Credit Cards (US)

How to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card?

Petal® 1 "No Annual Fee" Visa® Credit Card gives you 2% - 10% cash back at select merchants with no annual fee. And it can help you build a credit score with responsible use. Check out how to get yours!

Petal® 1 “No Annual Fee” Visa® Credit Card application

The Petal® 1 “No Annual Fee” Visa® Credit Card, issued by WebBank, can be the newest addition to your wallet. And you don’t need to have a perfect credit score to apply for one. In fact, since it reports to all three major credit bureaus, it can help you to get your financial life back on track with responsible use.

Also, it rewards you with 2% – 10% cash back at select merchants. That’s how you can earn a statement credit while supporting local businesses.

Plus, it features a great mobile app so you can manage your finances with the right tools. And it is a Visa® card, which means you get many of its benefits.

Last but not least, this card doesn’t charge annual or foreign transaction fees at all.

Learn now how to apply for it!

Apply online

Access the Petal website and select Petal 1 at The Cards tab.

Then, click on Start Applying. If you have an email offer, enter it. If you don’t have one, fill in the forms with your contact and personal information.

After that, it will show you the offers, and you can submit them.

Also, you can pre-qualify for it without impacting your credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Download the Petal mobile app on Play Store or App Store and follow the instructions. It is easy, straightforward, and fast.

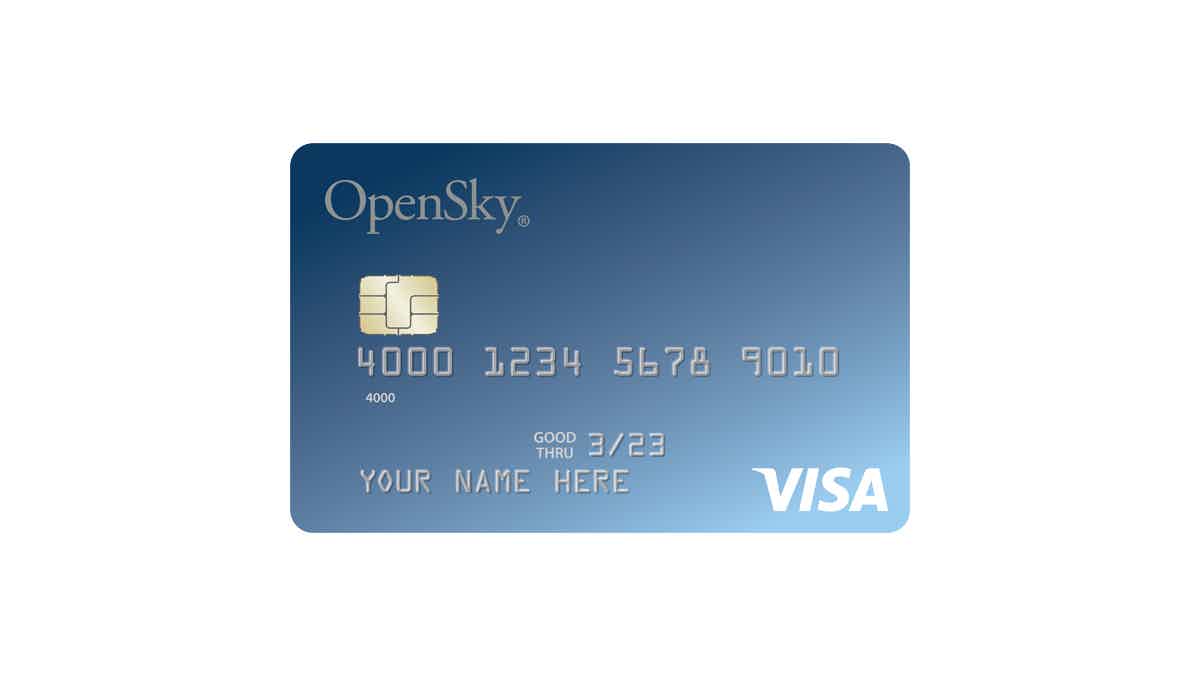

Petal® 1 “No Annual Fee” Visa® Credit Card vs. OpenSky® Secured Visa® credit card

Both these cards don’t require a high credit score to apply. But the Petal® 1 “No Annual Fee” Visa® Credit Card doesn’t charge an annual fee.

Although both of them don’t offer welcome bonuses, the Petal card gives you cash back at select merchants.

| Petal® 1 “No Annual Fee” Visa® Credit Card | OpenSky® Secured Visa® card | |

| Credit Score | Fair/Bad/Limited/No Credit | Bad credit/no credit |

| Annual Fee | $0 | $35 |

| Regular APR | 24.74% – 34.24% variable | 21.14% (variable) on purchases 21.14% (variable) on cash advances |

| Welcome bonus | None | None |

| Rewards | 2% – 10% cash back at select merchants | None |

How to apply OpenSky® Secured Visa® Credit Card?

The OpenSky® Secured Visa® Credit Card is an option for people who don’t have a good credit score or even a bank account. So, check out how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Best credit cards for travelers in 2023

Learn the best credit cards for travelers in 2023, and choose yours to start planning your next vacation with unlimited miles and rewards.

Keep Reading

How to apply for the Capital One SavorOne Student Cash Rewards Credit Card?

Capital One SavorOne Student Cash Rewards Card offers unlimited cash back on all purchases with no annual fees. See how to apply!

Keep Reading

How to apply for Lendio Small Business Loans?

If you are in need of a loan to help you build your business plan, you can read on to learn how to apply for Lendio Small Business Loans!

Keep ReadingYou may also like

Avant Personal Loan review: how does it work, and is it good?

If you need speedy cash for a personal project, but don't have a good credit score, check out our Avant Personal Loan Review, and see how it can help you achieve that goal. Keep reading to learn more.

Keep Reading

Chase Slate Edge℠ review: Consolidate debt easily!

Struggling with multiple cards and debt payments? Check out our Chase Slate Edge℠ review and see how this card helps lower your debts!

Keep Reading

Marriott Bonvoy Bevy™ American Express® Card Review: Earn more

Explore the Marriott Bonvoy Bevy™ American Express® Card — a key to exclusive rewards and expanded privileges within the Marriott Bonvoy program.

Keep Reading