CA

Allure Mastercard® credit card review

Check out the Allure Mastercard® credit card review and support the Quebec Breast Cancer Foundation. The card also gives your many advantages and perks. Find out more right below!

Allure Mastercard® credit card: support the Quebec Breast Cancer Foundation while enjoying many benefits.

National Bank features a credit card that gathers all in one place. With the Allure Mastercard®, you get the chance to earn cashback while paying a zero annual fee and supporting an important cause through the Quebec Breast Cancer Foundation. Also, the bank is one of the best among credit card issuers, elected the most distinguished for customer experience for the second time, according to the 2021 Forrester CX Index. So today we’re gonna go in depth and talk about all you need to know about this product in our Allure Mastercard® credit card review.

Keep reading to learn more!

| Credit Score | 725 – 749 |

| Annual Fee | $0 |

| Regular APR | From 20.99% on purchases to 22.49% on balance transfers and cash advances |

| Welcome bonus | None |

| Rewards | 1 point for every $2 spent on purchases; For 1,000 points earned, you get $10 discount in your credit card account per year |

How to apply for Allure Mastercard® credit card?

Check out how to apply for an Allure Mastercard® credit card and make a difference in the world.

How does the Allure Mastercard® credit card work?

The Allure Mastercard credit card mixes excellent benefits with social impact. So, if you are looking for a cause to join, applying for this card might be worth considering.

In fact, this credit card is one of a few that supports a significant cause and makes a powerful impact.

By using it, you can donate 1% of your purchases to the Quebec Breast Cancer Foundation. Also, you earn 1 point for every $2 spent on purchases, whether online or in-store.

For every 1,000 points earned, you get a discount of $10 in your credit card account every year.

Furthermore, you get discounts on gift cards, Zero liability, security features through Mastercard ID Check, and an Extended Warranty.

The APR is competitive, and it ranges from 20.99% on purchases to 22.49% on balance transfers and cash advances.

Finally, all of that with no annual fee.

If you are a Canadian resident at the age of majority in the province you live in, you may enjoy holding an Allure into your wallet.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Allure Mastercard® credit card benefits

This card is a fantastic option for Canadians who search for outstanding benefits and social impact.

While you use it, you can support the Quebec Breast Cancer Foundation.

Also, you get cashback on purchases, discounts on gift cards, protection & security features, Mastercard acceptance worldwide, an Extended Warranty, and more.

All the benefits come with a zero annual fee and a reasonable APR.

Pros

- National Bank has been elected one of the best banks when it comes to Customer Experience for the second time in a row;

- Allure Mastercard supports the Quebec Breast Cancer Foundation;

- 1 point for every $2 spent on purchases, whether online or in-store;

- You get a discount on your credit card account once a year by accumulating 1,000 points;

- You also get discounts on gift cards;

- The card provides you with Zero liability, security through Mastercard ID Check, protection against damage or theft, and an Extended Warranty.

Cons

- The Allure doesn’t offer travel insurance;

- It lacks a higher tier of rewards.

How good does your credit score need to be?

Canandian residents who have reached the age of majority must have a credit score between 725 and 749 for eligibility. But applicants with a score 660 and above might also get the card after the bank’s personal analysis.

How to apply for Allure Mastercard® credit card?

If you are interested in making a difference in the world, learn how to apply for an Allure Mastercard credit card next.

How to apply for Allure Mastercard® credit card?

Check out how to apply for an Allure Mastercard® credit card and make a difference in the world.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Scotia Momentum® No-Fee Visa card?

If you love car rental discounts and cash back, read our post about the Scotia Momentum® No-Fee Visa card application and learn more!

Keep Reading

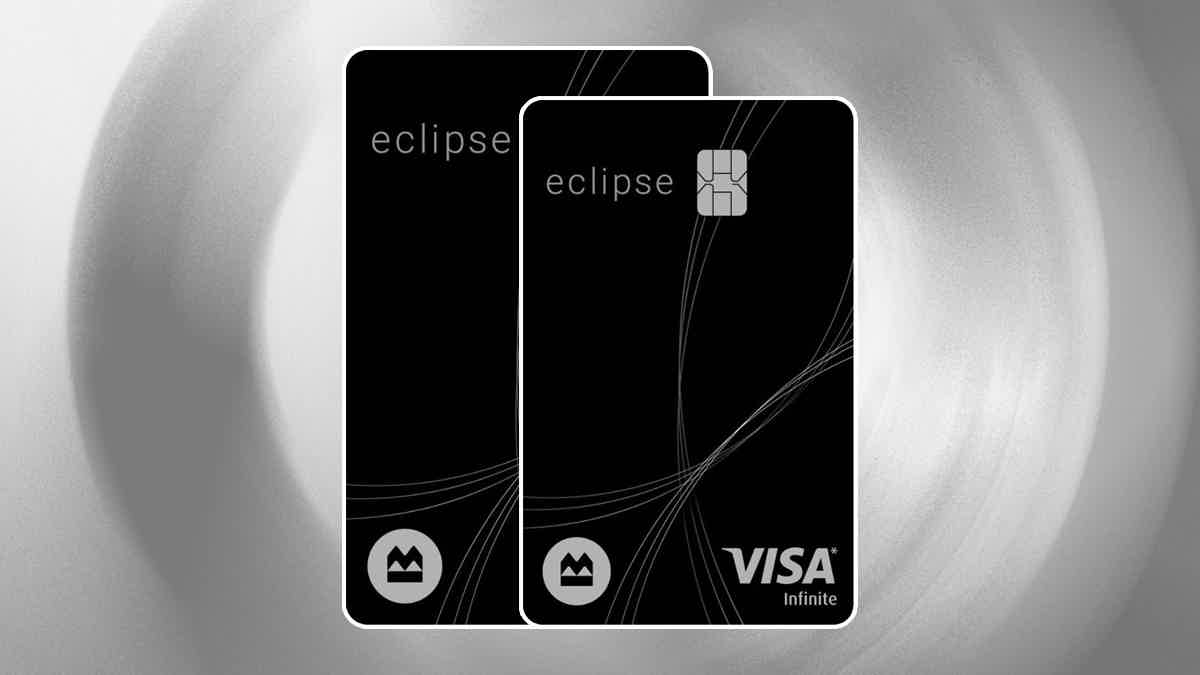

BMO eclipse Visa Infinite credit card full review

Do you need a card with great travel perks and rewards? Read our BMO eclipse Visa Infinite credit card review to learn more!

Keep Reading

10 best High-Interest Savings Accounts in Canada!

Do you want to make more money by leaving it in a savings account? If so, read more to see the Best High Interest Savings Accounts in Canada!

Keep ReadingYou may also like

Application for the Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card could be a good option for you. It offers miles that can be used for travel rewards, and it's easy to use. In this post, we'll explain how you can apply for it!

Keep Reading

Learn to easily apply for the PenFed Credit Union Personal Loans

Do you have questions about how to apply for the PenFed Credit Union Person Loans? Here you'll find the answers to make the application without hassles. Keep reading!

Keep Reading

3 Best student credit cards: choose yours!

In this article we point out the most important factors you should consider when choosing a student credit card, and give you 3 recommendations.

Keep Reading