UK

How to join the MoneySuperMarket Credit Monitor?

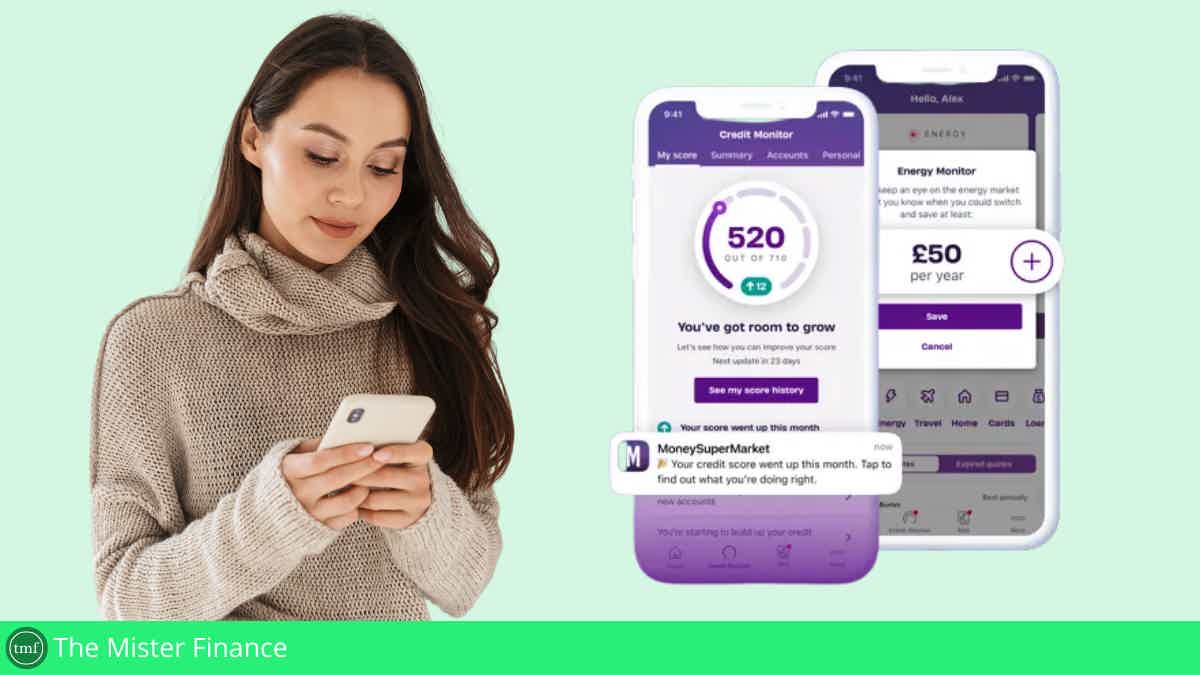

Are you looking to make managing your finances easier, save money, and boost your credit score? If so, read on to learn how to join MoneySuperMarket Credit Monitor!

Join MoneySuperMarket Credit Monitor: Save money and increase your score!

Are you looking for a way to track your credit score in the UK and stay on top of your finances without paying outrageous fees? If so, you can learn how to join MoneySuperMarket Credit Monitor!

Also, you should know that this platform is here to help. Moreover, with their simple yet powerful service, you can gain access to important financial information about yourself and ways to improve it for free.

In addition, they can offer ways to understand how lenders will interpret your data, identify fraudulent activity early, and calculate tips that’ll boost your credit score quickly!

Moreover, they offer everything you need in one convenient package! Therefore, read on to find out how easy it is to join MoneySuperMarket Credit Monitor!

Join online

You can join this platform by creating your login through the official website. Also, all you need to do is create your username and password. Plus, they may require you to give your best email address.

So, make sure you give them a good email address for you to receive all the info regarding your credit score or any other info you may want them to send you regarding financial products!

Moreover, you should know that the platform doesn’t charge any fees for you to use its services. Also, you don’t need to pay any fees to use the credit monitoring feature!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Join using the app

You can download the MoneySuperMarket app to check your credit score and get monthly updates if it changes somehow.

Moreover, you’ll be able to use the app for additional features, such as Energy Monitor, to save your phone’s energy.

In addition, the best way to create your account login and use the app is through the official website. Therefore, check out our topic above to learn how to join online!

MoneySuperMarket Credit Monitor vs. My Credit Monitor

Are you searching for other credit monitoring platforms? If so, we can help! Moreover, you can try joining the My Credit Monitor membership!

Also, with this platform’s membership, you’ll be able to get the best and most focused insights on how your credit report works and how to improve it!

However, if you’re looking for a platform that offers much more than focusing on your credit score and report only, you may like MoneySuperMarket better.

Moreover, if you’re only looking to improve your credit score to reach a specified financial goal through your credit score, it may be best to go for the My Credit Monitor platform!

But you should know that the MoneySuperMarket features are free, including credit monitoring. On the other hand, the My Credit Monitor features have a monthly fee.

However, with My Credit Monitor, you’ll be able to get more insights and features focused on your credit score improvement.

Therefore, you should know that both platforms offer incredible perks. Also, you only need to choose the one that best meets your financial goals and needs at the moment!

How to join My Credit Monitor?

Looking for the best way to monitor your credit score and report 24/7? If so, read on to learn how to join My Credit Monitor!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

The Blue Business® Plus Credit Card from American Express: learn how to apply for it!

Learn how to get your The Blue Business® Plus Credit Card from American Express and start earning points with no annual fee.

Keep Reading

Capital One Quicksilver Secured Cash Rewards review

Check out the Capital One Quicksilver Secured Cash Rewards review article and learn how to build a credit score at a very low cost with it.

Keep Reading

OakStone Secured Mastercard® Gold Credit Card full review

OakStone Secured Mastercard® Gold Credit Card helps rebuild your credit score and provides a high credit limit. See the full review!

Keep ReadingYou may also like

Learn to apply easily for Integra Credit Personal Loan

Need fast cash? Find out how to apply for an Integra Credit Personal Loan. Get a loan even with bad credit! Keep reading to learn more!

Keep Reading

How to apply and get verified on the Electro Finance Lease easily

Do you have bad credit and are in need of a new phone, laptop, or gaming console? Electro Finance Lease is here to help! They offer accessible applications and fast verification for those who need it. So what are you waiting for? Learn how to apply today!

Keep Reading

What is a money market account and how to open one?

A money market account is a type of savings account that allows you to earn a higher interest rate than what you would get with an ordinary savings account. Find out if it's right for you by reading this post!

Keep Reading