Tips (US)

15 best and surprising money habits of financially successful people

Think like a wealthy person and you might become one. No, it will not be easy. But we are here to give you a hand. Keep reading and find it out!

Learn the surprising money habits of the financially successful people

The road to success is winding and full of setbacks that make us doubt if we will ever reach our goals. The majority of people who have attained the success they desire will tell you that adopting millionaire habits is not simple. Do not blame yourself if you wake up one day and realize your life is not going the way you planned.

Simply take a moment to pause, reflect, and accept responsibility for changing the course of your life going forward. Keep in mind that no change in results occurs without a change in behavior. It would be insane to believe otherwise. Changing one’s habits, activities, and plans can be critical to achieving one’s objectives.

Here are 15 tips you can follow right now to alter your life and put yourself on the path to success.

The 8 different types of investment accounts

In addition to having a normal bank account, you can open one of the different types of investment accounts there are. Come and see.

15 essential money habits from financially successful people that you can do too!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Have discipline

Discipline is a quality that has the power to improve our lives and produce amazing results on both a personal and professional level. The majority of individuals live in a state of anxiety, which makes it difficult to achieve their objectives more rapidly.

Study about money

Knowledge is a powerful tool. Those who wish to live a financially balanced and secure life may not be financial experts, but they must make it a habit to study and learn about the subject in order to make the best decisions.

Here at Mister Finance, you can find content to start learning more about money and get access to knowledge that will assist you in making sound financial decisions.

Recognize your spending patterns

What are your responsibilities? From those, which can be eliminated? If you have a company and it is expanding, what costs will you have? Actually, what extremely necessary costs will you have? Examine all of your responsibilities. The unexpected can occur, and you will need money to deal with what is really needed!

Large organizations fail due to a lack of management. Knowing how much cash is available, what are your banking transactions, the flow of sales, and products that have been halted in stock is critical for developing strategies that will help you boost your profitability and/or have working capital.

And the same applies to your personal life.

Always compare product and service prices

Comparing prices is an essential practice for anyone who wants to maintain a healthy financial situation. Moreover, this task has simply become a lot easier thanks to the internet. Visit websites you trust, such as eBay, before purchasing any product. This way, you will ensure you are getting the greatest deal.

Program your savings

First of all, your initial investment goal should always be building an emergency reserve. It is critical to transfer money every month to build up your reserve, do not forget that. Reserve first. However, these transfers can be scheduled straight on your bank platform. Meaning you will struggle less.

Make your monthly investments by transferring a percentage of your salary to your brokerage account, for example. Keep the monthly investments even after your emergency reserve is complete. This is something you should do for the rest of your life!

Make use of categories

This technique is excellent for budgeting. Some refer to the categories as envelopes, for example. The concept is to define the destination of your income. Determine how much you will probably spend for each category of expense: food, transportation, entertainment, investments, etc. The sum cannot be higher than your income!

To put it another way, each envelope will contain a certain quantity of money, less than your income and non-transferable. The envelopes for the categories can be imaginary. A spreadsheet, for example, can be used to control your spendings. Moreover, there are mobile apps that can help you with that.

As quickly as possible, pay your expenses

We have bills to pay every month. Water, energy, phone, mobile phone, health insurance, and so on… It is always a good idea to pay them as soon as possible. As soon as you get notified, and way before they are due.

Put them on automatic debit if possible. It not only makes your day-to-day life easier. It also keeps you from forgetting a bill and going into debt, interests being added.

Know how to choose the best investments

Another financial habit that successful people have in common is reading about the best investments, following the financial market news, and choosing the best applications for their profile and goals.

Those who want to create positive financial habits and not lose money need to go beyond common sense. In the current scenario, for example, savings accounts, despite being a popular product, are not the best alternative, even for those looking for a conservative investment.

Keep an eye on your financial investments

A habit that persons who care about their money should establish, in addition to reading about finances, is to continually examine their financial investments. An investment that pays off one day could not pay off the next.

Keep an eye on the performance of your investments and diversify them as much as possible based on your life goals (retirement, for example) and the amount of money you have to invest.

Think like a millionaire

Bill Gates, Jeff Bezos, Elon Musk, MArk Zuckerberg. You name. The richest men of the USA have already shared their way of thinking somehow. What does this mean? It means that, nowadays, there is no excuse to try to adopt these people’s strategically healthy financial habits.

Visualize your future financial success

One good habit you can adopt is the powerful of visualization. As science can prove, our brain does not know how to differentiate past, present and future experiences. In other words, we can think of a past event and our body will physically respond in the present.

