Credit Cards (US)

How to apply for a Capital One Platinum Secured card?

The Capital One Platinum Secured card helps you rebuild your credit. Check out how easy it is to apply!

Applying for a Capital One Platinum Secured: get pre-approved now

Capital One offers a wide range of cards for various needs and goals. The Platinum Secured is a fantastic tool for those who need to build credit and re-establish a good financial path.

Secured cards are always a good way to control finances and begin responsible financial behavior.

This secured card from Capital One offers more than that. It allows refundable security deposits, credit score monitoring, automatic credit line reviews, security features, and more.

Also, all those benefits come with a $0 annual fee, $0 foreign transaction, and $0 authorized user. Learn how easy and fast it is to get yours!

Apply for a Capital One Platinum Secured online

Access the Capital One website and select the Credit Cards tab.

Then, choose the Fair Or Building Credit tab.

After that, select the Platinum Secured from Capital One and click on Apply Now.

Furthermore, you can check out if you would be pre-approved with no hard inquiry to your credit by clicking on “See if I’m Pre-Approved”.

Fill in the forms with your personal, contact, and financial information. Choose the minimum security deposit ($49, $99, or $200) and make it.

Finally, open your account with an initial credit line of $200.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After opening your account at Capital One, download the mobile app to manage your newest card.

Another Great Recommendation for you: Capital One Platinum credit card

On the other hand, if you don’t want a card that requires a security deposit, Capital One offers an equally fantastic unsecured card for those who need to rebuild credit.

Find out more about the Capital One Platinum credit card!

| Capital One Platinum Secured | Capital One Platinum | |

| Credit Score | Bad | Fair |

| Fees | Cash Advance: 3% of the amount of the cash advance Late payment: Up to $40. | $0 |

| Regular APR | Purchase APR: 29.99% (Variable); Balance Transfer APR: 29.99% (Variable); Cash Advance APR: 29.99% (Variable). | Purchase APR: 29.99% (Variable); Balance Transfer APR: 29.99% (Variable); Cash Advance APR: 29.99% (Variable). |

| Welcome bonus | None | None |

| Rewards | None | None |

Check out how to get a Capital One Platinum and enjoy an unsecured credit card with no need for a security deposit.

How to apply for a Capital One Platinum?

Capital One Platinum credit card charges no annual fees and helps you build a credit score. Learn how to apply!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

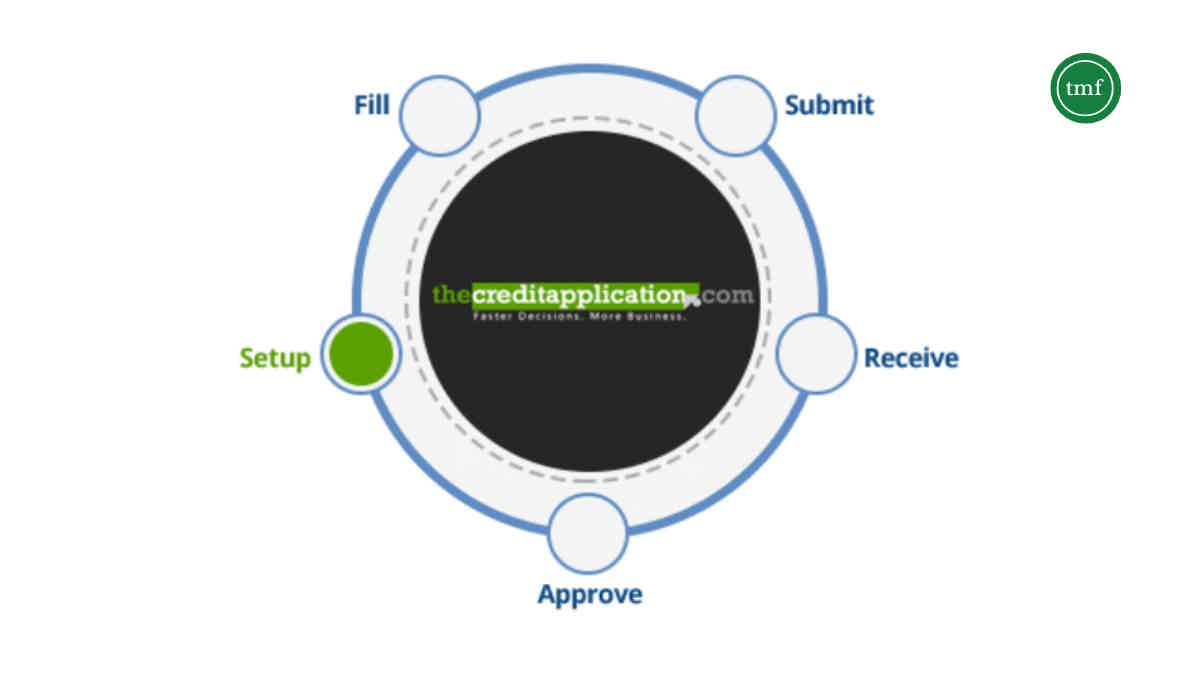

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

Keep Reading

The 10 best personal loans for bad credit 2021

Meeting your basic needs can be a struggle, and may make you ask for credit. If you have bad credit, learn the best personal loans for you!

Keep Reading

Grace Loan Advance review: learn about the best loans

You can find the perfect lender for your loan with the Grace Loan Advance platform. So, read our Grace Loan Advance review to learn more!

Keep ReadingYou may also like

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

If you have a bad score or no score, this is an excellent way to fix it. Learn more about the advantages of this card and what makes it so successful in our Surge® Platinum Mastercard® credit card review!

Keep Reading

An Irresistible APR To Smash Debt: PNC Core® Visa® review

Slash your interest rates and eliminate your debts with the card in our review: the PNC Core® Visa® Credit Card! Pay $0 annual fee!

Keep Reading

Fortiva® Credit Card review: no security deposit

Do you need to build credit and need a credit card that accepts fair scores? If so, the Fortiva® Credit Card might be right for you!

Keep Reading