Loans (US)

How to apply for Monevo USA Personal Loan?

To find out how to apply for a Monevo USA personal loan and get the loan that best suits your needs, read our blog post today. You can apply without affecting your credit score!

Applying for Monevo USA Personal Loan: learn how to apply for the perfect loan

Monevo USA offers personal loans to those in need of a little extra cash. Also, applying is simple and takes just minutes to complete. This blog post will give you tips to follow the steps you need to take to apply for a Monevo USA personal loan. So, whether you need some quick money for a special purchase or have an unexpected expense, Monevo can help! Read more to know how to apply for a loan with Monevo USA Personal Loan!

Apply online

On the Monevo platform, you can easily apply for a loan. You can also use their calculator to estimate your loan rate. You can also finish your application after checking your rate for free. The platform will then ask for some personal information to find you the best lender.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

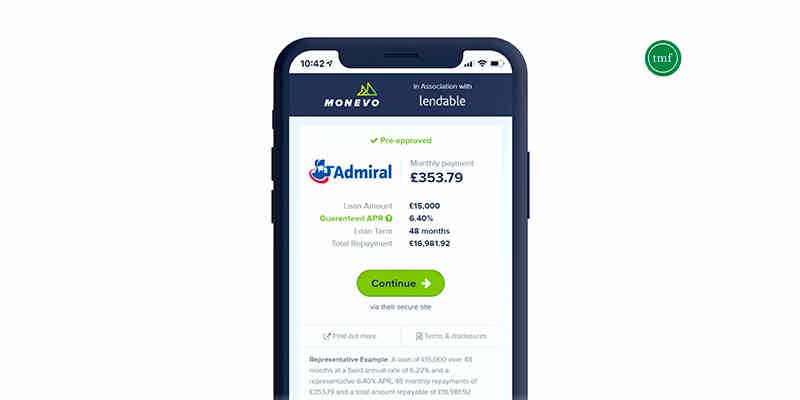

Apply using the app

On the Monevo platform, you can only apply for a loan online. However, there is little information online about a user-friendly mobile app. So, use the above tip to find the best lender match.

Monevo USA Personal Loan vs. Cashnet USA Loans

If you’re still undecided, we can help you explore other personal loan options. For example, you can find a lender without using a loan platform. Check out our table below to see if you prefer Cashnet USA or Monevo USA personal loans!

| Monevo USA Personal Loan | Cashnet USA Loans | |

| APR* | 2.49 to 35.99%. *Terms apply. | Ranges from 85% to 579%. *Information depends on the state. |

| Loan Purpose* | Personal loans for home improvements and refinancing, and others. | Payday, installment, and flex loans. Plus, line of credit. *Information depends on the state. |

| Loan Amounts* | The loan amounts vary by lender. But you can get loans of up to $100,000. | Texas has the most at $1,800. $100 to 3,500 loan amounts available. *Information depends on the state. |

| Credit Needed* | On the platform, you can find lenders who accept bad credit. | Accepts low credit scores. *Information depends on the state. |

| Terms* | From 12 to 144 months. *Terms apply. | 8 to 35 days payday loans (maximum loan term of 180 days in Texas). From 4 to 24-month installment loans. *Information depends on the state. |

| Origination Fee | The origination fee varies by platform lender. | This lender charges fees for loans. The fees vary greatly by location. |

| Late Fee | Lenders’ late fees and other charges vary. | The terms of late fees vary depending on the state. |

| Early Payoff Penalty | The early payoff penalty depends on the lender. | N/A. |

How to apply for Cashnet USA Loans

Are you on the lookout for a fast online loan option? View our guide to applying for a loan with CashNetUSA Online Loans for more information!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

11 Curiosities About The Financial World

Know some interesting curiosities about facts about the financial world. So, learn more below and learn more about it.

Keep Reading

How to apply for the Accion Opportunity Fund?

Learn how the Accion Opportunity Fund application works so you can get the funds you need to overcome obstacles holding your business back.

Keep Reading

How to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard?

Looking for a low annual fee card with flight discounts? Read on to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard!

Keep ReadingYou may also like

Southwest Rapid Rewards: a complete guide

If you're looking for a comprehensive guide to Southwest Rapid Rewards, look no further. This article will tell you everything you need to know about this popular airline rewards program.

Keep Reading

Western Union® Netspend® Prepaid Mastercard® review

Send and receive money, pay bills, and enjoy the benefits of a credit card without the worry of overspending. Discover the Western Union® Netspend® Prepaid Mastercard®!

Keep Reading

Walmart MoneyCard® review: Perfect for Walmart shoppers

The Walmart MoneyCard® is here to make your life easier and your shopping experience better! Read our full review to learn more.

Keep Reading