CA

Scene+TM Student Banking Bundle full review

Check out the ins and out of signing up for a Scotia reward package on this Scene+TM Student Banking Bundle review.

Scene+TM Student Banking Bundle: earn up to 12,500 Scene+ points when bundling

This Scene+TM Student Banking Bundle review gathers everything you must know about this package offered by Scotiabank.

How to apply for Scene+TM Student Banking Bundle

Learn how to apply for the Scene+TM Student Banking Bundle and enjoy the limited offerings of up to 12,500 Scene+ points at no monthly fees.

In the first place, it is suitable for students who want to take advantage of building a solid financial path while earning valuable rewards.

On the other hand, the promotion is limited, so you better run to enjoy the offers!

Then, take a look below at how it works!

How does the Scene+TM Student Banking Bundle work?

The Scene+TM Student Banking Bundle is a limited promotion offered by Scotiabank, which includes a student bank account and a reward program membership.

Also, you can add a credit card and a savings account to earn even more.

While the account has no minimum balance requirements and no monthly fees, the Scene program allows you to access discounts on entertainment, rewards with flexible redemption, and merchandise.

However, as mentioned above on this Scene+TM Student Banking Bundle review, the promotion is limited. In fact, the offerings are available until April 30th, 2023.

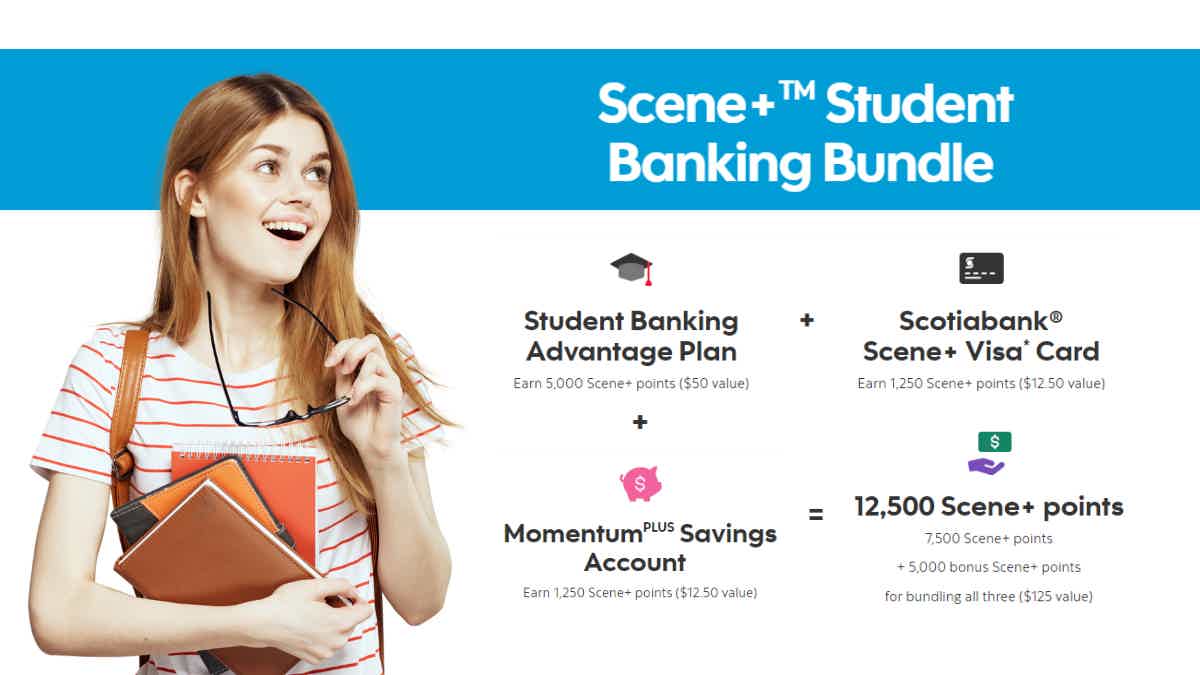

Then, now, learn more about what you can get when bundling Scotiabank products for students:

- Open a Student Banking Advantage® Plan, complete one of the two tasks within 60 days of account opening, and earn 5,000 Scene+ points;

- Add a Scotiabank® Scene+™ Visa* Card and earn 1,250 Scene+ points;

- Open a MomentumPLUS Savings Account and earn 1,250 Scene+ points;

- Bundle the three of the above and earn extra 5,000 Scene+ points.

As can be seen, you can earn a total of 12,500 Scene+ points or a $125 value as a welcome bonus.

In addition, it is essential to mention that other conditions apply for you to receive your rewards, for example, maintaining the accounts in good standing and using the credit card responsibly.

Regarding the Student Banking Advantage® Plan, the tasks that need to be done are the following:

- Set up an eligible automated and recurring direct deposit;

- And/or set up an eligible pre-authorized transaction recurring for at least two consecutive months.

Lastly, and most importantly, there are no monthly fees or minimum balance requirements attached to the accounts and card above.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Scene+TM Student Banking Bundle benefits

Generally, students must access affordable financial products to build their finances. Also, the higher earnings, the better.

