Reviews (US)

How to apply for the One Finance Account?

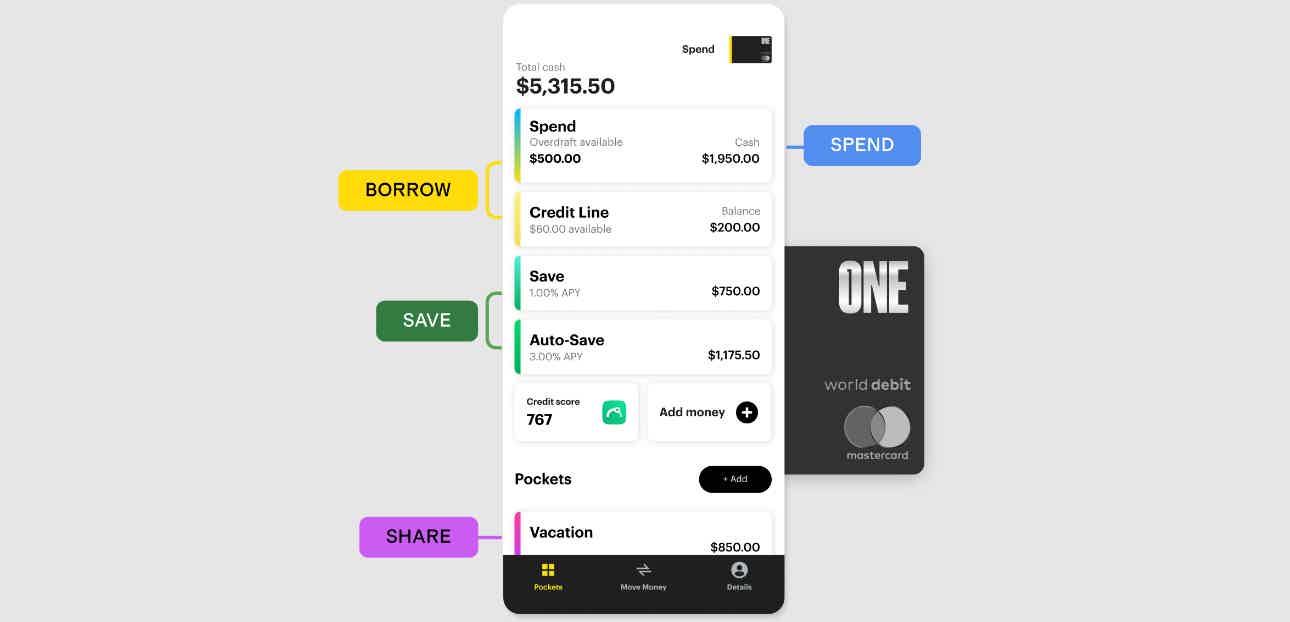

The One Finance launched an account that has it all: a checking and saving account that you can manage through pockets. And it provides you with a high APY. So, check out how to apply for the One Finance Account!

One Finance Hybrid Account application process

The One Finance account is a great option for those looking for an online bank account, because it offers high APY if compared to other banks and no monthly fees or minimums.

The One Finance hybrid account is a great way for managing your personal finances in one place. Plus, it’s quick, easy, and safe to apply online with One Finance!

So, if you are looking for agility and convenience, the One Finance hybrid account delivers it. As a free online checking and saving accounts at the same place, you can manage your money right in your hand through your cellphone.

Even though it offers a credit line, note that it charges a 12% APR on it.

However, if you think it fits your needs, check out the application process detailed below. This post will explain how to open your own One Finance account in just a few steps!

Apply online

Access the One website at https://www.onefinance.com/ and click on Get Started.

Then, enter your email address and create a password.

After that, fill in the form with your personal information such as full name, Social Security Number, home address in the US.

Finally, after approval, you will receive a virtual card right away. And then a debit card within 14 business days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After the account opening, you can add up your virtual card to a digital wallet.

One Finance Hybrid Account and Buy On Trust credit account comparison

On one side, we have the One Finance Hybrid Account that blends two types of accounts at the same place: checking and saving, with no fees and a high APY.

On the other side, we have the Buy On Trust credit account with a different purpose: a lease-to-own program that allows you to lease up to $5,000 in products at Best Buy. So, check out how to apply for the Buy On Trust Account below and choose the best option for your financial needs!

| One Finance Account | Buy On Trust Account | |

| Intro Balance Transfer APR | N/A | N/A |

| Regular Balance Transfer APR | N/A | N/A |

| Balance Transfer Fee | N/A | N/A |

How to apply for Buy On Trust Account?

The Buy On Trust Credit Account allows you to lease up to $5,000 in products at Best Buy. See how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Aspire® Cash Back Reward Card review

Do you need a credit card with a free credit score check? If so, read our Aspire® Cash Back Reward Card review to learn more about it!

Keep Reading

The Key Rewards Visa full review: more rewards at no annual fee

Learn everything about the new Capital One card that lets you earn more rewards at a $0 annual fee. Read The Key Rewards Visa review article.

Keep Reading

The difference between a secured and an unsecured card!

Do you know that there are two types of credit cards? Read on to learn the difference between a Secured and an unsecured card!

Keep ReadingYou may also like

OpenSky® Plus Secured Visa® Credit Card Review

Boost your score with zero risk! Read our review of the OpenSky® Plus Secured Visa® Credit Card to start building credit without the invasive hard inquiry.

Keep Reading

Bull vs bear market explained: understand how they affect you

Here's a breakdown of a bull vs. bear market, what each means for investors, and some tips on where to invest now.

Keep Reading

Apply for the Verizon Visa® Card: enjoy no annual fee

Find out how to apply for the Verizon Visa® Card and enjoy the convenience of $100 statement credit in the first year. Stay tuned!

Keep Reading