AU

Afterpay Card full review: Buy now, pay later

It's no secret that many people love shopping. And it can be even better if you can shop with sales and pay later! So, read our Afterpay Card review to learn more about it!

Afterpay Card: Get the best offers and pay later!

Are you looking for a great way to shop from your favorite brands? Look no further than our Afterpay Card review! This card lets you get the best offers and pay later, making it the perfect way to shop.

How to get your Afterpay Card?

Are you looking for a card to make payments and pay over time with no interest? If so, read on to learn how to apply for the Afterpay Card!

| Credit Score | There are no credit score requirements. |

| P.A. | No p.a. |

| Annual Fee | There are no annual fees or monthly fees. |

| Fees | There are no fees if you make all your payments on time. |

| Welcome bonus | None. |

| Rewards | You can access offers, discounts, and sales from your favorite brands and pay with your card. |

Plus, there are no fees if you pay off your purchase within six weeks! Moreover, you can even never pay any interest on your payments!

Also, you can get exclusive offers and sales to use your card. There are many different categories, from electronics to clothing!

So, what are you waiting for? Keep reading our Afterpay Card review to learn more about this card and start shopping!

How does the Afterpay Card work?

The Afterpay card is an incredible option for those who want to make some purchases from their favorite brands but don’t have the money to pay in full.

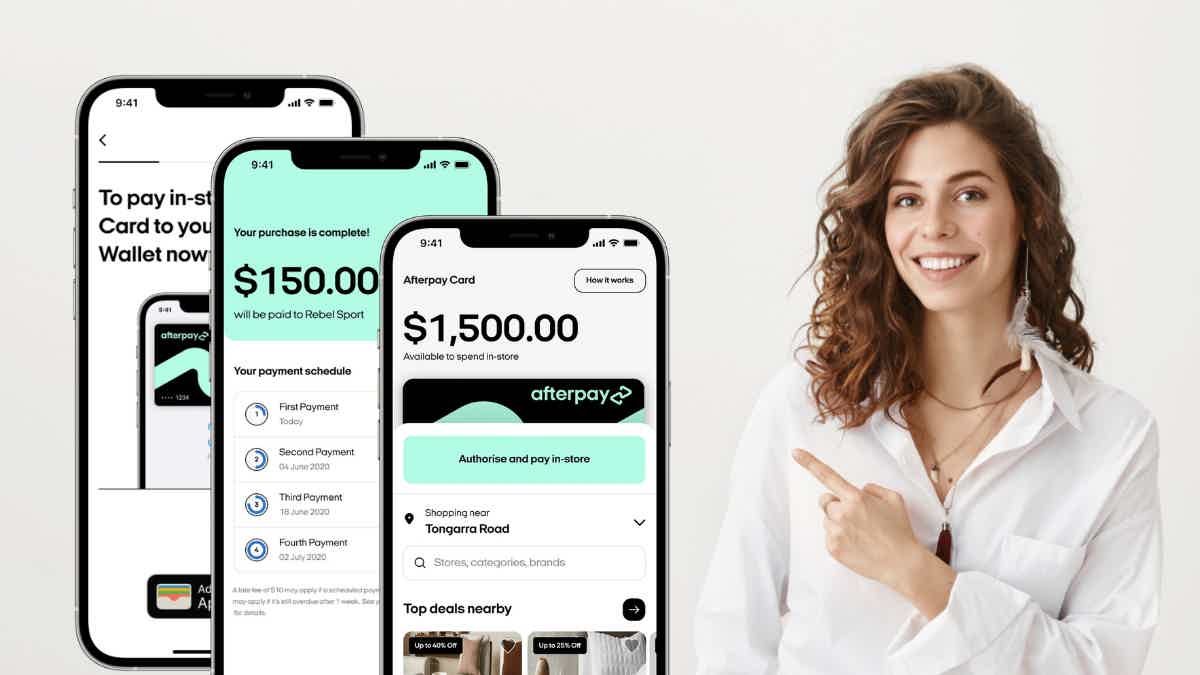

So, you’ll be able to make your first installment payment at the time of the purchase and pay the rest over the course of six weeks.

Also, the amount you can spend depends on the spending limit they approve for you to use on the mobile app.

