Credit Cards (US)

Upgrade Triple Cash Rewards Visa® review

Upgrade launches one more credit card full of rewards. Read the Upgrade Triple Cash Rewards Visa® review and learn more about its benefits, such as unlimited cash back and no annual fee!

Upgrade Triple Cash Rewards Visa® card.

In today’s Upgrade Triple Cash Rewards Visa® review, you’ll learn about the pros and cons of this great financial product!

So, Upgrade is a fintech company that claims to deliver a whole innovated way to do finances. It offers a new banking experience to its customers, and it features affordable loans and cards.

How to get an Upgrade Triple Cash Rewards Visa®?

Upgrade Triple Cash Rewards Visa® is a hybrid credit card and personal loan. Learn how to apply for one!

And one of those cards is the Upgrade Triple Cash Rewards, a Visa® credit card that rewards you with unlimited cash back on all payments.

So, if you are interested in getting one, read the review right below to see if it fulfills your needs.

| Credit Score | Average – Excellent |

| Annual Fee | $0 |

| Regular APR | From 14.99% to 29.99%. |

| Welcome bonus | $200 bonus after opening a Rewards Checking account and making 3 debit card transactions. |

| Rewards | Up to 3% cash back on payments. |

How does the Upgrade Triple Cash Rewards Visa® credit card work?

Upgrade credit cards convert carried balance into fixed-rate installment loans at low costs. So, besides the rewards and other regular credit card features, you can feel peace of mind with predictable loans.

This is a card that offers $0 annual fee, $0 activation fees, and $0 maintenance fees.

Also, it doesn’t charge a foreign transaction fee or a return payment fee.

Even though it does not offer welcome bonuses, the unlimited up to 3% cash back is pretty good.

Besides that, it offers a great mobile app, and a $0 fraud liability.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upgrade Triple Cash Rewards Visa® benefits

This Upgrade card functions as a hybrid credit card and personal loan at low costs. Even though it can reach 29.99% APR, note that it doesn’t charge most of the fees that other cards do.

Plus, it offers unlimited cash back on all payments, as follows:

- 3% cash back on payments in Home, Auto, and Health categories;

- 1% cash back on all other payments;

In addition, it provides you with a mobile app, a high range of credit lines, and a $0 fraud liability.

However, it doesn’t allow balance transfers, and it requires a good credit score for the application process.

Pros

- Unlimited cash back on all payments;

- Earn a $200 bonus on your Upgrade Card after opening a Rewards Checking account and making 3 debit card transactions;

- $0 annual fee, $0 activation fees, $0 foreign transaction fees;

- Hybrid credit card and personal loan;

- Credit line from $500 to $25,000;

- Contactless technology;

- Mobile app;

- $0 fraud liability;

- Visa® convenience and acceptance.

Cons

- It requires at least a 630+ credit score;

- APR can reach 29.99%, which is quite high;

- It doesn’t allow balance transfers;

- Not available in DC, IA, WV, and WI.

How good does your credit score need to be?

It is recommended that you have punctuation of at least a 630 credit score, nearly as good credit for the application.

How to apply for an Upgrade Triple Cash Rewards Visa®?

If you are interested in getting your cash back right away, learn now how to get your Upgrade Triple Cash Rewards Visa® credit card by reading our next post!

How to get an Upgrade Triple Cash Rewards Visa®?

Upgrade Triple Cash Rewards Visa® is a hybrid credit card and personal loan. Learn how to apply for one!

Disclaimer: To qualify for the welcome bonus, you must open and fund a new Rewards Checking account and make 3 qualifying debit card transactions from your Rewards Checking account within 60 days of the date the Upgrade Card account is opened. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade VISA® Debit Card Agreement and Disclosures for more information. Your Upgrade Card and Rewards Checking account must be open and in good standing to receive a bonus. If you have previously opened a Rewards Checking account or do not open one as part of this application process, you are not eligible for this welcome bonus offer. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking account as a one-time payout credit within 60 days after the 3rd qualifying card purchase.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

9 best Student Loans for bad credit

Learn the 9 best student loans for bad credit or no credit and see if you would qualify for one of them, considering your current situation!

Keep Reading

How to apply for the Wise debit card?

Check out how the Wise card application works, and start making purchases, sending, and receiving international money with the best rates!

Keep Reading

Top 5 Crypto with most potential to invest in 2022

Check out these crypto investment options with the most potential in 2022 that are sure to yield great returns for your financial life!

Keep ReadingYou may also like

Walmart MoneyCard® application: how does it work?

Learn how easy and fast it is to apply for the Walmart MoneyCard® and make the most out of your Walmart shopping - online and in-store!

Keep Reading

Federal Pell Grant: receive up to $7,395

Get the details on what a Federal Pell Grant is! Receive payments to cover your college costs. No need to pay back! Read on!

Keep Reading

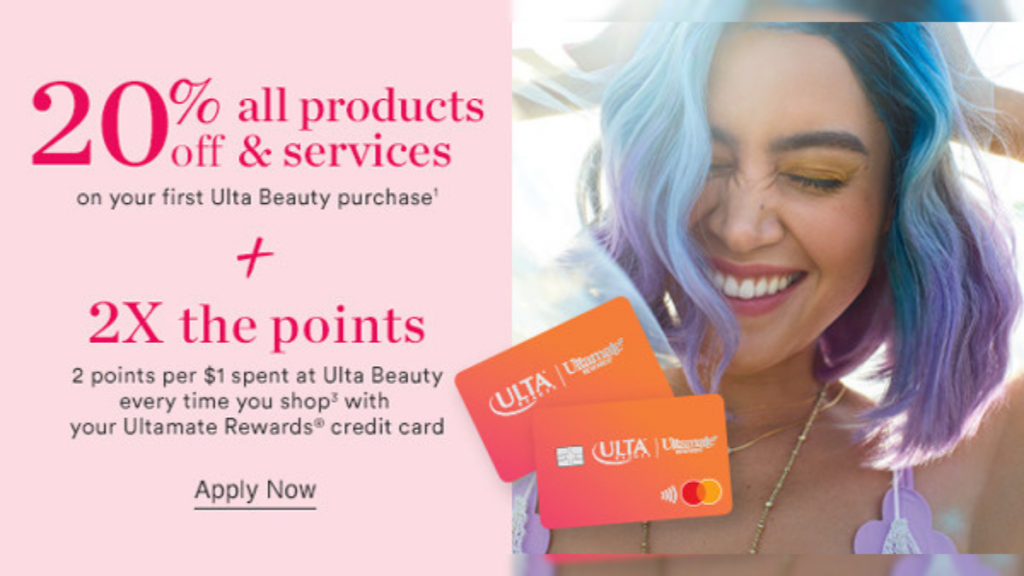

Get the Ulta Credit Card: A Simple Way to Apply Today!

You can now get your cherished beauty products from Ulta while earning points that can be converted into discounts. Read on and learn more!

Keep Reading