Credit Cards (US)

Milestone® Mastercard® – Unsecured For Less Than Perfect Credit full review

The Milestone® Mastercard® - Unsecured For Less Than Perfect Credit is an excellent option for those with not-so-good scores. Plus, you can access your online account 24/7 and enjoy $0 liability protection. Keep reading to learn more about its benefits!

Milestone® Mastercard® – Unsecured For Less Than Perfect Credit.

Do you want to rebuild your credit score with a card that reports to all three major credit bureaus in the U.S.? Then check our our full Milestone® Mastercard® – Unsecured For Less Than Perfect Credit review.

With responsible use, you will be able to improve your credit while enjoying a real Mastercard product. The card offers the ability to increase your purchasing power while you work on your finances.

So, to know more characteristics about this card, keep reading our full review!

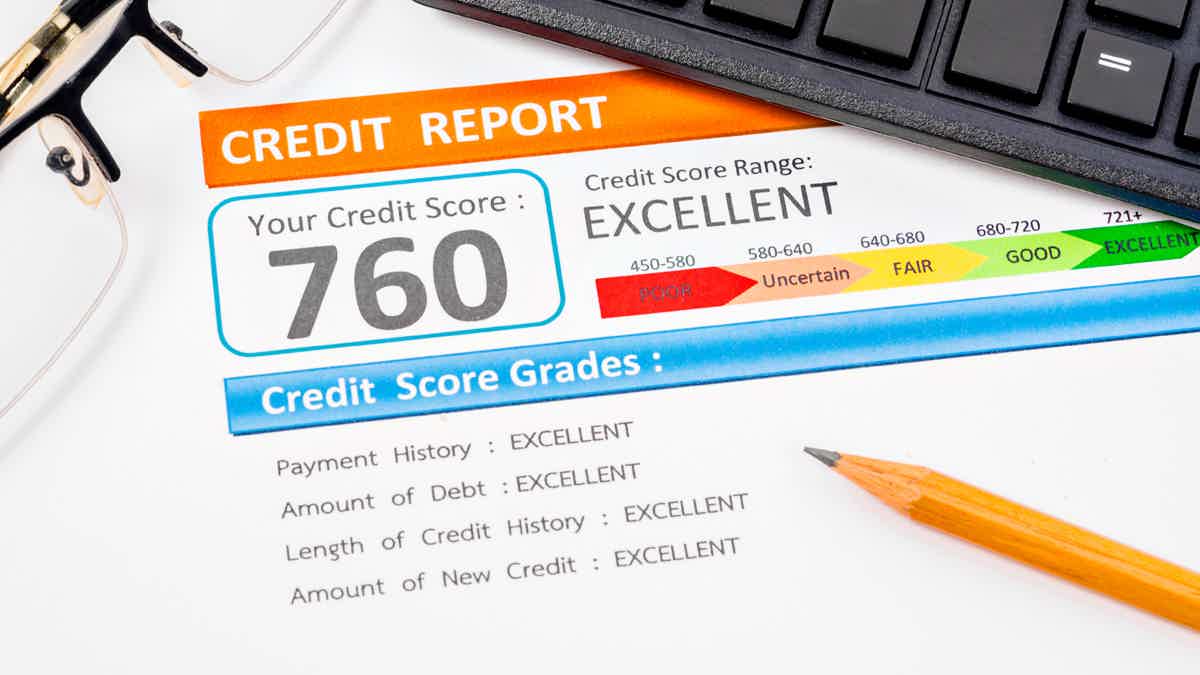

| Credit Score | Poor/Bad |

| Annual Fee | $35 – $99* *Dependent on credit worthiness |

| Regular APR | 24.9% |

| Welcome bonus | N/A |

| Rewards | N/A |

Apply for the Milestone® Mastercard® Unsecured

The Milestone® Mastercard® – Unsecured For Less Than Perfect Credit accepts people with low scores! Keep reading to know how to apply!

How does the Milestone® Mastercard® – Unsecured For Less Than Perfect Credit work?

Once you get approved, you can work on establishing a stable financial foundation.

That is because this card can help you grow your credit if you use it responsibly since it reports your account history to the three major credit bureaus in the U.S.

In addition, it doesn’t require a security deposit, and the pre-qualification process does not affect your credit score.

Moreover, this credit card is a Mastercard®, which can be good because it is accepted in a wide range of places all across the U.S. The card’s issued by The Bank of Missouri.

Also, you will get zero liability guarantee coverage and identity theft monitoring. So, you can have peace of mind knowing that you’ll not have to be responsible for purchases you did not authorize in your card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Milestone® Mastercard® – Unsecured For Less Than Perfect Credit benefits

Check out the benefits you can enjoy by applying for your card now!

Pros

- You can have a chance of approval with a less than perfect credit;

- The pre-qualification process is easy, and it does not affect your credit score;

- This credit card offers zero liability protection;

- You can access your account information online or on mobile advice 24/7;

- Fell peace of mind with protection from fraud if your card is stolen or lost;

- Your account history is reported to all three major credit bureaus in the U.S.;

- Also, this card has an identity monitoring program;

- Multiple card design options to choose from at no extra charge;

- You can enjoy having your own Mastercard®, one of the most widely accepted cards on the market.

Cons

- There is no welcome offer for new cardholders;

- You can only get a $300 credit limit;

- This credit card charges a relatively high APR of 24.9%;

- The annual fee ranges from $35 to $99, dependent on credit worthiness.

Although the card has some disadvantages, its benefits may be worth it if you want to responsibly work on your financial needs and goals. So, it is essential to compare its pros and cons to decide if it is the best option for you.

How good does your credit score need to be?

You do not need perfect credit to get a chance of approval. That way, you can apply for it even with a poor/bad credit score.

How to apply for a Milestone® Mastercard® – Unsecured For Less Than Perfect Credit?

You can easily apply for this card on the credit card company’s website. Also, you can do it online, and it can be really fast to see if you pre-qualify without affecting your credit score.

So, if you want to know more about how the application process to get this credit card works, check out our post below!

Apply for the Milestone® Mastercard® Unsecured

The Milestone® Mastercard® – Unsecured For Less Than Perfect Credit accepts people with low scores! Keep reading to know how to apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Axos High Yield Savings account full review

If you're looking for an online saving account with a high APY and no monthly fee, then check out our Axos High Yield Savings Account review!

Keep Reading

How to apply for the Gemini Credit Card?

If you need a card with no annual fee to help you with your crypto investments, read on to see how to apply for the Gemini Credit Card!

Keep Reading

OakStone Secured Mastercard® Gold Credit Card full review

OakStone Secured Mastercard® Gold Credit Card helps rebuild your credit score and provides a high credit limit. See the full review!

Keep ReadingYou may also like

FIT™ Platinum Mastercard® credit card review: easy to get, efficient to build credit

Are you trying to rebuild your credit history, but no credit card issuers are willing to give you this chance. Don't worry. FIT™ Platinum Mastercard® will help you with a $400 credit limit.

Keep Reading

Credit repair companies: worth it or not?

This article will give you the information to decide whether credit repair companies are worth your time and money. Keep reading!

Keep Reading

Copper - Banking Built For Teens application: how does it work?

Looking for a modern, secure banking solution tailored specifically to the needs of teens? Copper - Banking Built For Teens is designed with young people in mind. Get started today and find out how easy it is to apply!

Keep Reading