Reviews (US)

OppFi® credit card full review

If you carry a bad credit score, you must face many challenges and obstacles to get good financial products and services. But, today, on this OppFi® credit card review, you will learn how to get a second chance!

OppFi® credit card: build your credit history!

OppFi® credit card review is about a credit card featured by a company committed to providing opportunities to its customers to rebuild financial health.

It facilitates credit access at the same time as it enables savings so you can build wealth.

It offers credit cards and loans for those who are locked out of traditional and usual options.

As part of its social impact strategy, OppFi provides outstanding customer service, with high service-level standards and 100% US-Based Support.

Check out how it works!

| Credit Score | Bad |

| Annual Fee | $99 |

| Regular APR | 35.99% |

| Welcome bonus | None |

| Rewards | None |

How to apply for an OppFi® Credit card?

Build your credit history with an OppFi® credit card! See how the application works!

How does the OppFi® credit card work?

The newest addition to OppFi is its credit card. This card considers credit scores that are less than perfect and helps you rebuild your credit history.

Since it reports to all three major credit bureaus, you can increase your credit score if you manage to pay your bills on time.

Also, it features an outstanding card app, where you can manage your transactions, card information, and add it to your mobile wallet.

Furthermore, you can stay supported by a 100% US-Based representative by phone or email anytime you need help.

The application is easy, and you can start using your card on the same day you are approved. The process considers your bank account and employment history, so you don’t have to worry about impacting your FICO® score.

Moreover, you can freeze your credit card with a few steps to prevent fraud if stolen, lost, or misplaced.

Finally, you must know that it charges a $99 annual fee, a 35.99% APR, and the credit limit is pretty reasonable at $1,000.

Now, check the complete list of pros and cons below!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

OppFi® card benefits

Although it doesn’t offer rewards or sign-up bonuses, this card allows you to apply without worrying about impacting your credit score.

In fact, it helps you build and rebuild credit history since it reports to all three major credit bureaus.

So if you manage to hold your card and bills responsibly, you can increase your score significantly.

Furthermore, you get access to a fantastic team to support you, as well as a great mobile app where you can manage everything you need.

Pros

- It considers bad credit scores for the application;

- You can apply online without worrying about affecting your credit score;

- It reports to all three major credit bureaus;

- You can build your credit history;

- It provides excellent US-Based support;

- It features an outstanding mobile app.

Cons

- It charges an annual fee;

- The APR is relatively high;

- It doesn’t offer rewards or welcome bonuses.

How good does your credit score need to be?

You don’t need a perfect credit score to apply for the card. It requires only your bank account and employment history for approval decisions.

Also, the application doesn’t affect your FICO® score.

How to apply for OppFi® credit card?

Learn how to apply for this credit card so you can start building your credit history right away!

How to apply for an OppFi® Credit card?

Build your credit history with an OppFi® credit card! See how the application works!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Blue Cash Preferred® Card from American Express review

If you like cash back on everyday purchases, this Blue Cash Preferred® Card from American Express review is for you. Check it out!

Keep Reading

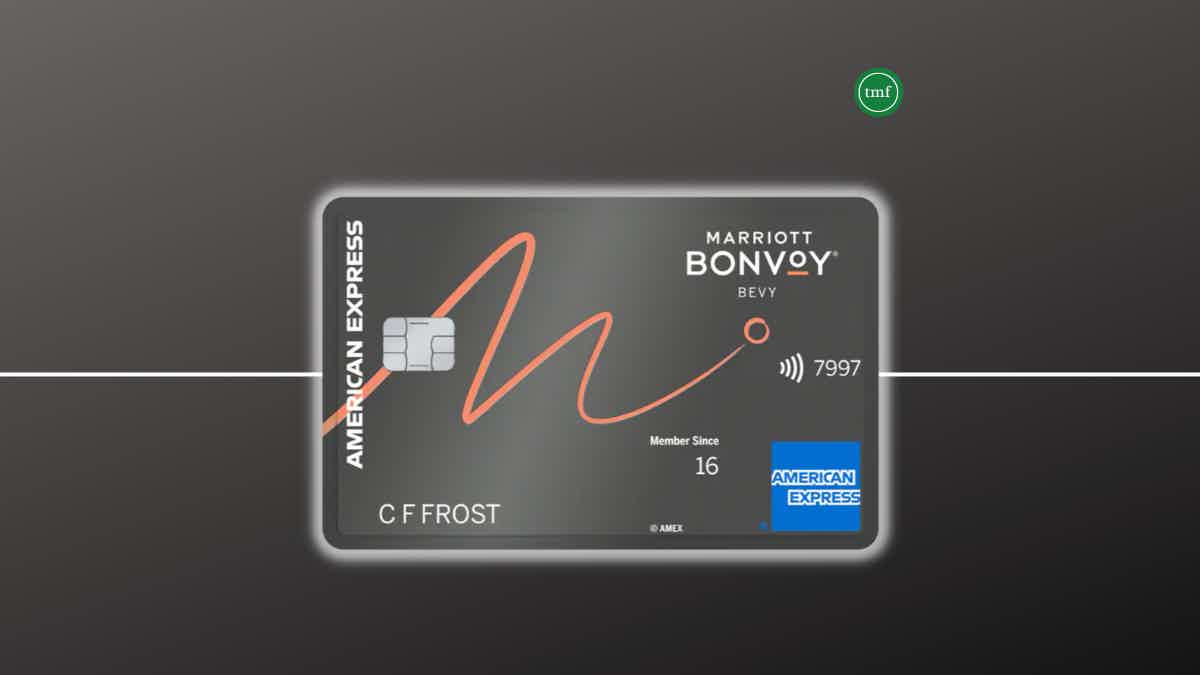

How to apply for the Marriott Bonvoy Bevy™ American Express® Card?

Learn how to apply for Marriott Bonvoy Bevy™ American Express® Card and enjoy earning 125,000 Marriott Bonvoy® Bonus Points within 3 months.

Keep Reading

How to opening a Ivy Bank High-Yield Savings account?

If you need an account that gives you high interest, read our post about the Ivy Bank High-Yield account opening and apply now!

Keep ReadingYou may also like

Where Zero Means More: Navy Federal Platinum Card Review

Get everything you need to know about the Navy Federal Platinum Card in our review and discover why "zero" is a great value - pay no hidden fees!

Keep Reading

Better Mortgage review: how does it work and is it good?

We have made a Better Mortgage review to tell you why this can be the place to find the money you need. You'll find finance and buying options, understand how it works, and discover its pros and cons. Read on!

Keep Reading

Citi Custom Cash℠ Card: a guide to the application

If you're looking for a card with a welcome bonus and cash back rewards, the Citi Custom Cash℠ Card may be what you need. Check out how to apply for it and start earning rewards right away!

Keep Reading