Reviews (US)

Alliant Credit Union Bank review: hassle-free bank!

Do you need a new bank that offers rewards and is easy to use? If so, read our Alliant Credit Union Bank review!

Alliant Credit Union Bank: find high-rate accounts

If you’re looking for a hassle-free bank, then you’ll want to check out our Alliant Credit Union Bank review! Alliant is known for its amazing customer service and its easy-to-use banking portal! So, read on!

| Financial products offered | Bank accounts, loans, investment options, and more! |

| Fees | There are no monthly fees to be a member. |

| Minimum balance | It depends on the financial product. |

| Investment choices* | You can earn interest with the high-rate savings account option. Plus, you can invest in IRA, trust accounts, and more! *Terms apply. |

How to start banking with Alliant Credit Union?

When you join Alliant Credit Union Bank you can earn rewards and much more! Read our post to learn about how to join this bank!

Alliant Credit Union is a hassle-free bank that can provide you with all the banking services you need! There is a great variety of products and services.

Plus, you can find some of the best customer service to help you bank even better. So, keep reading our Alliant Credit Union Bank review to learn more about this incredible bank!

How is banking with Alliant Credit Union Bank?

You can find many excellent financial services with the Alliant Credit Union Bank. As a new member, you can earn a $100 bonus deposit (valid for the high-rate savings account).

Also, you can find investment options, such as Traditional IRA and Roth IRA. Plus, with the high-rate savings account, you can earn 1.20% APY. And there are no monthly fees!

Also, you can get access to 24/7 customer service. With this, you’ll be able to get all the help you need to start banking better than ever before!

Moreover, you can get access to online banking available 24/7. This way, you’ll be able to bank from anywhere with ease!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Alliant Credit Union Bank experience: is it trustworthy?

With the Alliant Credit Union Bank, you can find the most trustable and safe financial services. Also, you can get rewards if you apply for the unlimited cash back credit card.

Plus, as a new member of the high-rate savings account, you can get a $100 bonus! And this account has a 1.20% APY.

You can even get access to the high-rate checking account. There is a 0.25% APY and no monthly fees or overdraft fees.

However, as with any bank, the Alliant Credit Union Bank also has some downsides. So, check out our list below of the pros and cons of the Alliant Credit Union Bank!

Pros

- High-rate savings and checking accounts.

- New member bonus for the high-rate savings account.

- No monthly fees for the accounts.

- Unlimited cash back credit card with no annual fee.

Cons

- There are no physical branches.

Should you choose the Alliant Credit Union Bank?

If you like a bank that has some of the traditional banking features combined with more modern features, you’ll like this bank.

How to start banking with Alliant Credit Union Bank?

The application process to start banking with the Alliant Credit Union Bank is very simple. All you need to do is go check out our post below and learn how to bank with Alliant Credit Union Bank!

How to start banking with Alliant Credit Union?

When you join Alliant Credit Union Bank you can earn rewards and much more! Read our post to learn about how to join this bank!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What happens to your loans if your bank fails?

If you have ever taken out a loan from a bank, one of your main concerns may be what happens to loans if the bank fails. Read on to learn!

Keep Reading

How to apply for Identity Guard®?

Check out how to apply for Identity Guard®, so you always feel safe and secure to shop, bank, and do your business on the web with freedom.

Keep Reading

Sam’s Club® Plus Member Mastercard® credit card full review

Check out the Sam's Club® Plus Member Mastercard® credit card review and learn about its benefits, such as reward program and no annual fee!

Keep ReadingYou may also like

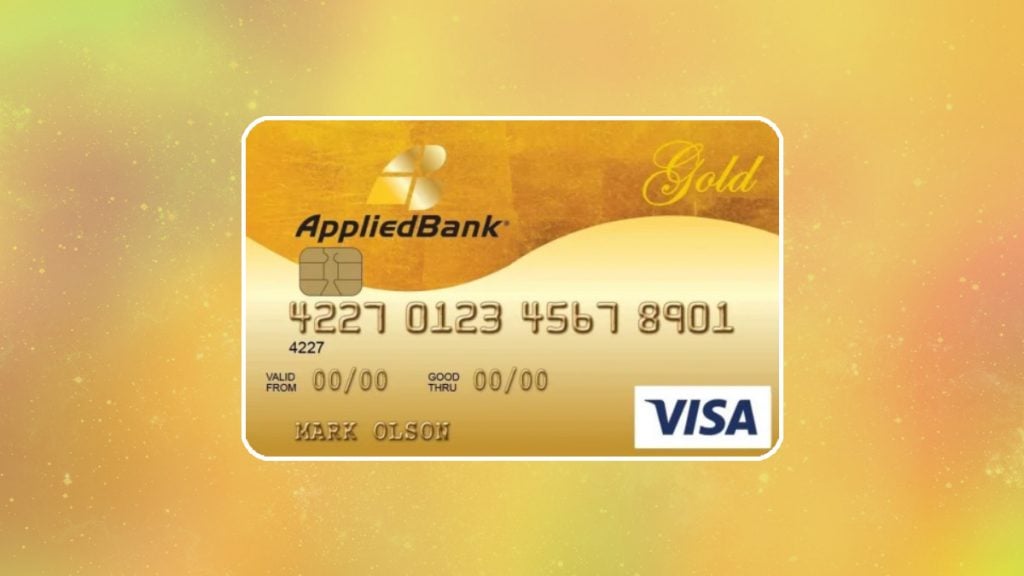

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Keep Reading

Learn to apply easily for the OppLoans Personal Loan

Want to know how to apply for an Opploans Personal Loan? We've got you covered. Borrow up to $4,000 for several purposes! Keep reading!

Keep Reading

How to buy cheap Breeze Airways flights

Planning a trip soon? Here's everything you need to know about finding cheap flights on Breeze Airways, from booking and loyalty programs to tips and tricks.

Keep Reading