Fortunately, Scotiabank gathers that in a limited promotion, in which you can bundle both your checking and savings accounts while adding a credit card with no annual fee.

By doing it, you can earn up to 12,500 Scene+ points with no minimum balance requirements.

Pros

- You can earn welcome bonuses when applying for a student checking, savings, or credit card;

- You can earn even more when bundling the three options;

- The accounts and card have no monthly or annual fees;

- There are no minimum balance requirements.

Cons

- The offers are limited.

How good does your credit score need to be?

Since the products are designed for students, you don’t need to have a perfect credit score to sign up for the promotion. Also, a credit card helps you build a credit history.

But, it is important to know that your credit will be impacted every time you apply for a credit solution, including cards.

So, using it responsibly can lead you to build solid creditworthiness.

How to apply for the Scene+TM Student Banking Bundle?

Now, learn how to apply for the Scene+TM Student Banking Bundle and earn up to 12,500 Scene+ points.

How to apply for Scene+TM Student Banking Bundle

Learn how to apply for the Scene+TM Student Banking Bundle and enjoy the limited offerings of up to 12,500 Scene+ points at no monthly fees.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Mogo Prepaid card?

Do you need a card that can help you control your finances? Read our post about the Mogo Prepaid card application and learn more!

Keep Reading

How to apply for the BMO World Elite Mastercard credit card?

Check out how the BMO World Elite Mastercard credit card application process works so you can apply now and start earning rewards right away!

Keep Reading

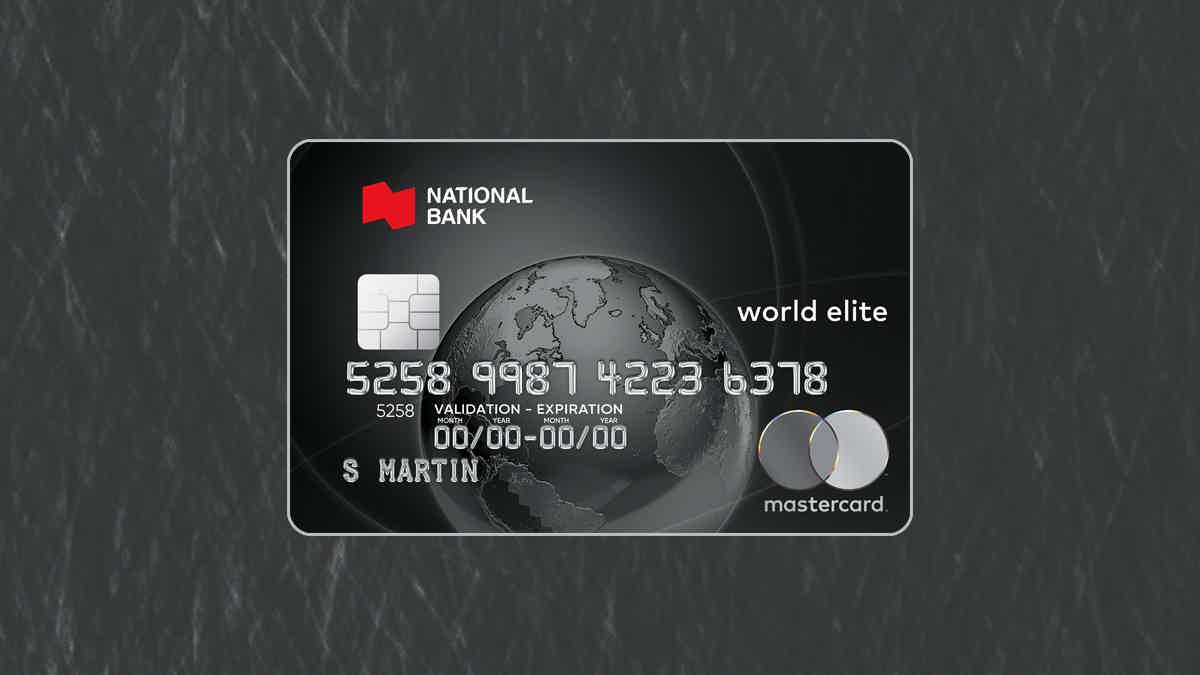

How to apply for the BNC World Elite® MasterCard® credit card?

BNC World Elite® MasterCard® credit card offers a full list of advantages for those who love to travel worldwide. Learn how to apply for it!

Keep ReadingYou may also like

Learn to apply easily for the Happy Money Personal Loan

Discover the step-by-step process to apply for a Happy Money Personal Loan here. Check it out!

Keep Reading

Debt consolidation loan: an uncomplicated guide

Read this article to learn how a debt consolidation loan can help you pay off your debts faster, save money, and improve your credit score. Check it out!

Keep Reading

Happy Money Personal Loan review: how does it work and is it good?

This Happy Money personal loan review covers all the important details. Read on if you want to learn more about this incredible lender.

Keep Reading