Loans (US)

Merrick Bank personal loan full review

Merrick Bank personal loan is built for you as it accepts a fair credit score and charges low fees. Check out the full review and see if it fits your needs!

Merrick Bank personal loan

Getting a loan might be pretty difficult when you don’t have a perfect credit history. Merrick Bank features a personal loan that accepts credit scores as low as 580.

Also, the application process is pretty fast and simple, unlike other traditional loans in which you spend a lot of time waiting for approval and funding.

Plus, it charges reasonable rates considering the benefits you get from this loan.

Keep reading to learn all you need to know before applying for it!

| APR | From 27.99% to 35.99% |

| Loan Purpose | Personal |

| Loan Amounts | From $2,500 to up to $12,500 |

| Credit Needed | At least fair credit score |

| Terms | From 3 to 36 months |

| Origination Fee | 5% |

| Late Fee | Yes (see terms) |

| Early Payoff Penalty | None |

How to apply for Merrick Bank personal loan?

Merrick Bank loan features a quick and easy application process with fair rates. Learn how to apply for it!

How does the Merrick Bank loan work?

Let’s get started with the application process. It is made to fit your needs perfectly. So, it requires your income, employment history, financial history, and recent credit behavior.

By sending this information to the Merrick Bank, it will reply to you with a loan built for you.

And you don’t need a perfect credit history to apply for it. If you have a fair credit score, you might be able to get the funds you want.

Also, you can get amounts starting at $2,500 to up to $12,500. And you can pay off from 3 to 36 months.

Furthermore, it doesn’t charge you with an early payoff penalty.

However, there is an origination fee and some other fees that apply. So, consider checking all terms and conditions before applying for it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Merrick Bank personal loan benefits

The main benefit is the fact that it doesn’t require a perfect credit score for the application. Most of the banks recommend at least a good credit history to loan money. But Merrick Bank accepts applicants with low 580-credit punctuation.

Furthermore, the application process is really fast. So, you apply within minutes and receive your funds as soon as one day after getting approved.

On the other hand, it charges a quite high APR, origination, and late fees. So, before applying for it, pay attention to those fees in the terms and conditions.

Pros

- It accepts applicants with a fair credit score

- The application process is really simple and fast

Cons

- It charges a quite high APR

- It charges up to 5% origination fee

- Plus, it charges late fee

Should you apply for the Merrick Bank personal loan?

If you need funds quickly and don’t have enough credit score to apply for a loan from other banks, the Merrick personal loan might be an alternative for you.

Can anyone apply for a loan at Merrick Bank?

Everyone with a Social Security Number or tax identification number, a U.S. federal, state, or local government-issued ID, an income, a bank account, and over 18 years old can apply for this loan.

What credit score do you need for Merrick Bank?

You don’t need a perfect credit history to apply for it. It accepts credit scores as low as 580.

How to apply for a Merrick Bank loan?

If you need funds quickly for a personal reason and don’t have a perfect credit score, then learn how to get your Merrick Bank personal loan now!

How to apply for Merrick Bank personal loan?

Merrick Bank loan features a quick and easy application process with fair rates. Learn how to apply for it, then.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

OneMain Financial Personal Loan review

Looking for easy and fast funding? Check out our OneMain Financial Personal Loan review to see if it's the right lender for your needs.

Keep Reading

What are refundable credits? Find out how to benefit!

You must wonder: What are refundable credits? If so, you want to find ways to save money on taxes, and we can help in this post!

Keep ReadingThe Mister Finance recommendation – U.S. Bank Smartly™ Checking review

Take a look at our review of the U.S. Bank Smartly™ Checking Account and learn how easy it is to manage your finances with the right tools.

Keep ReadingYou may also like

750 credit score: what does it mean?

Want to increase your buying power, qualify for the best loans, and get access to more rewards? Having a 750 credit score is key. Read on and learn!

Keep Reading

15K bonus points: My GM Rewards® Mastercard® review

Drive a GM vehicle? Cut down on expenses with My GM Rewards® Mastercard®- Check out our review! Pay $0 annual fee!

Keep Reading

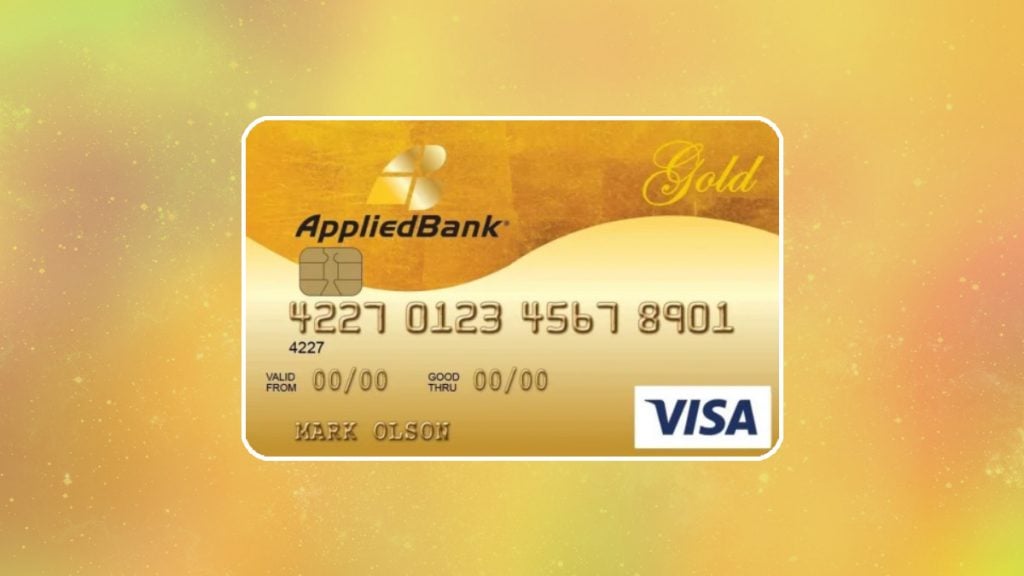

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Keep Reading