Read on to learn about a marketplace to help you make your purchases now and pay later!

Zebit, over 1,500 brands available and no hidden fees!

With the Zebit marketplace, you can get access to purchases from over 1,500 top brands and make your payments over six months! Moreover, you can even go through the application process with no harm to your credit score. Plus, you can get all these perks with no annual or hidden fees!

With the Zebit marketplace, you can get access to purchases from over 1,500 top brands and make your payments over six months! Moreover, you can even go through the application process with no harm to your credit score. Plus, you can get all these perks with no annual or hidden fees!

Learn the main perks you can get by joining Zebit!

When you apply to join the Zebit marketplace, you don’t need to worry too much about your credit score since they don’t check it during the application. However, they will check other information about you, and they will contact credit reporting agencies to determine if you are qualified.

To apply for the Zebit marketplace, you’ll need to provide your full name, home address, and other personal info to determine if you’re qualified. They will also ask for your Social Security Number to verify your official identity and access your creditworthiness. However, there is no credit check!

You can find various incredible and necessary products to buy at the Zebit marketplace. There are electronics, furniture, health equipment, computer, and even regular everyday accessories. Plus, they update their products regularly to give you the best options.

Zebit has high ratings on various trustable rating websites, and the customer reviews are good. Also, you can be sure that they will keep your data safe and follow the account agreement to give you six months to complete your purchase payments on time!

If you are unable to make all your Zebit account payments, they will freeze your credit to make any other payments. Moreover, they can give your name to the internal collections service to contact you and understand what happened. So, the best way to use Zebit is to make your payments on time to keep getting the benefits.

If you’re now even more interested in having your Zebit marketplace account, read our post below to learn all you need to join!

How to join Zebit?

If you need a way to shop at marketplaces while paying over time, read on to learn how to join the Zebit marketplace!

Now, if you are more interested in learning about a different option, you can consider the Walmart Money Card. With this card, you’ll be able to make all your favorite purchases at Walmart.com and in-store. Plus, overdraft protection is up to $200 and other incredible perks!

If you want to get a Walmart card to make all your favorite purchases, read our post below to learn how to apply!

How to apply for the Walmart Moneycard debit card?

You can easily and quickly apply for the Walmart Moneycard debit card. So, check out how you can start earning cash back and all the benefits of this card.

Trending Topics

How to join Tastyworks investing?

Tastyworks investing offers trading with high technology and low fees. See how to join it and enjoy all the benefits of having an account!

Keep Reading

Chime® Credit Builder card or Self Visa® Credit Builder?

Chime® Credit Builder card or Self Visa® Credit Builder? Check out the following comparison and choose wisely which one is the best for you!

Keep Reading

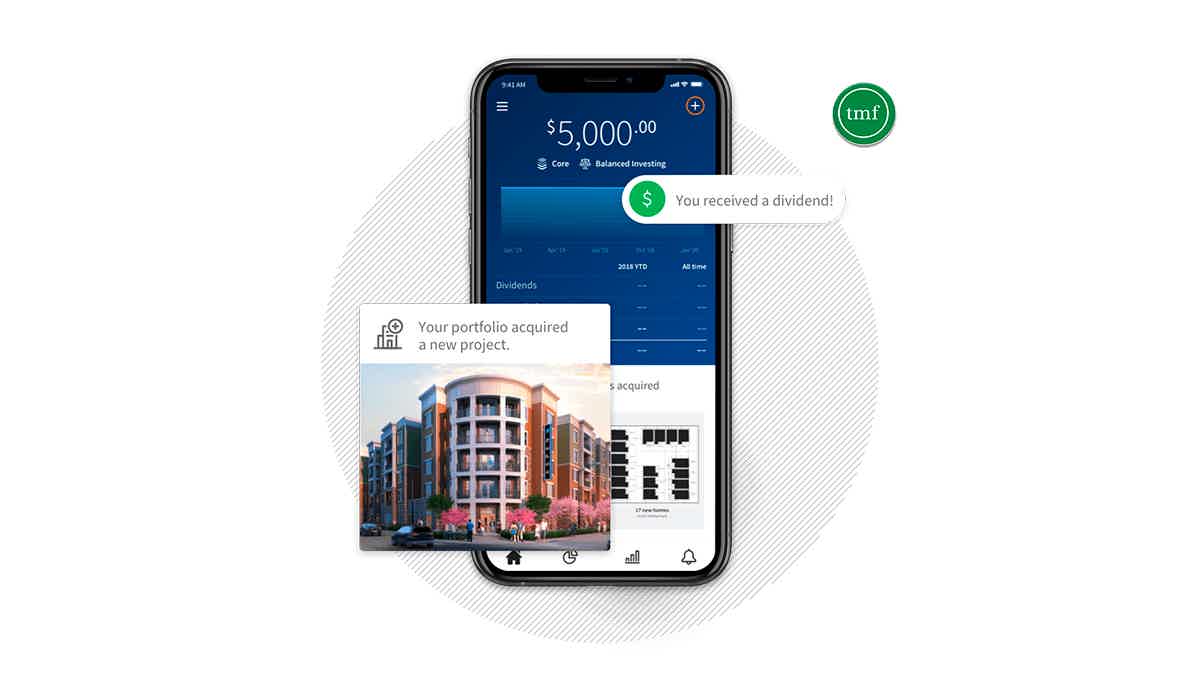

Fundrise Investments review: the best real estate investments

If you want to start investing in real estate but think it is a closed market. Read our Fundrise Investments review to know it is possible!

Keep ReadingYou may also like

How to Apply for the X1 Credit Card and Get the Best Rewards

Looking for a rewards credit card you can trust? Learn how to apply online for the X1 Credit Card. Earn up to 10X points - keep reading and learn more!

Keep Reading

Mogo Prepaid Card Review

By getting a Mogo Prepaid Card, you can save money while reducing your environmental impact. Check our Mogo Prepaid Card review to learn all that this product can do for you and for the planet.

Keep Reading

Application for the Bank of America Customized Cash Rewards card: how does it work?

Learn how to apply for the Bank of America Customized Cash Rewards card and get yourself a credit card with a rewards program that you can tailor to your spending habits.

Keep Reading