The perfect credit card for reducing debt and making big ticket purchases!

Wells Fargo Reflect® Card, 0% intro APR for up to 21 months!

The Wells Fargo Reflect® Card offers a long period of 0% introductory APR on purchases and qualifying balance transfers for up to 21 months. Also, you don’t need to worry about annual fees, and you get a package of benefits, including cell phone protection, Zero Liability, Roadside Dispatch, and the My Wells Fargo Deals program. Read our full review to learn how this card can help your finances!

The Wells Fargo Reflect® Card offers a long period of 0% introductory APR on purchases and qualifying balance transfers for up to 21 months. Also, you don’t need to worry about annual fees, and you get a package of benefits, including cell phone protection, Zero Liability, Roadside Dispatch, and the My Wells Fargo Deals program. Read our full review to learn how this card can help your finances!

The Wells Fargo Reflect® Card offers unique features that can help you manage your expenses and protect your credit. Learn how this credit card can save you money and make your life easier by checking some of the many benefits it has to offer below:

To become eligible for a Wells Fargo Reflect® Card, you need to have at least a good credit score. That means a FICO® score of 700 or more. Your annual income and existing debt will also play an important role as to whether or not Wells Fargo will approve your request. You also need to be a U.S. citizen or resident above the age of majority, with a valid SSN and a U.S. mailing address.

No, the Wells Fargo Reflect® Card is not a rewards credit card. What that means is that you won’t get any cash back on purchases. However, with this card, you can have access to My Wells Fargo Deals. This program offers a series of personalized deals from selected merchants accross the country to increase your shopping experience.

The Wells Fargo Reflect® Card offers all new cardholders 18 months of 0% intro APR for balance transfers, with the possibility of a 3-month extension for good behavior. Once that period ends, the variable APR is 16.74% to 28.74%. The card charges a 3% balance transfer for 120 during the introductory period, and 5% thereafter. There’s also a 3% foreign transaction fee.

If you’d like to learn more details about the Wells Fargo Reflect® Card application process, follow the link below for a complete walkthrough. We’ll show you all the eligibility requirements as well as how you can apply online.

How to apply for a Wells Fargo Reflect Card?

Enjoy intro APR for up to 21 months with a Wells Fargo Reflect Card. Check out how to apply!

But if what you’re looking for is a rewards credit card, there’s a great alternative. The Bank of America® Customized Cash Rewards Credit Card offers 3% cash back on the category of your choice.

You’ll also have access to a generous welcome bonus and tons of exclusive features that will help you manage your expenses. Check the link below to learn more about it, including how to apply!

How to apply for Bank of America® Customized card?

The Bank of America® Customized Cash Rewards Secured card has no annual fee and can help you build credit. Read more to know how to apply!

Trending Topics

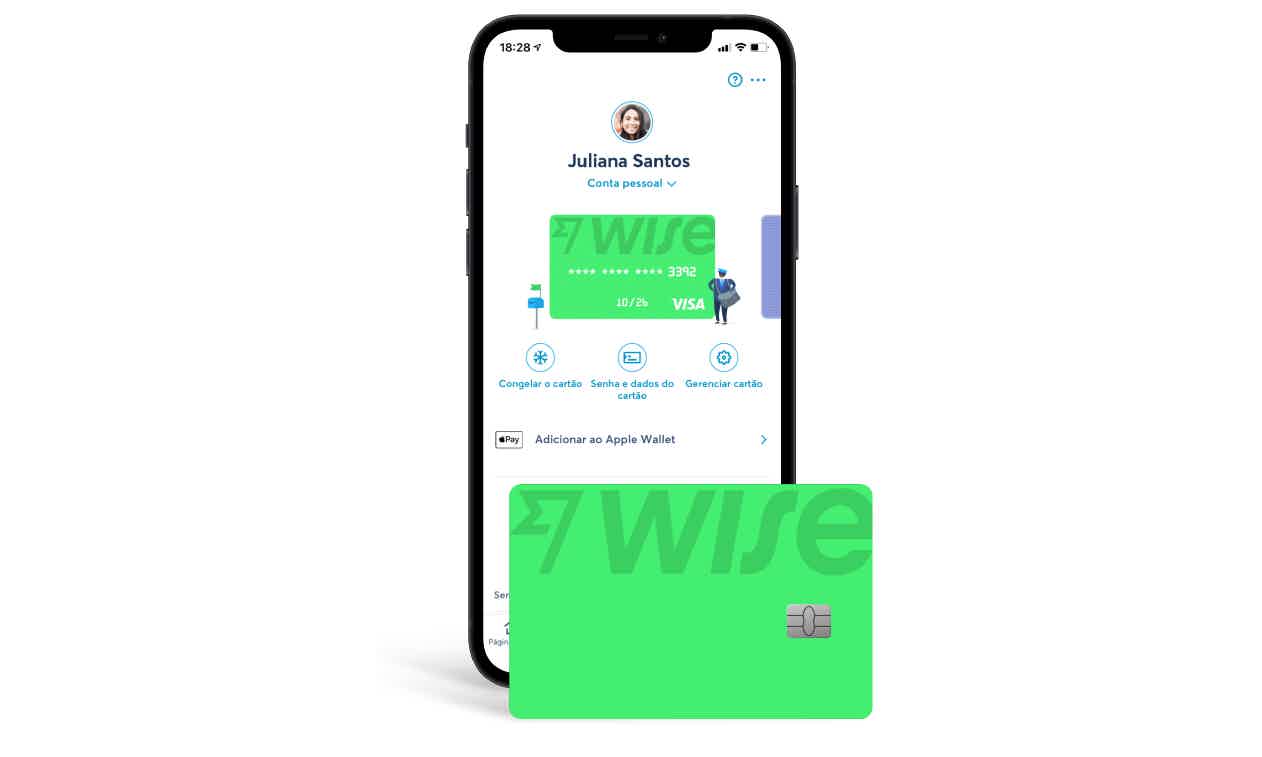

Wise Debit Card full review

In this Wise debit card review article, you will learn how it works and the benefits of having a cheap borderless account! Check it out!

Keep Reading

What is a store card? A complete guide on how to use it

What is a store card? A complete guide on how to use it, how it works, and the differences between a store card and a regular credit card.

Keep Reading

How to apply for MaxCarLoan?

Learn how easy it is to apply for MaxCarLoan and purchase the vehicle you want through a quick and simple 3-steps online form. Check it out!

Keep ReadingYou may also like

What is a checking account and how can it benefit you: find out here!

With a checking account, you can access your funds 24/7. Most checking accounts offer features such as ATM cards, online banking, and bill pay. Read on to learn what a checking account is!

Keep Reading

A major drop and stablecoin collapse cause a wild week among cryptocurrencies

Take a closer look at the volatility in the cryptocurrency market this week, with bitcoin and a stablecoin both taking big hits. Read on to learn more!

Keep Reading

Destiny Mastercard® Review: Reclaim Your Finances!

Destiny Mastercard® will give you a $700 credit limit with no security deposit required. Is that what you are looking for? If so, read this article to learn more about this card.

Keep Reading