Finances (US)

How to join the Consumer Connect by CreditSoup

Looking for a way to connect with credit card companies and lenders? Then meet the Consumer Connect from CreditSoup. They can help you find the best offers available so you can get the most out of your credit.

Consumer Connect by CreditSoup application: Find the best financial solutions for your financial needs!

When it comes to your finances, it’s important to be proactive and connect with the right resources. Consumer Connect by CreditSoup is here to help make that process easy for you. The program provides access to a wide variety of financial solutions, so you can find the perfect option for your needs.

They have partnerships with some of the country’s leading providers, so you can be sure you’re getting the best possible service. Plus, their team is always available to answer any questions or help you through the process.

Consumer Connect by CreditSoup offers a variety of services that can make it easier for you to get your finances in order. They can help you find the best credit cards, loans, and other financial products tailored to your financial profile. CreditSoup also provides advice on how to improve your credit score and save money on your bills.

So, are you ready to join their program? Keep reading to learn how to do it.

Online Application Process

To use the Consumer Connect by CreditSoup online, you don’t necessarily need to create a CreditSoup account. However, you’ll need to have one in order to access your free credit score data and other resources.

To find the best offers tailored to your financial needs, you will need to provide the website with information about yourself, as well as your contact details and SSN number.

You can find the Consumer Connect resource by looking for it on your search engine of choice. To find the best deals, the website will walk you through a series of questions regarding your current credit score, if you have a checking account and more.

Once you write down all the required information, you should be able to see all the offers available to you. Remember that Consumer Connect by CreditSoup only connects you to these lenders. So whatever alternative you choose to apply for, you’ll need to deal directly with them.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

Sadly, CreditSoup does not have a mobile app. If you want to take part in their Consumer Connect program, you’ll need to use their website to do so.

What about another recommendation: Experian BOOST™ Credit Score and Monitoring

Even though the Consumer Connect by CreditSoup and the Experian BOOST™ Credit Score and Monitoring do not provide the exact same service, you can also benefit from the free credit monitoring from Experian.

This resourceful tool can help you boost your credit rating and monitor it with an easy-to-use mobile app. If you’d like to know more details about it, check the link below. Both services are free and can help you improve your financial life so you can achieve all of your goals!

How to improve credit scores with Experian BOOST™?

Raise your credit score using Experian BOOST™ Credit Score & Monitoring! Learn how to use it.

About the author / Aline Barbosa

Trending Topics

How to apply for the SoFi Private Student loans?

SoFi Private Student loans are great for those looking for flexible repayment options with zero fees. Check out how to apply for a loan now!

Keep Reading

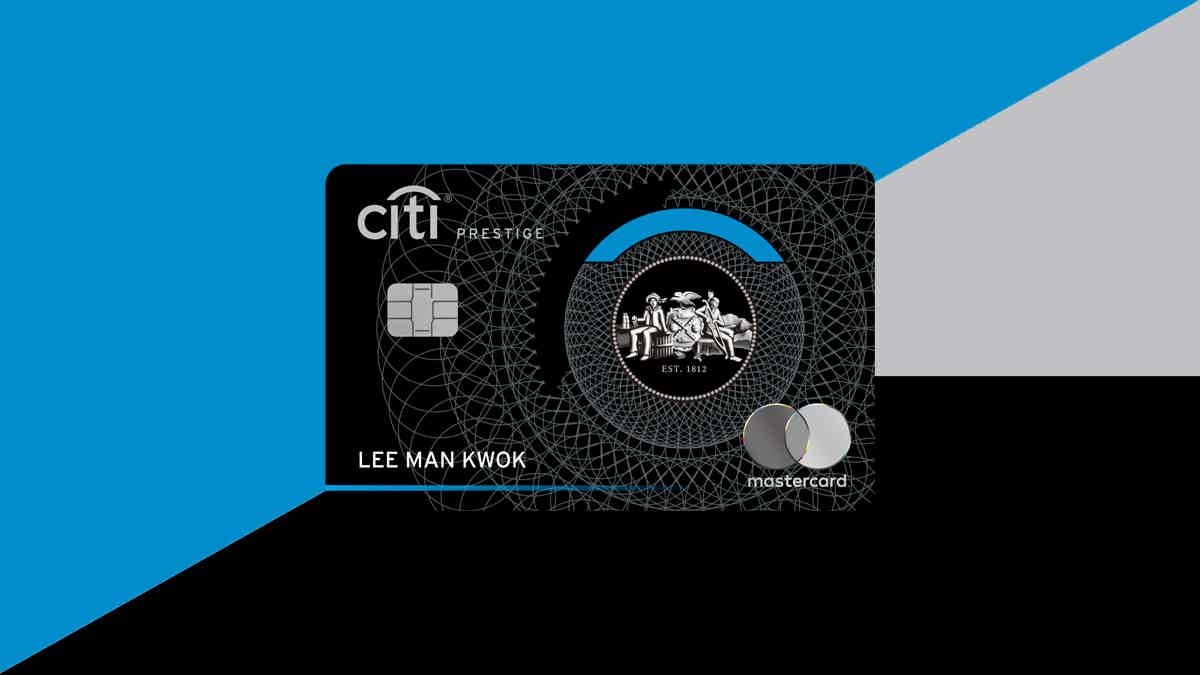

Citi Prestige® Card review

Check this Citi Prestige® Card review to learn more about the eatures and benefits of this card, including travel rewards and more.

Keep Reading

Find the best cards for grocery shopping

Looking for a card to help you save money on everyday purchases? If so, check out our list of the best cards for groceries!

Keep ReadingYou may also like

Ink Business Cash® Credit Card Review: up to 5% Cash Back

Save more on your small business with a card that offers up to 5% cash back on office supplies. Discover the potential of the Ink Business Cash® Credit Card in our detailed review.

Keep Reading

Capital One Savor Rewards Credit Card review: is it worth it?

The Capital One Savor Rewards Credit Card's generous cash back categories make it an attention-grabbing option for foodies and bargain hunters. Read our review to find out if this is the best product for your lifestyle!

Keep Reading

Choose the best card to build your credit score: improve your finances!

Unsure of which card is right for you? Read this guide to find out how to choose the best card to build your credit score and start improving your financial situation today!

Keep Reading