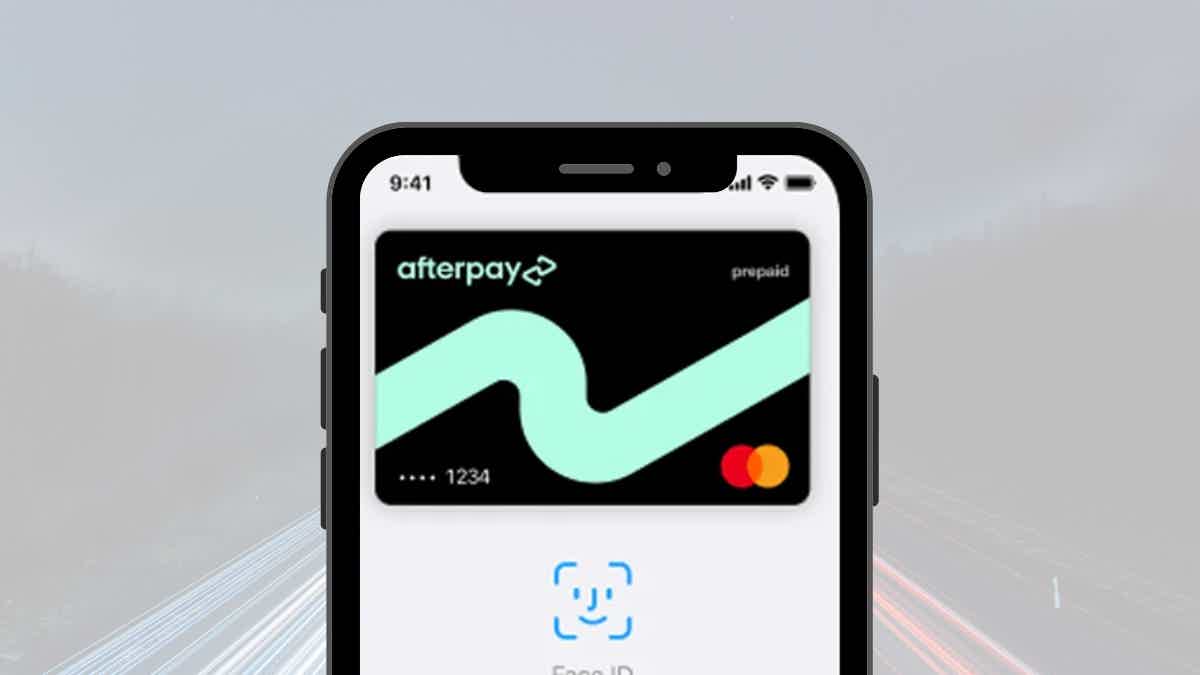

So, you’ll need to download the app to use the online card and in stores. So, you won’t really get a physical credit card. However, you’ll be able to use it at physical stores just as easily as online.

You will be redirected to another website

Afterpay Card benefits

As we mentioned, the Afterpay card offers many benefits for those who love to shop. However, you’ll need to use the card responsibly if you don’t want to pay late fees.

Pros

- There are no credit score requirements;

- You can pay through the mobile app;

- There are sales and offers available;

- You won’t have to pay any annual or monthly fees.

- There are no interest charges for the payments you make over the six weeks.

Cons

- You’ll need to pay late fees if you ever miss any payments;

- There is only one type of financing option;

- There is no guarantee that you’ll be able to make all your purchases with the Afterpay card. Some may not be approved.

How good does your credit score need to be?

There are no credit score requirements for you to use the Afterpay card. All you need is to have a compatible mobile phone to download the app and start using it.

Also, there is no interest in your payments. However, you should know that if you ever miss any payments, you’ll need to pay a late fee.

How to apply for Afterpay Card?

You can easily start using your Afterpay card at any time. All you need is to learn how to download the app and make sure you can make the payments on time!

How to get your Afterpay Card?

Are you looking for a card to make payments and pay over time with no interest? If so, read on to learn how to apply for the Afterpay Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for a Virgin Money Low Rate Card?

In the market for a card with low rates and great perks? If so, read our post to learn how to apply for the Virgin Money Low Rate Credit Card!

Keep Reading

How to apply for the HSBC Platinum Credit Card?

Looking for a card option with low intro rates and an annual fee? If so, read on to learn how to apply for the HSBC Platinum Credit Card!

Keep ReadingThe Mister Finance recommendation – NOW Finance Personal Loans review

With the NOW Finance Personal Loans, you'll find secured and unsecured loans with great terms to consolidate debt and much more!

Keep ReadingYou may also like

Solicitud de la Wells Fargo Reflect® Card: ¿cómo funciona?

¿Deseas solicitar la Wells Fargo Reflect® Card? ¡Genial! ¡Lee este artículo y aprende todo lo que necesitas sobre el proceso de solicitud de esta tarjeta! ¡Lo hemos simplificado! ¡Vamos allá!

Keep Reading

Cheap flights on SkyScanner: flights from $29.99

Learn how to make the most of your budget when traveling with Skyscanner cheap flights. Keep reading and save a lot on your next trip!

Keep Reading

Up to $15,000: VivaLoan review

Uncover the details of VivaLoan, a short-term loan option that can help you get funds quickly. Get the money you need with any type of credit!

Keep Reading