Credit Cards (US)

How to apply for the PREMIER Bankcard® Grey Credit Card?

We know it's hard finding a card that will take you in, regardless of your credit scores. See our PREMIER Bankcard® Grey Credit Card application post and learn how to get yours today!

PREMIER Bankcard® Grey Credit Card application: get the opportunity to build your credit score with this card

Want to apply for a PREMIER Bankcard® Grey Credit Card? We are here to help you find the best option for your financial needs. This option is reliable and helps you build (re)credit before moving to more profitable and beneficial options. Cover the process of applying for a PREMIER Bankcard® Grey Credit Card and make the best choice for your lifestyle! See our PREMIER Bankcard® Grey Credit Card application post to make the right decision!

Apply online

application process is extremely simple; simply visit the First PREMIER Bank website and click on “Apply Now” under the PREMIER Bankcard® Grey Credit Card section of the menu bar on the left. Then enter your information so that they know who to send the card to, and select your card design!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After completing your application and receipt of your new credit card, you will be granted access to a very user-friendly mobile application. It allows you to keep track of your recent transactions, pay bills and make purchases, as well as manage your personal finances. All of this is literally at the tips of your fingers!

PREMIER Bankcard® Grey Credit Card vs. First PREMIER® Bank credit card

If you are unsure about getting the PREMIER Bankcard® Grey Credit Card, we can give you some details about the First PREMIER® Bank credit card! For example, you don’t need a credit score to apply for this credit card. So, check out our comparison table below to help you decide!

| PREMIER Bankcard® Grey Credit Card | First PREMIER® Bank credit card | |

| Credit Score | Fair to bad credit score. | No credit history required. |

| Annual Fee | $50 to $125 in the intro period. $45 to $49 after then. Annual fees vary according to the credit limit. Check their terms to know all about it. | $75 to $125 in the intro period. $45 to $49 after then. |

| Regular APR | 36% APR. | 36% APR. |

| Welcome Bonus | This card features no welcome bonuses. | This card features no welcome bonuses. |

| Rewards | This card features no reward package. | This card features no reward package. |

How to get the First PREMIER® Bank credit card?

Learn how the First PREMIER® Bank credit card application works so you can apply for it even with a poor credit history. Start building your credit right away!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

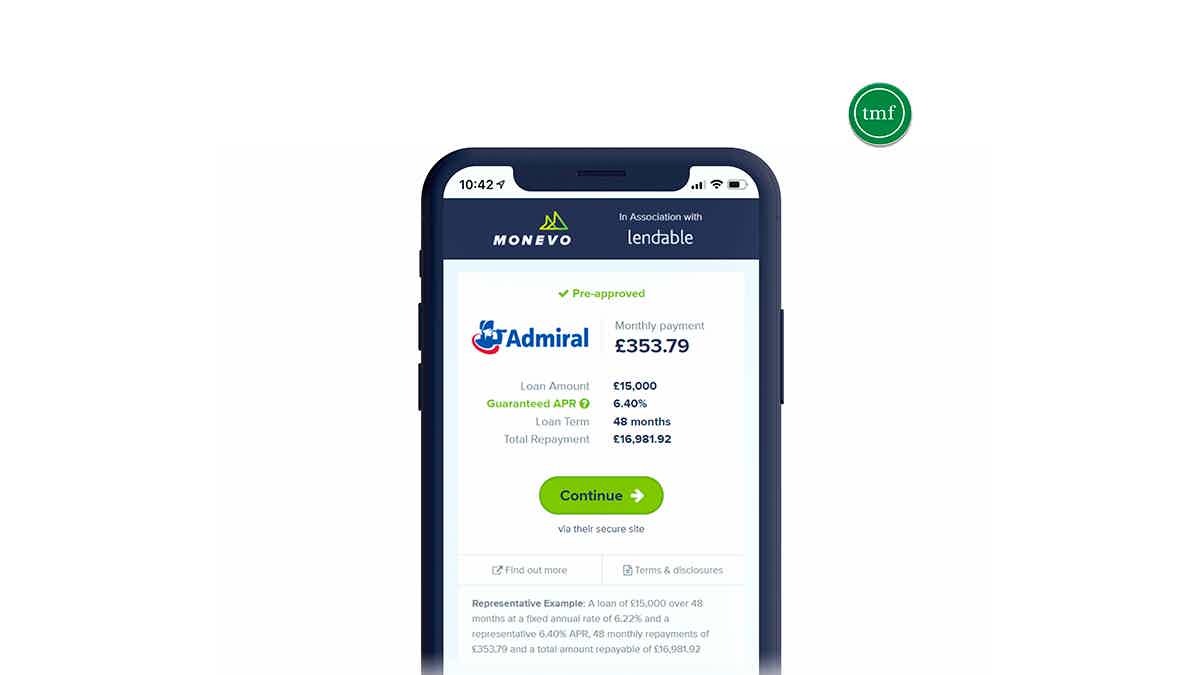

Monevo USA Personal Loan full review: what you need to know before applying

Is the Monevo loan platform right for you? Read our Monevo USA Personal Loan review to know if you can get the best options!

Keep Reading

JetBlue Flight Deals review: from flights to hotel stays!

If you're looking for a great way to save on your next vacation, you can read our JetBlue Flight Deals review to learn about this airline!

Keep Reading

15 best online brokerage accounts of 2021

Are you thinking of starting to invest or already an investor? We have come up with a list of the best online brokerage accounts!

Keep ReadingYou may also like

Understanding Annuities as an Investment: a guide for starters

We know investing can be confusing sometimes. Do you know how to have annuities as an investment? If you don't even know what an annuity is, don't worry. You can learn more about this topic by reading this article.

Keep Reading

Capital One Venture Rewards Credit Card review: is it worth it?

Wondering if the Capital One Venture Rewards Credit Card is right for you? Find out how this card can help you earn miles, what its benefits are, and if it's worth considering.

Keep Reading

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

If you have a bad score or no score, this is an excellent way to fix it. Learn more about the advantages of this card and what makes it so successful in our Surge® Platinum Mastercard® credit card review!

Keep Reading