Read on to learn about a lender that can give you personalized rates and good terms!

Wisr Personal Loans, upt o $64,000 in unsecured loans with good terms!

With Wisr Personal Loans, you’ll be able to get personalized loan rates depending on your credit score and finances. Moreover, you can find a variety of personal loans available, including green loans, medical loans, and even electric vehicle loans. Plus, you’ll even be able to check your rate with no harm to your credit score!

With Wisr Personal Loans, you’ll be able to get personalized loan rates depending on your credit score and finances. Moreover, you can find a variety of personal loans available, including green loans, medical loans, and even electric vehicle loans. Plus, you’ll even be able to check your rate with no harm to your credit score!

See the main perks of applying for Wisr Personal Loans!

In Australia, the two main credit reporting agencies are Equifax and Experian. Therefore, working closely with them is a top priority for Wisr. They provide secure entry to your credit information (at your discretion, of course), so they may present it to you straightforwardly.

To live up to its reputation as a trustworthy lender, Wisr will check your documents meticulously. Even though they may be a digital non-bank institution, real people are working on accepting your loan. They promise to come back to you with a decision as soon as possible, ideally within 48 hours.

A non-banking financial institution in Australia offering consumer loans is Wisr (ASX: WZR). It was significant because it was the first public firm in Australia to focus on its sector. Plus, its loan options are very wide and with good terms depending on your finances.

Does Wisr Personal Loans have all the features you are looking for in a personal loan? If so, you can try to apply for it! Therefore, you can read our post below to learn more and see how the application process works!

How to apply for the Wisr Personal Loans?

Looking for a lender to give you varied loan options and personalized rates? Read our post to learn how to apply for Wisr Personal Loans!

If Wisr Personal Loans doesn’t offer all that you need right now for a personal loan, you can try different options. For example, you can try applying for a loan through MoneyPlace Personal Loan!

With this lender, you’ll be able to get good rates if you have healthy finances. Therefore, check out our post below to learn more about this lender and how to apply for a loan!

How to apply for the MoneyPlace Personal Loan?

Do you need a loan with good rates and terms and a quick application? If so, read on to learn how to apply for the MoneyPlace Personal Loan!

Trending Topics

British Airways American Express® Premium Plus Card full review!

If you need a card to get Avios points and travel perks, read our British Airways American Express® Premium Plus Card review!

Keep Reading

Westpac Low Rate Credit Card full review: reduced interest and rewards

Read this Westpac Low Rate Credit Card review to decide if a card with low rates on purchases and balances would help you with your finances.

Keep Reading

OurMoneyMarket Personal Loan full review

Check out this OurMoneyMarket Personal Loan review article to learn how much you can borrow, for how long, and the applicable rates and fees.

Keep ReadingYou may also like

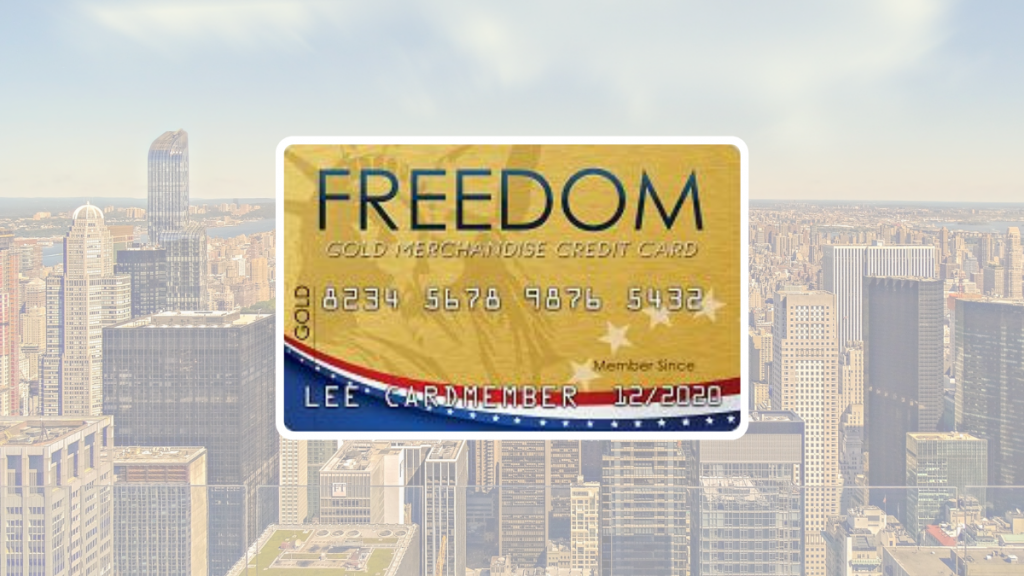

Freedom Gold credit card review: is it legit and worth it?

Have you heard about the Horizon outlet? You can enjoy exclusive benefits with the Freedom Gold credit card at this website. Let's talk more about it in this review.

Keep Reading

LightStream Personal Loan review: how does it work and is it good?

Discover what LightStream Personal Loan is all about in this complete review. Ensure fast access to the money you need and no hidden fees.

Keep Reading

Apply for the Navy Federal nRewards® Secured Card: $0 annual fee

No credit history? No problem! Apply for the nRewards® Secured and join thousands who have successfully built their credit scores with Navy Federal.

Keep Reading