Reviews (US)

Monevo USA Personal Loan full review: what you need to know before applying

Wondering if a Monevo loan is right for you? We can help you decide if this platform will give you the best options. So, read our Monevo USA Personal Loan review to know more!

Monevo USA Personal Loan: find the best lender match for you

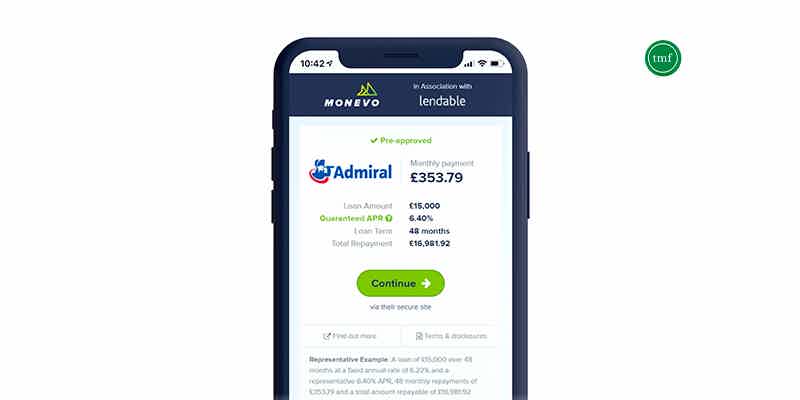

Monevo USA is a personal loan platform that offers borrowers access to various of loans from various lenders. The company has helped over 2 million borrowers get the money they need. In this full review, we’ll look at what Monevo USA has to offer and what you need to know before applying. So, whether you’re considering borrowing through Monevo USA or want to learn more about them, read our Monevo USA Personal Loan review!

| APR* | From 2.49 to 35.99%. *Terms apply. |

| Loan Purpose | Home improvements, home refinancing, and other personal loans. |

| Loan Amounts | The loan amounts depend on the lender. But you can get loans of up to $100,000. |

| Credit Needed | You can find lenders on the platform that accept lower credit scores. |

| Terms* | Approximately from 12 to 144 months. *Terms apply. |

| Origination Fee | The origination fee depends on the lender you deal with on the platform. |

| Late Fee | The late fee and other fees also vary by lender. |

| Early Payoff Penalty | The early payoff penalty depends on the lender. |

How to apply for Monevo USA Personal Loan?

Read our post to learn the tips you need to apply for a Monevo USA personal loan and get the perfect loan for your needs!

How does the Monevo USA Personal Loan work and its benefits?

Monevo Personal Loans is a great place to make your first or new loan. You can also find the best lenders and loan options in minutes. Monevo also wants to create a platform for those who need an easier way to get a loan.

But Monevo has flaws. You may receive unwanted phone calls from lenders. This is because Monevo must share your information with potential lenders. To learn more about this personal loan platform, read on.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros

- You can complete your loan application in a matter of minutes or even seconds.

- The Monevo personal loan platform is free to use.

- Your personal loan application with Monevo will not affect your credit score.

Cons

- You will only find good loan options if you are looking for a personal loan. If you need a loan for some other situation, it might be difficult to find it with Monevo.

- Monevo will need to share your personal data with many lenders to find the best for you. Also, for them to analyze your profile. This might result in some unwanted calls from these lenders.

What credit score do you need for Monevo USA Personal Loan?

The Monevo platform helps you find the best lender for your loan. So, you don’t need a perfect credit score to find an ideal loan. On Monevo’s platform, you can also find your perfect loan in minutes. Even with bad credit, this can happen.

How to apply for Monevo USA Personal Loan?

Applying for a personal loan through the Monevo platform can be very straightforward. Also, you can do it all in minutes and from your home. Therefore, if you want to know more about how to apply for a loan with this personal loan platform, read our post below!

How to apply for Monevo USA Personal Loan

Read our post to learn the tips you need to apply for a Monevo USA personal loan and get the perfect loan for your needs!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join the Ameritrade Investing app?

Do you fit the investor profile to use Ameritrade Investing? If so, keep reading to know more about how to apply!

Keep Reading

How to apply for Citrus Loans?

Citrus Loans offer amounts of up to $2,500 with an easy online process and fast funding. Check out how to get the money you need right away!

Keep Reading

How to apply for the OppLoans?

Looking for a way to get the money you need with no hassle? You can learn how to apply for OppLoans and pay no hidden fees!

Keep ReadingYou may also like

Marcus by Goldman Sachs Personal Loans application: how does it work?

If you want to learn how to apply for a personal loan at Marcus by Goldman Sachs Personal Loans, we can help. The application process is easy and pre-qualification doesn’t harm your credit score.

Keep Reading

Learn to apply easily for the Veterans United Home Loans

Veterans United Home Loans assists those who have served the country. Find out how to take advantage and apply with 24/7 support! Read on!

Keep Reading

Learn to apply easily for Next Day Personal Loan

Are you in a bind and want to get some extra cash? Next Day Personal Loan can help. They are the ideal go-to site for connecting borrowers and lenders. So what are you waiting for? Apply now!

Keep Reading