard® Card has many fees like an annual one and a high APR and foreign transaction, it offers you the opportunity to build up a credit score since it does not require a good credit history.

Also, it is an unsecured card, which means that you don’t need a secured deposit to use it as a credit limit.

Keep reading the content below if you’d like to learn how to apply for it.

Apply online

If you think this credit card is a good option for your financial needs, you just have to follow some simple steps to apply for it.

First, access the First Digital website, fill in the form, providing information about you, such as Full Name, Email, and residential address, Income details, and Employment details.

Then, submit it and wait for approval.

The process is fast and easy, and you get an answer in less than 60 seconds.

Also, note that you need to have a checking account before applying for it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, there is no app available for this credit card. So, you cannot manage your account through your mobile phone.

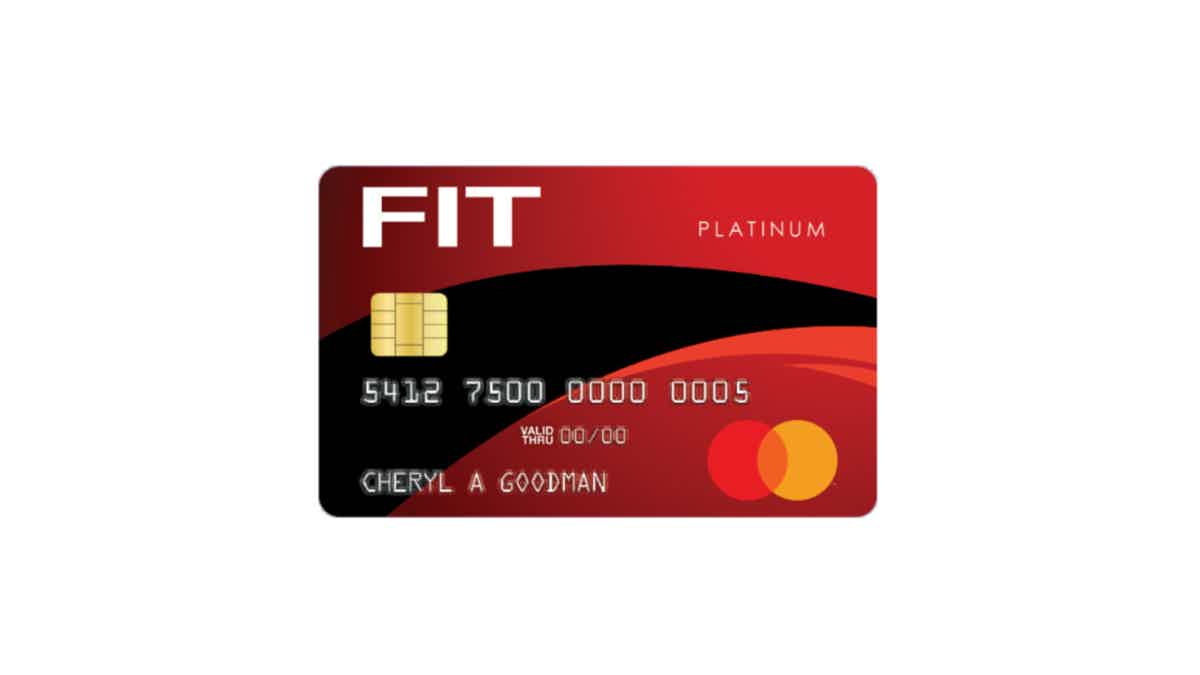

First Digital Mastercard® Card vs. FIT Mastercard® Card

To help you with your next card decision, we have made a comparison table between the First Digital Mastercard® Card and FIT Mastercard® Card. So, take a look at it and compare these two great options available on the market!

| First Digital Mastercard® | Fit Mastercard® | |

| Credit Score | See website for details. | From bad to fair |

| Annual Fee | $75.00 for first year. After that, $48.00 annually. | $99 |

| Fees | Activation Fee: One-time $95. Late Payment Fee Up to $41.00. Return Payment Fee Up to $41.00. Cash Advance Fee: Either $10, or 3% of the amount. | Activation Fee: One-time $89. Maintenance Fee: $6.25 per month after the 1st year. |

| Regular APR | 35.99% | 29.99% Variable APR |

| Welcome bonus | None | None |

| Rewards | None | None |

How to apply for Fit Mastercard® credit card?

Do you need to organize your finances and clear debt? The Fit Mastercard® card can be a great option for you. See how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Surge® Platinum Secured Mastercard® Card application

The Surge® Platinum Secured Mastercard® Card helps you build your credit score and gives you cash back on purchases. See how to apply now!

Keep Reading

How to apply for the Sable Account?

Sable Account offers both debit and credit cards and has no monthly fees. Learn how to open an account today and enjoy all its benefits!

Keep Reading

J.P. Morgan Self-Directed vs Robinhood: Which is the best to invest in?

Are you a trader looking for the best broker for you? If so, keep reading to know which one is best: J.P. Morgan Self-Directed or Robinhood!

Keep ReadingYou may also like

Bad credit accepted: apply for BankAmericard® Secured Credit Card

Looking for a secure way to build credit? Then discover how to apply for the BankAmericard® Secured Credit Card. Keep reading to learn more.

Keep Reading

Supplemental Security Income (SSI): see if you qualify

If you're caring for someone who has a disability or can't work because of medical issues, read this post. You’ll learn about SSI eligibility, application, and benefits of this welfare program that helps with essentials. Keep reading!

Keep Reading

Delta SkyMiles® Blue American Express Card Review: Earn big

Looking for a budget-friendly credit card for your travels? Check out our Delta SkyMiles® Blue American Express Card Review. No transaction fees and miles earned on purchases make it a great choice. Learn more!

Keep Reading