Credit Cards (US)

Valero® Credit Card full review: Save money with the app!

Are you looking for a card with fuel discounts, rewards, and no annual fee? If so, read our Valero® Credit Card review to learn more!

Valero® Credit Card: Get personalized customer service!

Are you looking for a credit card that’s both easy to use and can save you money at the pump? If so, look no further than our Valero® Credit Card review!

How to apply for the Valero® Credit Card?

If you need a card to help you get fuel discounts and rewards for no annual fee, learn how to apply for the Valero® Credit Card!

| Credit Score | Good to excellent. |

| APR | 29.49% variable APR for purchases. |

| Annual Fee | No annual fee. |

| Fees | Late payment fee: Up to $38; Return payment fee: Up to $27. *Terms apply. |

| Welcome bonus | No welcome bonus for new cardholders. |

| Rewards* | Get savings every* time you use your Valero® Credit Card within the ValeroPay+ app; Flexible payment terms; Get exclusive in-store savings; Regular fuel discounts. *Terms apply. |

Also, with this card, you get exclusive access to discounted fuel prices at any of the more than 5,000 Valero fuel locations across the United States.

Moreover, on top of all those savings each time you fill up your tank, there are also plenty of other perks that come along with this card, like great rewards and benefits, as well as no annual fees.

Therefore, let’s take an in-depth look into what makes the Valero® Credit Card such a great value for anyone looking to save money on their fuel costs!

How does the Valero® Credit Card work?

With the Valero® Credit Card, you’ll be able to get incredible customer service and personalized service! Moreover, you’ll be able to access flexible payments to meet your financial needs!

In addition, you’ll be able to save money with this card by using it within the ValeroPay+ mobile app!

Moreover, you can get access to pay-at-the-pump convenience! Also, this card offers exclusive and regular fuel discounts!

And this card doesn’t require an annual fee to get all of these perks and much more!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Valero® Credit Card benefits

As we mentioned, the Valero Credit Card offers incredible perks to its cardholders. Moreover, you’ll be able to get many savings through the ValeroPay+ app using your card in it.

In addition, this card allows you to get flexible payment terms, and there is no annual fee! However, this card also has some downsides.

Therefore, you can read our pros and cons list below to learn more about it!

Pros

- You won’t need to pay any membership fees to use this card;

- You’ll be able to get savings by using your Valero Credit Card through the ValeroPay+ app;

- Get exclusive in-store savings;

- You’ll be able to access flexible payment terms to meet your financial needs.

Cons

- Unfortunately, this card has spending caps on the reward you can get;

- There could be higher rewards rates;

- The APR can be relatively high for some people.

How good does your credit score need to be?

We recommend that you have at least a good credit score to try applying for this credit card.

Moreover, if you have a not-so-good credit score, you may not be able to go through the application process and get a positive response.

However, they may need to perform a hard credit check during the application process. Therefore, make sure you have your credit score in good standing.

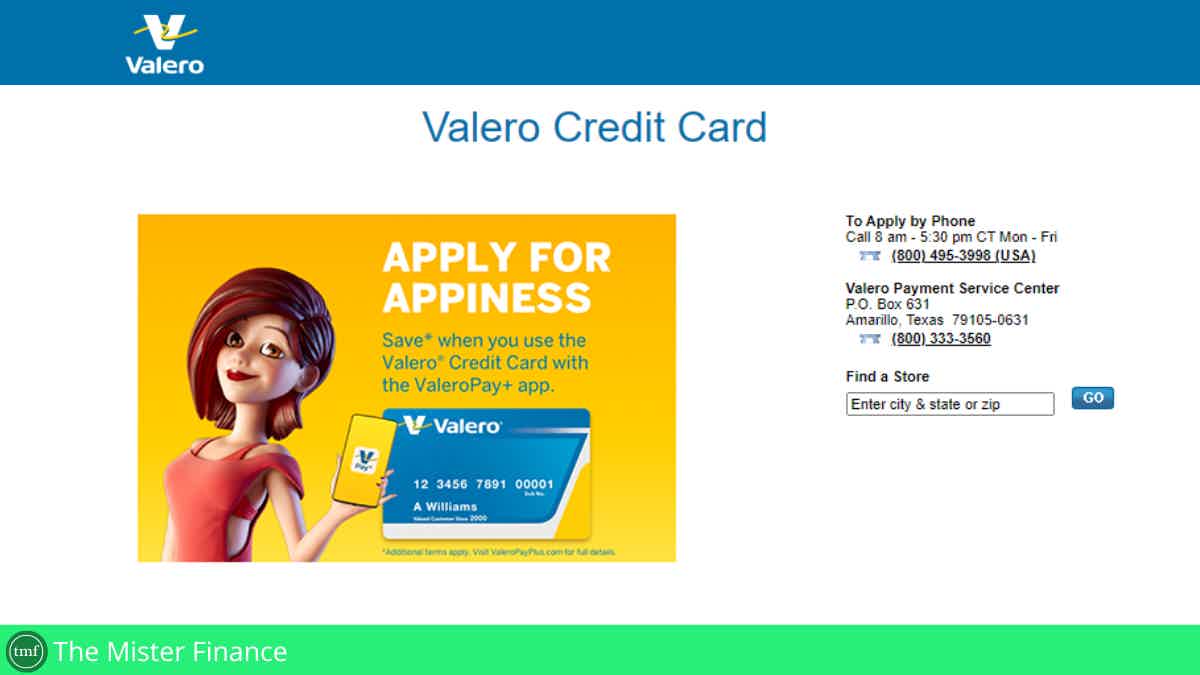

How to apply for the Valero® Credit Card?

You can easily apply for this incredible credit card online through the official website and application form. Moreover, you’ll be able to add your card to the ValeroPay+ app to use it as a payment method!

How to apply for the Valero® Credit Card?

If you need a card to help you get fuel discounts and rewards for no annual fee, learn how to apply for the Valero® Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

QuicksilverOne Cash Rewards full review

Check out our QuicksilverOne Cash Rewards review and learn more about its benefits, such as cash back on all purchases and more!

Keep Reading

How to close a Bank of America account

Check out how to close a Bank of America account and learn simple tips on what to do before closing. Find out an alternative account for you!

Keep Reading

How to apply for the Mastercard® Luxury Titanium credit card?

Before accessing perks and benefits, you will need to learn how to apply for the Mastercard® Luxury Titanium credit card.

Keep ReadingYou may also like

How to apply and get verified on the Buy On Trust Lending easily

Don't let your limited credit history stand in the way of getting the products you want. Apply for a Buy On Trust Lending account and get your hands on big-ticket items from major brand names!

Keep Reading

Payday loans: are they a good alternative?

If you need quick cash, try to avoid Payday Loans. They have incredibly high interest, and that can end up damaging your score. Keep reading to understand what they are, their costs, and their alternatives.

Keep Reading

Milestone® Mastercard® Review: Boost your credit

When you're working on improving your credit score, it's important to find the right tool for the job. So is Milestone® Mastercard® the best option? Let's take a closer look at our review.

Keep Reading