Account (US)

How to open a Checking Account at SDFCU?

Learn how to open a Checking Account at SDFCU, how to become a member, and start enjoying all the benefits offered by it.

Open a Checking Account: Basic, Advantage, or Privilege according to your profiles, needs, and goals

How to open a Checking Account at SDFCU? The State Department Federal Credit Union offers many financial products and services, including three account types: the basic, the advantage, and the privilege.

You can choose which fits your life better, and by becoming a member, you might enjoy a variety of benefits.

It is simple and fast to choose a checking account and join the membership. Check out the step-by-step right below.

Apply online

Access the SDFCU website and click on Checking & Savings. After that, select Compare Accounts.

There are three types available: the Basic, the Advantage, and the Privilege account. Although the basic one doesn’t pay interest, it doesn’t require a minimum balance.

After choosing the account you want, click on Open an Account.

If you are not an SDFCU member, you must become one. The list of required documents is right at the top of the page.

Finally, sign in and use your credentials to finalize your account opening.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Use the app

After choosing the account that better fits your needs, open it as described above, and then download the app to manage your finances.

SDFCU vs. Dover Federal Credit Union

If you want another option, check out the summary about a checking account at Dover Federal Credit Union.

| SDFCU Checking Account | Dover Federal Credit Union | |

| Features offered | From basic to advantage and privilege options that include: debit card; interest earnings; large ATM network access; Credit Union benefits | Online Bill Pay; 24/7 customer service; Online & mobile app; Debit card; Free access to over 55,000 ATMs |

| Maintenance fees | $0 | Not fully disclosed |

| Minimum balance | Basic: $0 Advantage: $2,000 Privilege: $25,000 | Not fully disclosed |

Dover also offers a business checking account if you need to cover your business with an accessible service.

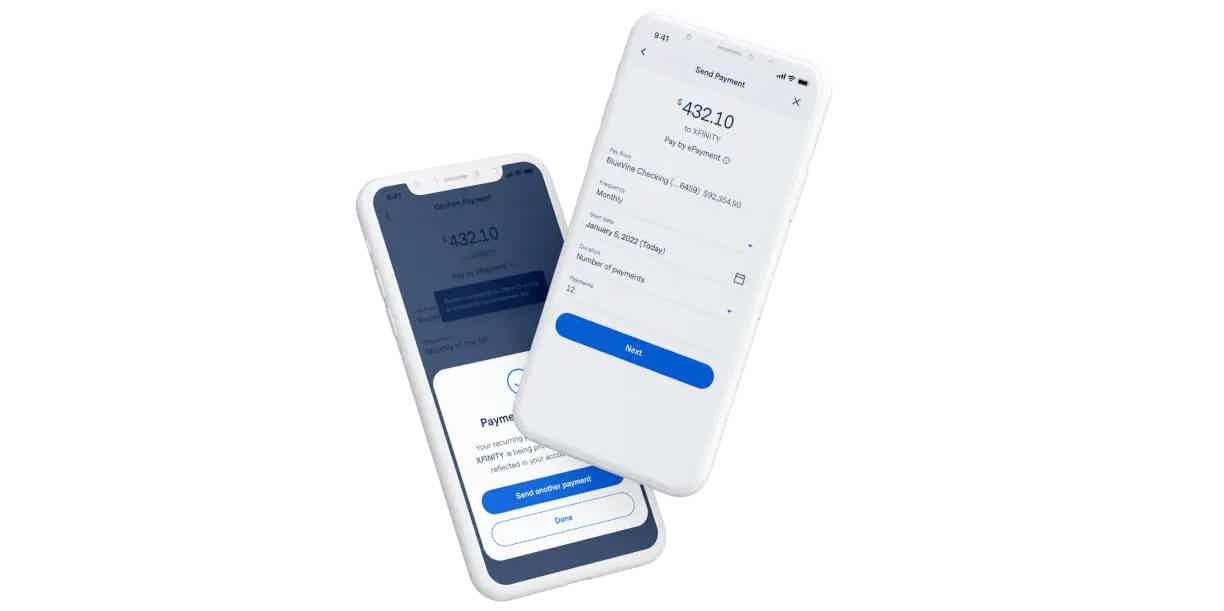

How to apply for a BlueVine checking account?

Learn how to open a BlueVine checking account so you can manage your business without worrying about the banking barriers you are used to.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Copper Banking review: Investing and more!

If you need a banking solution for your kids or teens to learn how to finance, read our Copper Banking review to learn more!

Keep Reading

How do you get the Citi Custom Cash℠ Card?

The Citi Custom Cash℠ Card has great cash back rewards for its cardholders. Read more if you want to know how to apply!

Keep Reading

LendingClub vs Prosper personal loans: Which is the best?

LendingClub or Prosper personal loans? They are both peer-to-peer lenders that have competitive rates. Read on to know which one is best!

Keep ReadingYou may also like

Apply for the Blue Cash Preferred® Card from American Express

Are you wondering what the Blue Cash Preferred® Card from American Express is all about? Get the scoop on their application process, rewards programs, bonus offers, and more. Read on!

Keep Reading

Revvi Card: credit card for bad credit with cashback

The Revvi Card double checks the benefits to rebuild your credit. Without a secured deposit, it offers 1% cash back on purchases. Read our review to learn more!

Keep Reading

What is a balance transfer credit card: is it a good idea?

Are you looking for a way to reduce your credit card debt? You may want to consider a balance transfer credit card. This product allows you to move your outstanding balance from one card to another, typically with a lower interest rate. Keep reading if you want to learn more!

Keep Reading