Loans (US)

American Express® Business Line of Credit review: grow your business faster!

Are you looking for a loan, and do you own a business? If so, read our American Express® Business Line of Credit review to learn how to get flexible funding!

American Express® Business Line of Credit: flexible line of credit for your business!

Whether you’re just starting out or you’re a well-established business, securing the right funding is crucial to keeping your company moving forward. So, read our American Express® Business Line of Credit review!

How to apply for Amex Business Line of Credit?

If you want a flexible business loan to grow your business, read our post to learn how to apply for American Express® Business Line of Credit!

| APR* | Monthly fees range from 3% to 9% for 6-month loans; 6% to 18% for 12-month loans, and 9% to 27% for 18-month loans. *Terms apply. |

| Loan Purpose | Multi-draw line of credit. |

| Loan Amounts* | From $2,000 to $250,000. *Terms apply. |

| Credit Needed | Good to excellent. |

| Terms | 6-, 12-, or 18-month loan term options with a corresponding monthly fee. |

| Origination Fee | N/A. |

| Late Fee* | Late fees vary from $10 to $100, depending on the amount owed. *Terms apply. |

| Early Payoff Penalty | N/A. |

So, if you need funding for your business, you’ll find American Express® Business Line of Credit, an easy, flexible line of credit that can be tailored to your specific needs.

Therefore, keep reading for a review of how the American Express® Business Line of Credit works and whether it might be the right choice for your business!

How does the American Express® Business Line of Credit work?

American Express® Business Line of Credit is a relatively new player in the small business loan market but has quickly made a name for itself. The company offers a flexible line of credit that can be used for various purposes.

These purposes range from covering working capital needs to finance large purchases. Also, you can only pay fees for the amount you use.

So, there are no APR fees. You’ll only need to pay the monthly fees according to your loan terms. Also, your terms and fees depend on your creditworthiness and the analysis they’ll perform on your business.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

American Express® Business Line of Credit benefits

As we mentioned above, you can see that the American Express® Business Line of Credit can offer incredible benefits to its clients.

With this lender, you can get a hassle-free loan for your business to grow like never before. Plus, you can be sure that it’s a safe lender because it’s an American Express brand.

In addition, you can get loan amounts from $2,000 to $250,000! This way, your business will have the money it needs to grow!

However, as with any other lending option, there are also some downsides. So, read our list below of the pros and cons!

Pros

- Flexible funding for your business;

- Only pay the monthly fees related to the amount of the loan you use;

- No APR fees, only monthly fees.

Cons

- You’ll need to fit some very specific requirements to get this loan.

- There are requirements for a high credit score to be able to qualify for a loan with this lender.

How good does your credit score need to be?

The American Express® Business Line of Credit can be an incredibly good business loan option. However, you’ll need to have a relatively high credit score to apply. So, you’ll need a FICO score of at least 640 at the time of the application to qualify.

How to apply for the American Express® Business Line of Credit?

Applying for a loan through American Express® Business Line of Credit can be easy. You’ll need to fit the requirements and fill out the application. A decision will come to you in no time!

How to apply for Amex Business Line of Credit?

If you want a flexible business loan to grow your business, read our post to learn how to apply for American Express® Business Line of Credit!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the M&S Shopping Plus Credit Card?

If you love to shop, you can get a credit card to help you get rewards! Read on to learn how to apply for the M&S Shopping Plus Credit Card!

Keep Reading

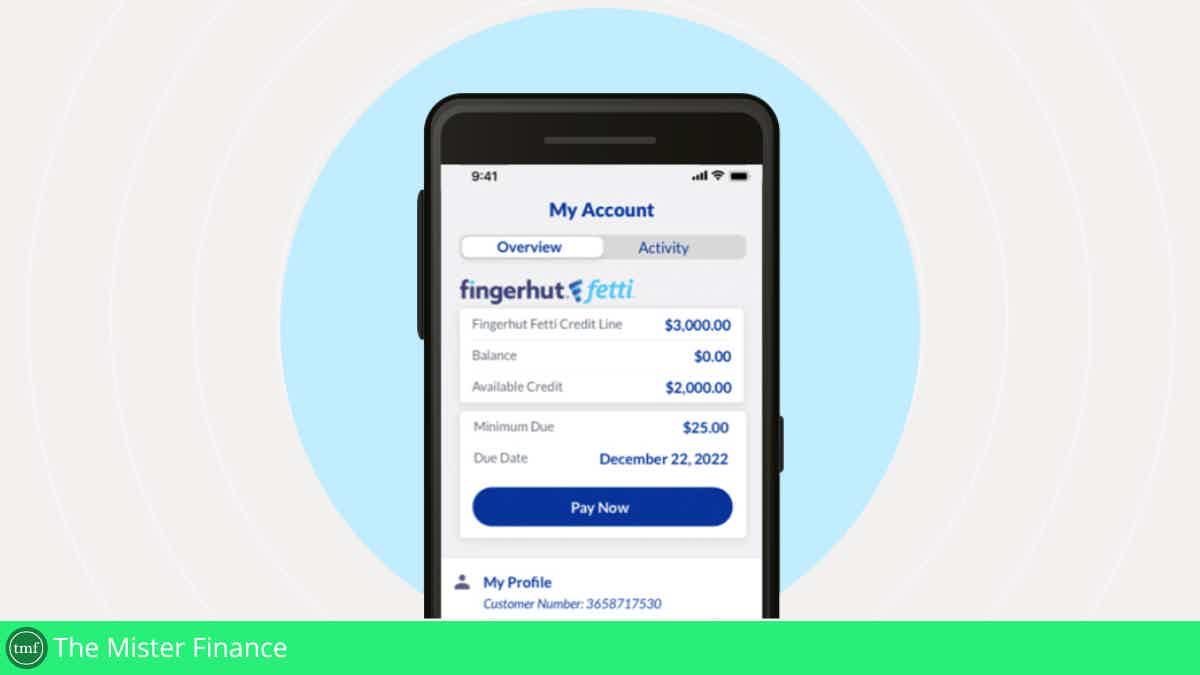

WebBank/Fingerhut Credit Account review!

Looking for an account to help you get perks and build your score with no hidden fees? Read our WebBank/Fingerhut Credit Account review!

Keep Reading

First National Bank Freestyle Checking account review

Do you need a perfect checking account? Read our First National Bank Freestyle checking account review to find out if it is for you!

Keep ReadingYou may also like

Application for the Bank of America Customized Cash Rewards card: how does it work?

Learn how to apply for the Bank of America Customized Cash Rewards card and get yourself a credit card with a rewards program that you can tailor to your spending habits.

Keep Reading

Blaze Mastercard® Credit Card Review: The best tool for building credit

Get the credit boost you need without settling for a typical secured card. Discover if the Blaze Mastercard® Credit Card is the right choice with our review. Keep reading!

Keep Reading

Extra Debit Card review: use debit to boost your credit

Do you want to build your credit by paying with debt? Then this Extra Debit Card review may be just what you need! No credit check required! Read on!

Keep Reading