Reviews (US)

How to apply for the Milestone® Mastercard®?

The Milestone® Mastercard® card is an option for you to start the year working on your financial growth and credit-building. Learn how to apply for one right away!

Milestone® Mastercard® credit card application.

Do you want to start the new year with the right foot regarding finances and credit? We’ll help you achieve that. Check out below how you can apply for the Milestone® Mastercard®.

The blue credit card is a Mastercard® full of benefits. And the best feature is that you can get yours even if you have a poor credit history.

Since it reports to all three major credit bureaus in the U.S., you can increase your credit when paying your dues on time.

Plus, you will feel peace of mind knowing that this card covers you in case of theft and loss.

In addition, it charges a fixed APR so that you won’t be surprised, and it doesn’t require a security deposit when opening the account.

So read on to learn how you can apply for the Milestone® Mastercard®!

Apply online

If you apply for the Milestone® Mastercard®, you can enjoy many benefits, such as $0 liability protection and 24/7 access to your account. Plus, the application process is simple, and you just have to follow some easy steps!

First, access the Milestone® website and register. By doing it, you get Free Online Bill Pay, Paperless Statements, and more.

Then, click on Get Started. After that, fill in the forms with your personal information and apply.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You cannot apply for the Milestone® Mastercard® via app. After getting approved, you can access your account from your mobile device 24/7. So, you can manage your finances and transactions in a convenient and easy way!

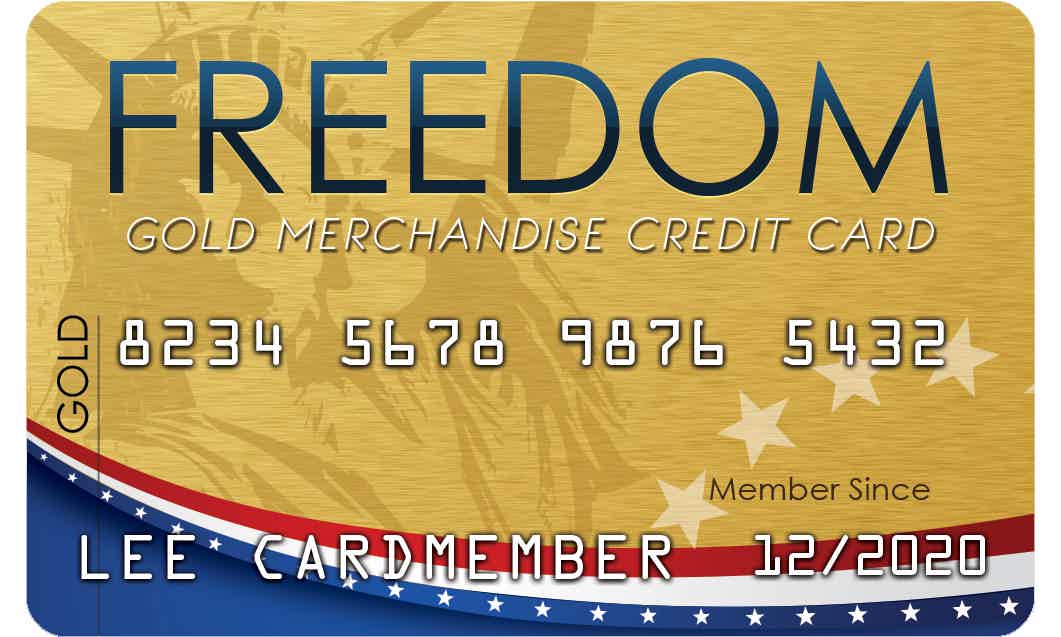

Milestone® Mastercard® vs. Freedom Gold

Both of these cards don’t require a perfect credit score. And both of them don’t offer rewards or welcome bonuses.

So, the difference between them remains in the fact that Freedom Gold charges a higher annual fee but a fewer APR. And the Milestone® Mastercard® does the opposite.

See the comparison chart below to make a wise decision based on your financial needs and goals!

| Milestone® Mastercard® | Freedom Gold | |

| Credit Score | Fair/Good | Bad/Fair |

| Annual Fee | $175 the first year; $49 thereafter. | Monthly fee of $14.95 ($179.40 annually) |

| Regular APR | 35.9% | 0% |

| Welcome bonus | N/A | N/A |

| Rewards | N/A | N/A |

How to apply for a Freedom Gold card?

The Freedom Gold is a catalog card that offers you a limit of $750 to buy at Horizon Outlet. Learn how to apply for it and enjoy its benefits!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to exchange online with FTX crypto wallet?

If you need a crypto wallet to buy the best coins in the crypto market, read our post and learn how to buy FTX Exchange crypto wallet!

Keep Reading

Destiny Mastercard® Credit Card review

Having trouble applying for an unsecured card? Check out the Destiny Mastercard® credit card full review we have prepared for you!

Keep Reading

PenFed Platinum Rewards Visa Signature® card review

Looking for a card with no annual fees and excellent rewards? Read our PenFed Platinum Rewards Visa Signature® card review to know more!

Keep ReadingYou may also like

Milestone® Mastercard® - Less Than Perfect Credit Considered review

If you've been struggling with your low credit, the Milestone® Mastercard® - Less Than Perfect Credit Considered may be the perfect solution for you!

Keep Reading

Bank of America Platinum Plus® Mastercard® Business Card review

Bank of America Platinum Plus® Mastercard® Business Card is here to help you! Keep reading! Ensure exclusive travel benefits and pay $0 annual fee!

Keep Reading

Wayfair Credit Card application: how does it work?

Find out how to apply for a Wayfair Credit Card and start enjoying this card's benefits! It offer cash back and multiple rewards for its cardholders. Keep reading and learn more!

Keep Reading