Credit Cards (SA)

How to apply for the RMB Private Bank Credit Card?

If you're looking for a credit card to earn eBucks and travel rewards while getting personalized rates, read on to learn how to apply for the RMB Private Bank Credit Card!

RMB Private Bank Credit Card application: eBucks travel!

Are you a South African looking for a credit card that offers travel and rewards perks? Look no further! You can learn how to apply for the RMB Private Bank Credit Card!

Moreover, this card has features to make any frequent traveler smile!

From exclusive eBucks rewards to airport lounge access, this card has the perfect balance of benefits abroad and at home! Therefore, keep reading to learn how to apply for this card!

Online Application Process

Before you apply online or through the app for this card, you’ll need to check if you meet the requirements. Also, you’ll need to meet some important requirements, such as earning at least R750,000 per year!

Moreover, after you know if you meet the requirements, you can go to the online application page and provide the information needed.

After that, you can complete the application process and wait for a quick response!

You will be redirected to another website

Application Process using the app

You can also apply for this card through the mobile app! Also, you’ll only need to provide the personal information required in their application form.

Moreover, you can download the app and just follow the instructions on the screen to complete your application process easily! Then, you’ll only need to wait for a quick application response.

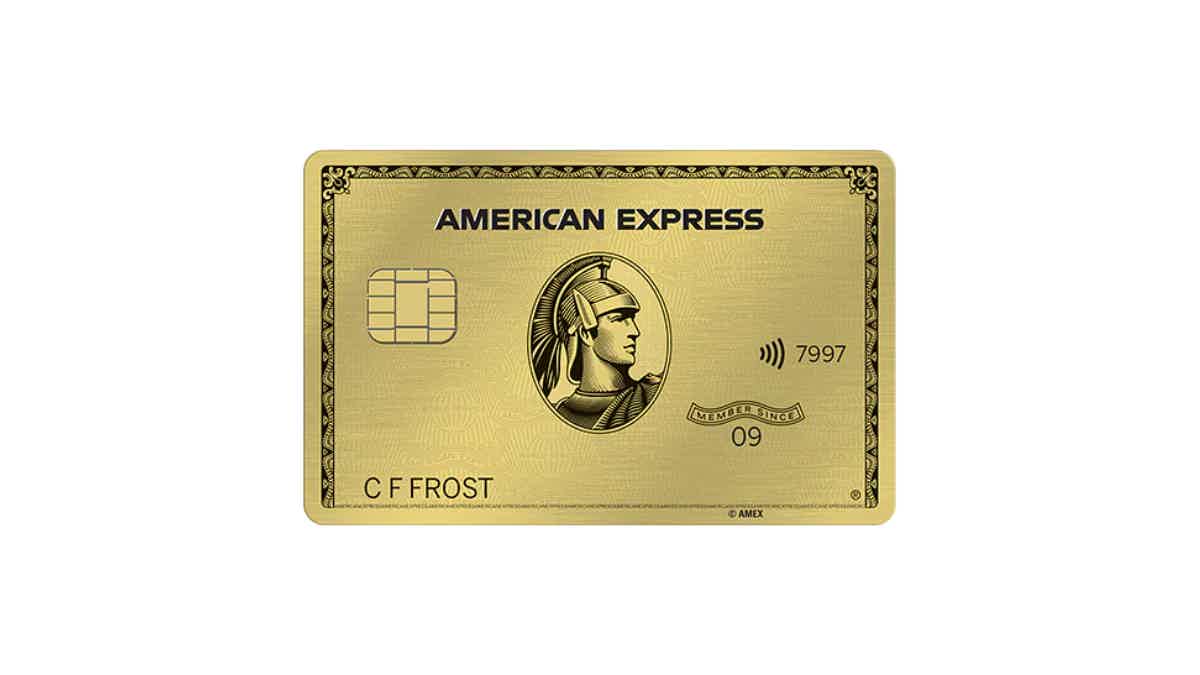

RMB Private Bank Credit Card vs. American Express® Gold Credit Card

If the RMB Private Bank Credit Card does not offer the best perks for your needs, you can try a different option, such as the American Express® Gold Credit Card!

Also, with this Amex card, you’ll be able to earn incredible travel rewards and perks! Moreover, the monthly and other fees can be lower than the RMB card’s fees!

Therefore, read our comparison table below to learn more about these cards and see which one is the best option for your finances!

| RMB Private Bank Credit Card | American Express® Gold Credit Card | |

| Requirements* | You’ll need to earn at least R750,000 or more per year or have a net asset in excess of R15 million. | You’ll need to have an income of at least R17,000 per month (before tax) and have a very healthy credit score. Plus other requirements. *Terms apply. |

| Initiation Fee* | Up to a maximum of R175. | R180. Rates & Fees. |

| Monthly Fee* | R258. | R75 per month for the primary card and no monthly fee for the additional card. Rates & Fees. |

| Fees* | Credit facility service fee: R17.20; You can get up to 5 additional cards at no charge. After that, R18.50 per card per month; Also, linked Petro card fee: R29.50 per card linked. *Terms apply. | Credit facility service fee: R21 per month; No fee for card enrollment; 2% international currency conversion fee; No late payment fees. Rates & Fees. |

| Rewards* | You can earn eBucks on all your eligible credit card purchases; There are eBucjs Travel rewards available. *Terms apply. | You can earn monthly lifestyle vouchers when you spend R3,500 per month (it needs to be valued at more than your monthly card fees); Also, earn 5,000 bonus Membership Rewards® points when spending R10,000 in your first 3 months using the card. *Terms apply. |

Do you think that the American Express® Gold Credit Card is a match? Read the following post, and you’ll see how you can apply for it and add it to your financial tools.

How to apply for the American Express® Gold Credit

Learn how to apply for the American Express® Gold Credit Card and get the best travel perks, insurance, and even lifestyle rewards!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Absa Student Credit Card review: zero monthly service fees

If you want a card designed for students to build stable financial credit records, this Absa Student Credit Card review is worth reading!

Keep Reading

Social Relief of Distress full review: Aid for emergencies!

Are you going through an emergency situation and need government aid? If so, read our Social Relief of Distress review!

Keep Reading

Isivande Women’s Fund full review

Find out more about women's economic empowerment acceleration through government investments by reading this Isivande Women's Fund review.

Keep ReadingYou may also like

Southwest Rapid Rewards® Priority Credit Card review

Don't miss this detailed Southwest Rapid Rewards® Priority Credit Card review if you want to learn about the benefits, perks, bonuses, and drawbacks. Check it out now!

Keep Reading

Chase Secure Banking℠ application: how does it work?

Are you looking for a simple and budget-friendly way of managing your finances? Check out Chase Secure Banking℠! This simple guide will help set up your financial future. Read on!

Keep Reading

Apply for CreditFresh: It's Fast and Easy

CreditFresh has a line of credit for those who want to improve their score and start a healthier financial path. Here, you'll discover how to apply for CreditFresh online. Keep reading!

Keep Reading