CA

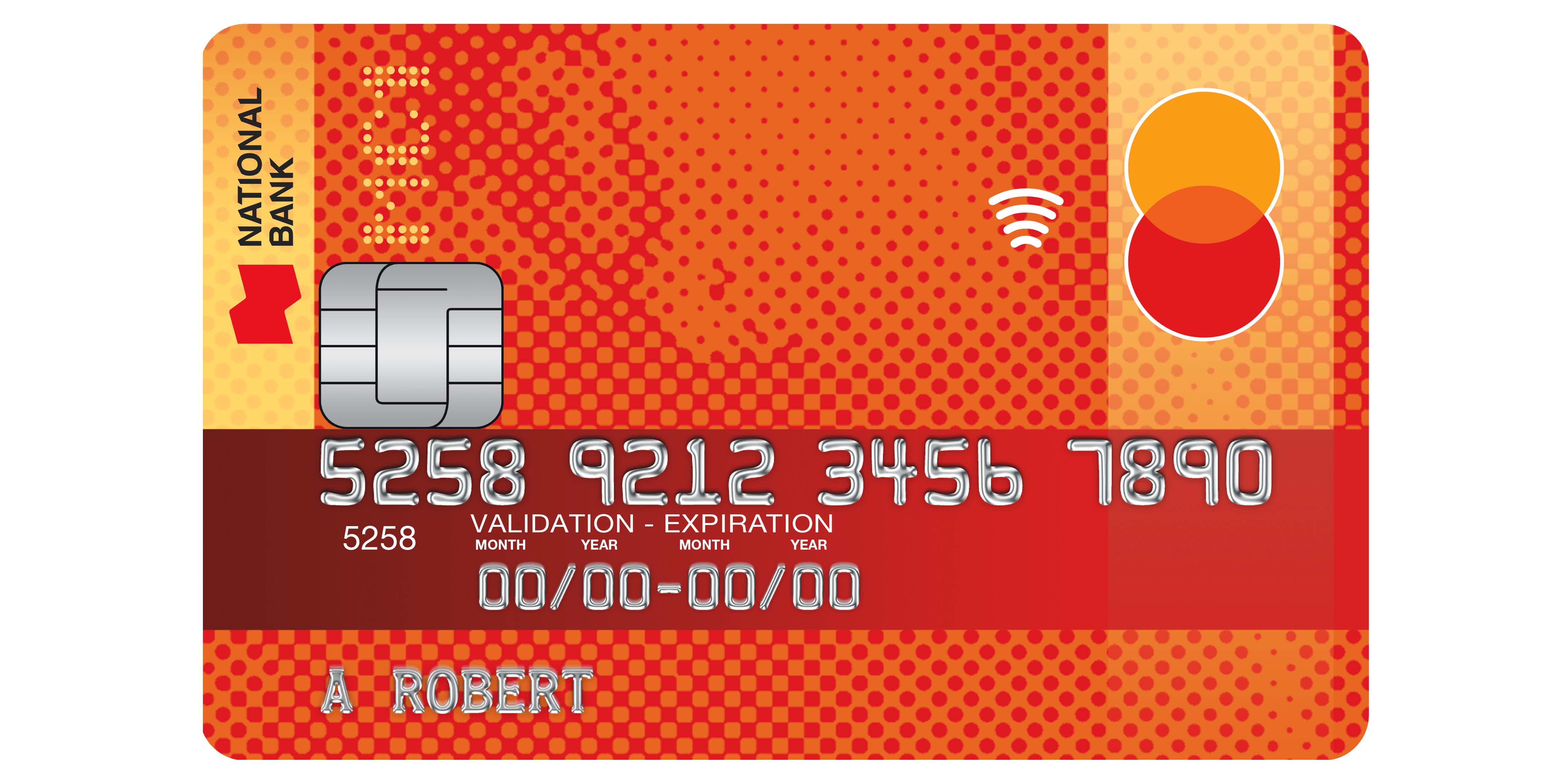

MC1 Mastercard® credit card review

Check out the MC1 Mastercard® credit card review to understand how the card works and to enjoy all the benefits it offers!

