Reviews (US)

Apple credit card full review

Looking for a new credit card? You might be surprised to learn that there's an option from the tech company we all know and love. Read our Apple credit card review to know more!

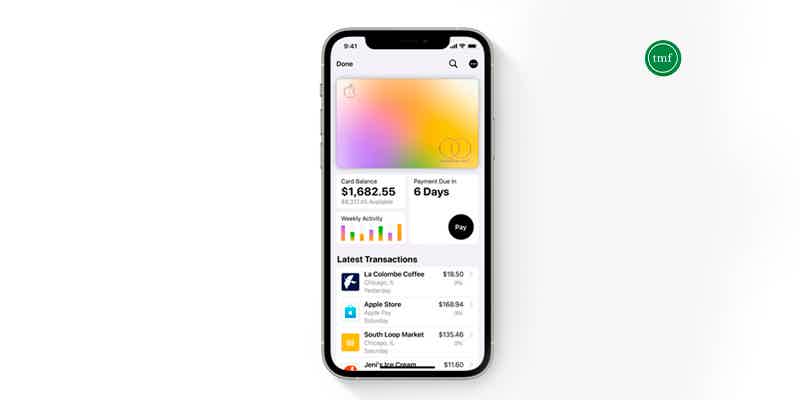

Apple credit card: get unlimited daily cash back

If you’re like most people, you probably think of Apple as a technology company. But did you know they also have a credit card? The Apple credit card has been around for a few years now, and in this blog post, we’ll take a look at what it’s all about. Also, we’ll discuss the pros and cons of the card and who is eligible to apply. So if you’re curious about this credit card, keep reading our Apple credit card review!

| Credit Score | Fair to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | From 10.99% to 21.99% variable APR. |

| Welcome bonus | There is no welcome bonus. |

| Rewards* | Unlimited 3% daily cash back for purchases made at Apple. 2% daily cash back when you make purchases through Apple Pay. 1% cash back on every other purchase you make with the card. *Terms apply. |

How to apply for the Apple credit card

Do you want to get the new Apple card? We'll show you how to apply and get great rewards! Read our Apple credit card application post!

How does the Apple credit card work?

The Apple credit card can be a great tool for Apple fans. Also, you can get up to 3% daily unlimited cash back when you buy Apple products with this credit card. You can buy an iPhone, an iPhone case, a Mac, and so on. Moreover, you can get 2% daily cash back when using your Apple card with Apple Pay. So, you can pay for things and get cash back with real money to spend more! Moreover, you can get a physical credit card in titanium material.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apple credit card benefits

This Apple credit card has many advantages for Apple fans. You can also use Apple’s card platform to manage your spending and spending limits. You can also control everything from the Wallet app. Despite its many benefits, this credit card has some drawbacks for Apple fans. For example, there is no new cardholder bonus. So, read on to find out the benefits and drawbacks of the Apple card.

Pros

- No annual fee.

- There are no hidden fees,

- You can use it with Apple Pay.

- The credit card allows you to pay for Apple products in installments.

- You can get daily unlimited cash back.

Cons

- You need to have an iPhone to use the card.

- There is no welcome bonus.

How good does your credit score need to be?

You definitely need a very high credit score to qualify for the Apple credit card. Also, your credit score should range from fair to excellent to get a chance of approval. However, You can see if you are pre-approved to get your Apple card without impacting your credit score.

How to apply for Apple credit card?

You can easily apply for an Apple credit card through Apple’s official website. Plus, you can see if you’re pre-approved with no impact on your score. Therefore, if you want to know our tips to apply for this credit card, check out our post below!

How to apply for a Apple Card

Do you want to get the new Apple card? We'll show you how to apply and get great rewards! Read our Apple credit card application post!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

FIT® Platinum Card or Surge® Platinum Card?

Compare the key features, benefits and differences between the FIT® Platinum and the Surge® Platinum cards to see which is best for you!

Keep Reading

How to apply for the Axos High Yield Savings Account?

See how to open an Axos High Yield Savings Account and get an account with one of the best APY rates on the market!

Keep Reading

How to apply for the Ollo Platinum Mastercard®?

Are you in need of a reliable card with perks and no surprise fees? Read on to learn how to apply for the Ollo Platinum Mastercard®!

Keep ReadingYou may also like

Target RedCard Review: Save More With a 5% Discount

Our Target RedCard review reveals how you can enjoy 5% off on purchases, extended return policies, and exclusive extras. Keep reading and learn more!

Keep Reading

Prime Visa Credit Card: is it worth it?

Looking for the right credit card to suit your lifestyle? Find out why the Prime Visa Credit Card is the perfect choice. Learn more about its features and benefits in our full review!

Keep Reading

How to get low interest rates on loans

When shopping for a loan, it's important to consider rates. So, we made a complete list of how to get low interest rates on loans. This post will tell you everything you need to understand and learn what impacts these rates. Read on!

Keep Reading