Therefore, following the same logic, you can imagine the future that you want and make you brain and body believe you are already rich. As a consequence, you will start acting and thinking like one.

Establish a finance department

Sometimes, if you are a very busy person, you can think of outsourcing your personal finance duties to a trusted person or a skilled professional. But be sure to monitor, analyze, and even learn so you can start taking over control over your finances at some point.

Moreover, you may ask this person to help you to understand your budget patterns, necessities, and non-necessary-costs.

Take chances, but don’t trip over yourself!

The importance of being cautious and analyzing the market cannot be overstated. As the title suggests, proceed with caution, study the needs you will have to meet and the market. Also, consider whether you will need to make changes in the short-term or long-term.

Give your family peace of mind

Setting up an emergency reserve, as mentioned at the beginning, is the first step before investing for the medium and long term. However, if you are married or have children, it is also critical to ensure your family’s safety. Applying for a life insurance policy, for example, is a viable option. Private pension plans, education-related investments are also considerable options.

Celebrate the small steps towards success

Finally, all of these tips require effort from your part. It will not be easy, So, appreciate your own hard work, even if it does not look like it at the moment. Be grateful, be proud, learn from your mistakes, and keep up the hard work.

Enjoyed our content. Then we invite you to read more!

Financial Planning is easy: steps for beginners

Many people fail at controling their finances. Fortunately, putting together a financial planning is easier with our h

About the author / Thais Daou

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

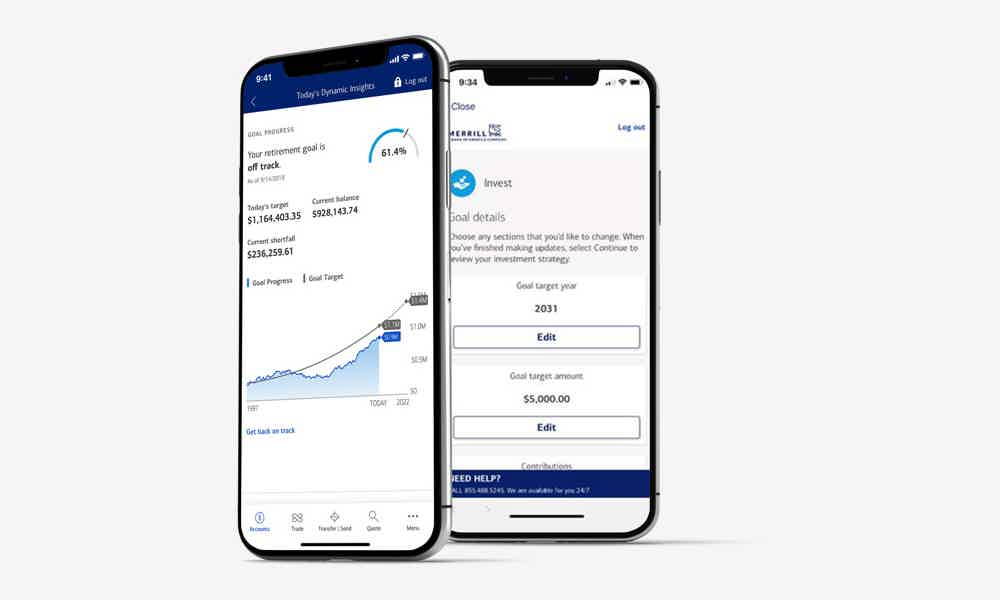

Merrill Edge investing full review

Get a full range of investment choices with no annual account fees investing at Merrill Edge. Check out the Merrill Edge investing review!

Keep Reading

Bitcoin miners: What is it?

Are you interested in knowing about the world of crypto mining and how Bitcoin miners work? If so, keep reading our post to learn more!

Keep Reading

How to apply for DCU Personal Loans?

This is your chance to get a loan at a low cost. Check out how to apply for DCU Personal Loans and enjoy its affordability and flexibility.

Keep ReadingYou may also like

PNC Bank Mortgage review: how does it work and is it good?

If you dream of buying your own house but don't have much money to start, the PNC Bank Mortgage review can be a lifesaver. Read on to understand how this loan works and how you can start with a 3% down payment. Check it out!

Keep Reading

U.S. Bank Cash+™ Visa Signature® credit card review: is it worth it?

When it comes to cashback, the more you get on daily spending, the better. That's the case with the U.S. Bank Cash+™ Visa Signature® credit card. You can choose the best categories for you. Learn more about it in this article.

Keep Reading

Mogo Prepaid Card Review

By getting a Mogo Prepaid Card, you can save money while reducing your environmental impact. Check our Mogo Prepaid Card review to learn all that this product can do for you and for the planet.

Keep Reading