MC1 Mastercard® credit card: many benefits at a zero annual fee

National Bank is one of the best financial institutions in Canada when it comes to customer experience. According to Forrester CX IndexTM, this bank has achieved first place for Customer Experience for the second year. So now you can get one of its credit cards: the MC1 Mastercard®. The card comes with many benefits, security features, and an experiential program that allows you to get exclusive menus and upgraded rooms. You’ll learn all that and more in our MC1 Mastercard® credit card review.

So, check out all the details about it right below and keep reading for more!

| Credit Score | Fair |

| Annual Fee | $0 |

| Regular APR | 20.99% (purchase rate) 22.49% (cash advances and balance transfers) |

| Welcome bonus | None |

| Rewards | None |

How to apply for MC1 Mastercard® credit card?

Learn how to apply for an MC1 Mastercard® credit card and enjoy all its benefits at a zero annual fee!

How does the MC1 Mastercard® credit card work?

The MC1 Mastercard is a fantastic option for Canadians that want to build a credit history and enjoy benefits at a zero annual fee.

Although the card doesn’t come with rewards and a welcome bonus, it offers many security features, such as Purchase Protection for up to 90 days after purchase, an Extended warranty, and Fraud Protection against unauthorized transactions.

Also, it provides you with a contactless payment option and ID Check to guarantee secure online purchases.

Furthermore, this credit card offers a program called Priceless Cities, in which cardholders can enjoy entertainment experiences, culinary encounters, priority access, and many other events across the world.

The interest rate ranges from 20.99% on purchases to 22.49% on cash advances and balance transfers.

And there is no annual fee for an additional card, as well.

Finally, the minimum credit limit is a reasonable $500.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

MC1 Mastercard® credit card benefits

Firstly, one of the main benefits you can get from an MC1 card is the $0 annual fee. Contrary to many other credit cards available in Canada, this one guarantees zero cost to both primary and additional cards.

Also, it provides you with a complete package of security features. Moreover, it includes Mastercard’s Zero Liability, Purchase Protection, Extended Warranty, and Mastercard® ID CheckTM for online shopping.

In addition, the card comes with a contactless payment option for your convenience.

Even though there are no welcome bonuses, the card offers a program for cardholders. Including dining, shopping, and entertainment worldwide.

Pros

- There is no annual fee;

- It offers a complete package of security features;

- The application requirements are accessible;

- You can build a credit history by using the credit card responsibly;

- It offers the Priceless Cities program.

Cons

- The card doesn’t offer a welcome bonus or rewards;

- The interest rate is relatively high.

How good does your credit score need to be?

The credit score recommended for applying for this card is a fair score. Also, you must be a Canadian resident at the age of majority in the province you live in.

How to apply for an MC1 Mastercard® credit card?

If you are interested in getting a secure credit card to enjoy a good customer experience, check out how to apply for an MC1 Mastercard right on the next post!

How to apply for MC1 Mastercard® credit card?

Learn how to apply for an MC1 Mastercard® credit card and enjoy all its benefits at a zero annual fee!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for Fairstone Loans?

Fairstone offers loans, mortgage vehicle financing, vehicle financing, and many more. You will be amazed by how easy it is to apply!

Keep Reading

Hazelview Investments review: invest in real estate and profit

If you need to invest in public and private real estate, Hazelview can be the best! Read our Hazelview Investments review to know more!

Keep Reading

How to apply for the Women’s Economic Security Program?

Are you a woman in need of support to improve your finances? If so, read on to learn how to apply for the Women’s Economic Security Program!

Keep ReadingYou may also like

Apply for Marriott Bonvoy Business® American Express® Card today

Discover how to apply for the Marriott Bonvoy Business® American Express Card. Earn up to 6x points on purchases and more!

Keep Reading

Marriott Bonvoy Boundless® Credit Card application: how does it work?

Looking for an easy way to gain travel rewards? Consider applying for the Marriott Bonvoy Boundless® Credit Card and start enjoying amazing benefits! Here are a few simple steps to get started on your journey.

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

If you can’t afford another hard pull to your credit score, this lender will only do it when you say you’re ready. Check our Merrick Bank Personal Loan review and learn more!

Keep Reading