CA

My Canada Payday Loans review: 100% online loans

When you are in need, payday loans can solve your problems. So, check out our My Canada Payday Loans review to learn more about this lending platform!

My Canada Payday Loans: what you need to know before applying

When you’re in a financial bind, it can be tough to know where to turn for help. If you’re looking for a loan in Canada, My Canada Payday can lend up to $1,500! Read our My Canada Payday Loans review!

| APR* | From $15 per $100 borrowed to $19 per $100 borrowed. *Terms apply. |

| Loan Purpose | Payday loans. |

| Loan Amounts | Up to $1,500. |

| Credit Needed | There is no need for a credit check. |

| Terms | The next month. |

| Origination Fee | N/A. |

| Late Fee | There may be fees depending on the loan amount. |

| Early Payoff Penalty | There are no prepayment penalty fees. |

How to apply for My Canada Payday Loans?

When you're in a bind, payday loans can be a lifesaver. So, check out our post to learn how to apply for a loan with My Canada Payday Loans!

Do you want an online loan to help you borrow some money for an emergency? If so, My Canada Payday Loans can help you out!

This lending platform is recognized by TrustPilot and is rated 4.6 stars out of 5! So, keep reading our My Canada Payday Loans review to learn more!

How does the My Canada Payday Loans work?

With this lending platform, you can find the best lenders and loan options for your situation. Also, you can find loans of up to $1,500. Plus, there is no need for a credit check to qualify!

Moreover, you don’t need to go to a physical agency or to fax documents. All you need to apply is a computer and internet access!

However, there is not much information about the late fees. Therefore, we recommend that you read the terms before you apply.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What credit score do you need for My Canada Payday Loans?

You don’t need a high credit score to apply for a loan through the My Canada Payday Loans platform. They consider other aspects of your finances to analyze your application, and they don’t make credit checks!

My Canada Payday Loans highlights

This lending platform offers incredible benefits to its users. Also, you can find up to $1,500 in loan amounts, and they don’t perform credit checks!

Plus, you don’t need to fax any documents during the application process. The process is completely online, and you can finish everything in as little as 15 minutes!

However, My Canada Payday Loans also has some downsides, such as the late payment fees. So, check out our list below with the pros and cons of using My Canada Payday!

Pros

- You can get up to $1,500 in payday loans.

- There is no need for a credit check.

- You can complete the application process in as little as 15 minutes.

Cons

- There is not much information about the late fees.

- You can only find payday loans.

How to apply for My Canada Payday Loans?

To apply for a loan through My Canada Payday, you only need internet access and a computer or smartphone. Check out our post below to learn all the details of how to apply!

How to apply for My Canada Payday Loans?

When you're in a bind, payday loans can be a lifesaver. So, check out our post to learn how to apply for a loan with My Canada Payday Loans!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

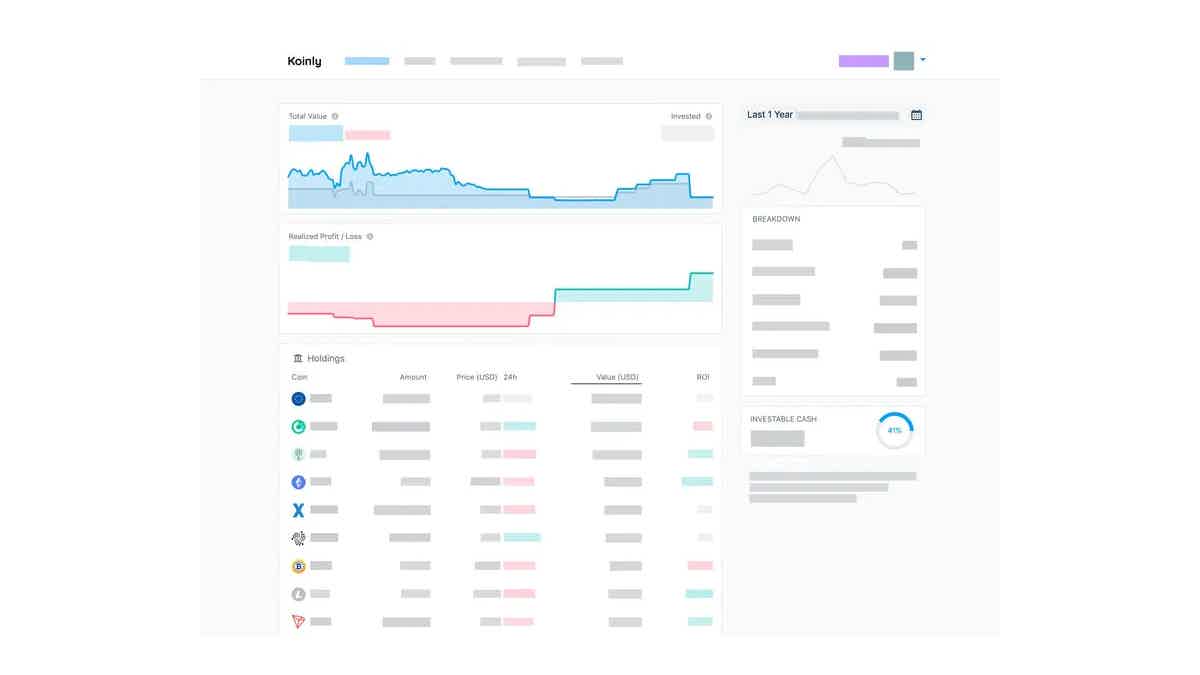

Koinly review: how does it work?

If you are a crypto investor in Canada, you must be aware of declaring your tax return. Check out how to do it with our Koinly review.

Keep Reading

Allure Mastercard® credit card review

Check out the Allure Mastercard® credit card review and learn how to support the Quebec Breast Cancer Foundation while getting many benefits.

Keep Reading

Fortrade application: How to join Fortrade?

If you are looking for an investment platform with educational resources and other benefits, read our post about the Fortrade application!

Keep ReadingYou may also like

Dare App review: Cope with anxiety and Panic Attacks!

This app can be a powerful tool for reducing anxiety in your life. Sometimes it just takes creativity to make a new approach to managing stress and anxiety, so have fun with this Dare app review!

Keep Reading

Women, Infants, and Children (WIC): nutritional support for families

The Women, Infants and Children program provides pregnant women and new mothers with infants under five years old with supplemental foods. Read on to learn more about this program!

Keep Reading

Ink Business Cash® Credit Card Review: up to 5% Cash Back

Save more on your small business with a card that offers up to 5% cash back on office supplies. Discover the potential of the Ink Business Cash® Credit Card in our detailed review.

Keep Reading