Uncategorized

British Airways American Express® Premium Plus Card full review!

Do you need a card to get even more Avios points and boost your travel? If so, read our British Airways American Express® Premium Plus Card review to learn more!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

British Airways American Express® Premium Plus Card: Avios points!

Are you looking for a card that gives you exclusive Avios points, rewards, and other travel perks? Then the British Airways American Express® Premium Plus Card review is for you!

How to apply British Airways Amex Premium+?

Looking for a card to help you earn Avios points? If so, read on to apply for the British Airways American Express® Premium Plus Card!

| Credit Score | Good to excellent. |

| APR* | Purchases (simple rate): 25.56%; Cash advances (simple rate): 31.14%; Balance/money transfers (simple rate): 25.56%; 56 days interest-free on purchases (terms apply). Rates & Fees |

| Annual Fee* | £250. Rates & Fees |

| Fees* | Cash advances: 3% (£3 minimum); Balance/money transfer: 3% of the transfer amount; Also, Late payment fees and returned payment fee: £12. Rates & Fees |

| Welcome bonus* | 25,000 bonus Avios points after you spend £3,000 in your first three months with the card. Also, you can get a Companion Voucher in any cabin when you spend £10,000 in a Cardmember year. *Terms Apply |

| Rewards* | 3x Avios on purchases you make with British Airyas or BA Holidays (for each £1 spent); 1.5x Avios on other eligible purchases for each £1 spent. *Terms Apply |

Also, with this card, you’ll get access to big sign-up bonus points and competitive rates of Avios collection per pound spent each time.

In addition, get ready to enjoy great travel perks, including insurance and more! Therefore, read our British Airways American Express® Premium Plus Card review below to find out more!

You will be redirected to another website

How does the British Airways American Express® Premium Plus Card work?

With this credit card, you’ll be able to earn 3x Avios on eligible purchases and 1.5x Avios for other purchases! Moreover, you can even earn more Avios if you invite a friend!

Also, you’ll be able to get a high welcome bonus as a new cardholder. In addition, you can travel with a companion voucher!

British Airways American Express® Premium Plus Card benefits

You must know already that this card has incredible benefits related to travel. Also, you can find ways to earn many Avios points to boost your travel plans!

However, this card also has some downsides. Therefore, you can read our pros and cons list below to learn more!

Pros

- Travel perks;

- You can get travel insurance;

- There is purchase and refund protection available;

- 3x Avios points on purchases you make with British Airways or BA Holidays;

- Terms apply.

Cons

- The annual fee can be high for some;

- You may not get a high credit limit if you don’t have a good score;

- This card is not for those with not-so-good credit.

How good does your credit score need to be?

One of this card’s requirements is that you don’t have a previous history of bad debt. Therefore, you won’t be able to apply if you have a low or bad credit score.

So, you can try to find ways to improve your score before you start applying for this card.

How to apply for the British Airways American Express® Premium Plus Card?

Also, you can apply for this card with ease through the official website. Moreover, you’ll be able to qualify for this card if you meet all the requirements.

How to apply British Airways Amex Premium+?

Looking for a card to help you earn Avios points? If so, read on to apply for the British Airways American Express® Premium Plus Card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the British Airways American Express® Premium Plus Card?

Looking for a card to help you earn Avios points? If so, read on to apply for the British Airways American Express® Premium Plus Card!

Keep Reading

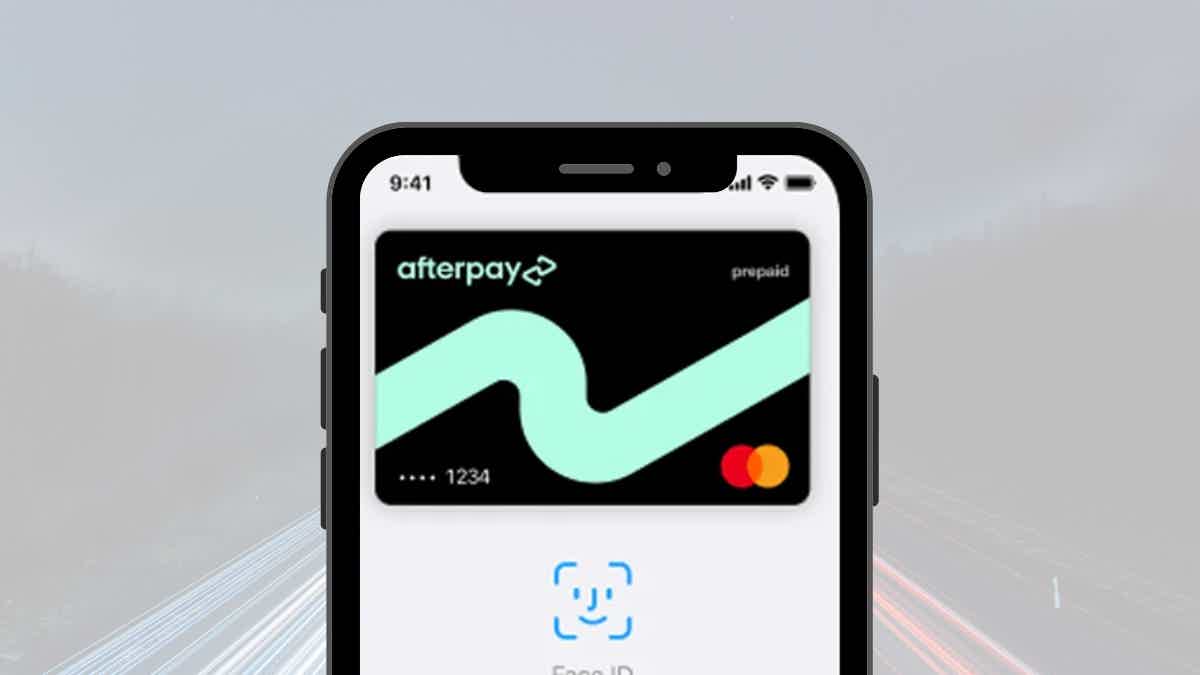

How to apply for the Afterpay Card?

Are you looking for a card to make payments and pay over time with no interest? If so, read on to learn how to apply for the Afterpay Card!

Keep Reading

How to join Citi PayAll?

If you need ways to earn more rewards with your Citi credit card, read our post to learn how you can join Citi PayAll!

Keep ReadingYou may also like

Juno Debit Card application: how does it work?

Apply for a Juno Debit Card and get all the benefits of a traditional banking account without visiting a physical branch. Read on!

Keep Reading

CreditFresh Review: Fast Cash and Flexible Credit

Need cash fast? CreditFresh promises $5K and no credit check, but is it too good to be true? Read our in-depth review to decide for yourself.

Keep Reading

OneMain Financial Personal Loan review: how does it work and is it good?

Our ultimate OneMain Financial Personal Loan review will help you discover what makes them unique. Borrow up to $20,000!

Keep Reading