SA

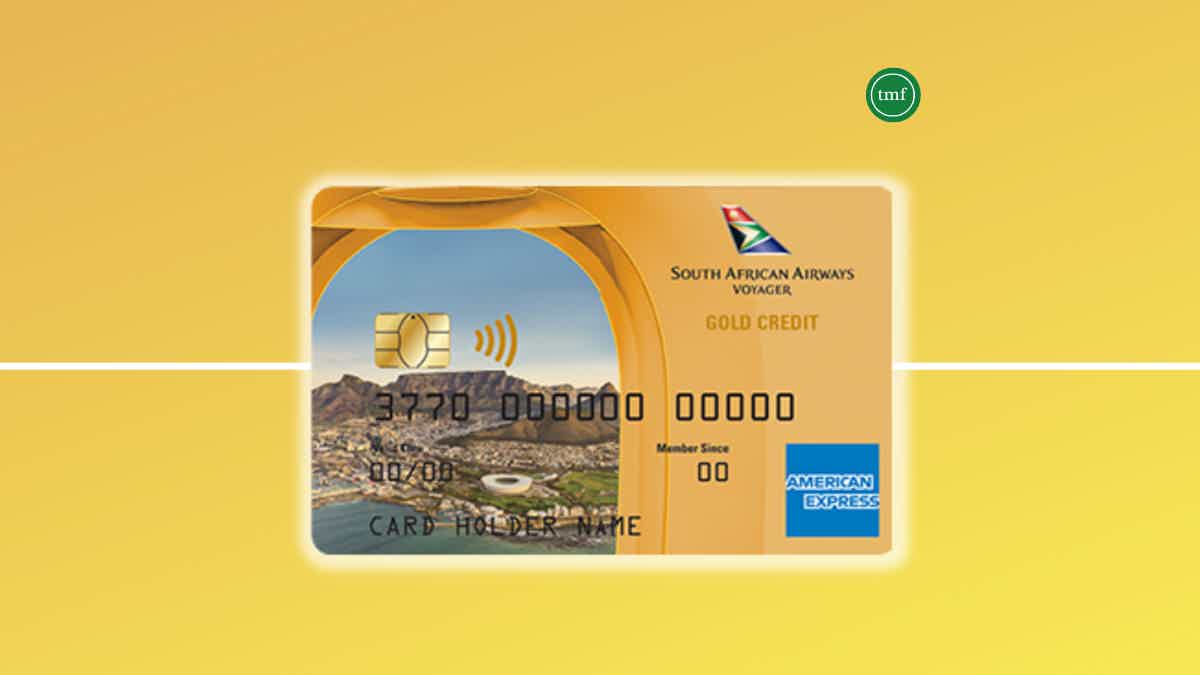

NedBank SAA Voyager Gold Credit Card review: Earn miles!

Having the right credit card to travel and earn miles can make all the difference. So, read our NedBank SAA Voyager Gold Credit Card review to learn more about this card!

NedBank SAA Voyager Gold Credit Card: Get personalized rates and earn miles!

Are you a South African looking for a credit card that rewards your spending and earns miles quickly? You can read our NedBank SAA Voyager Gold Credit Card review to learn more about this excellent card!

How to apply for the NedBank SAA Voyager Gold card

If you need a card to help you earn unlimited miles and travel promotions, read on to apply for the NedBank SAA Voyager Gold Credit Card!

| Requirements* | You’ll need a minimum income of R6,600 per month. *Terms apply. |

| Initiation Fee | N/A. |

| Monthly Fee | R27 credit facility fee; R700 annual service fee. |

| Fees* | Up to 55 days interest-free; R150 replacement card fee; No fees for card swipes; Cash deposits at Nedbank branch: R100 + R2.50 per R100 or part thereof; There are other fees. *Terms apply. |

| Rewards* | Unlimited miles on your NedBank SAA Voyager Gold Credit Card; You can double your miles in your first month; 1 mile for each R6.50 on eligible spending for Amex or R11.50 for Mastercard; 10,000 bonus miles on the first SAA ticket you use; Also, 15,000 bonus miles when spending R320,000 in a calendar year. *Terms apply. |

Also, this Nedbank card can be a great choice for seasoned frequent flyers and casual adventurers.

So, whether traveling around the world or just down the street, there are plenty of advantages to using this card! Therefore, keep reading our NedBank SAA Voyager Gold Credit Card review to learn more!

How does the NedBank SAA Voyager Gold Credit Card work?

Are you always looking for new ways to save and get more from your hard-earned money? If so, you’ve probably thought about how a credit card can help.

Well, the NedBank SAA Voyager Gold Credit Card can help you out! Also, this card offers rewards and miles bonuses!

Moreover, there are personalized rates, free miles, and other travel perks!

In addition, the NedBank SAA Voyager Gold Credit Card and see if it could be an ideal fit for South Africans looking for value, convenience, and miles opportunities.

Also, you can even earn up to 15,000 bonus miles when spending R320,000 in a calendar year!

Plus, there are other rewards, such as getting 1 mile for each R6.50 on eligible spending on the Amex card or R11.50 on the Mastercard!

You will be redirected to another website

NedBank SAA Voyager Gold Credit Card benefits

As we mentioned, this card offers incredible travel perks, such as an extended Global Companion ticket each year when you meet your spending thresholds.

Therefore, you can read our pros and cons list below to learn more about the NedBank SAA Voyager Gold Credit Card!

Pros

- You’ll earn high miles rewards and bonuses;

- You’ll get personalized interest rates;

- There is up to 55 days interest-free.

Cons

- The monthly income requirement can be high;

- There is a high annual fee for this card.

How good does your credit score need to be?

There is not much information about the credit score required to get this card. However, you’ll need to have a monthly income of at least R6,600 to qualify.

How to apply for the NedBank SAA Voyager Gold Credit Card?

You can apply for this card online and hassle-free! Also, all you need is to provide your personal information and wait for a response!

Read the following content and learn how to apply for the NedBank SAA Voyager Gold Credit Card.

How to apply for the NedBank SAA Voyager Gold card

If you need a card to help you earn unlimited miles and travel promotions, read on to apply for the NedBank SAA Voyager Gold Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

TymeBank Credit Card review: Earn Smart Shopper Points!

Are you looking for a card with Smart Shopper Points and flexible payment options? If so, read our TymeBank Credit Card review!

Keep Reading

How to apply for the Sanlam Money Saver Credit Card?

Looking for a credit card with up to 5% cashback and money-saving features? Learn how to apply for the Sanlam Money Saver Credit Card!

Keep Reading

FNB Private Clients Credit Card review: all-inclusive value and features

Learn how to access a wide list of all-inclusive values and features on this FNB Private Clients Credit Card review. Enjoy the remarkable!

Keep ReadingYou may also like

Walmart MoneyCard® application: how does it work?

Learn how easy and fast it is to apply for the Walmart MoneyCard® and make the most out of your Walmart shopping - online and in-store!

Keep Reading

First Phase Visa® Card review

Do you need to repair or build your credit from scratch? Check out the First Phase Visa® Card review, and find out more about how it can fix it. Read on!

Keep Reading

BankAmericard® Secured Credit Card review: build credit fast

How to boost your score quickly while paying $0 annual fee? Find out here in our complete BankAmericard® Secured Credit Card review.

Keep Reading