Credit Cards (US)

How to apply for the Mastercard® Luxury Black credit card?

Willing to have access to an exclusive club? The Mastercard® Luxury Black card can offer you that. But, first, you need to get to know how to apply for it. So, keep reading this post and get ready to enjoy a luxurious lifestyle.

Mastercard® Luxury Black credit card application

The Mastercard® Luxury Black card is that card that provides you a little extra: 24/7 concierge service, VIP access at airports, protection, and insurance.

It is a good deal for those who spend a lot of time traveling around the world and spending money on purchases and hotels.

If you live this kind of life, the credit card might be the right one for you.

So, do not waste time and learn how to apply for it right now!

Apply online

Access the Luxury Black Card website and click on Apply Now. Then, fill the long-form in with the information required. Then, you will need to wait for approval to get your Black and luxurious Card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

The app is exclusive to cardmembers. So, after you apply on the website and get approval, you can have access to it and manage your finances.

Mastercard® Luxury Black credit card vs. Mastercard® Luxury Gold credit card

In this luxurious and busy lifestyle of yours, a little perk extra may be a great deal to decide on which card to hold. Therefore, take a look at the comparison we’ve made between the Luxury Black credit card and the Luxury Gold one.

| Mastercard® Luxury Black card | Mastercard® Luxury Gold credit card | |

| Credit Score | From Very Good to Excellent | From Very Good to Excellent |

| Annual Fee | $495 (plus $195 for each additional and authorized user) | $995 |

| Regular APR | It charges 14.99% Variable APR on transfers and purchases | It charges 14.99% Variable APR on transfers and purchases |

| Welcome bonus | None | None |

| Rewards | 1 point for each dollar spent on all purchases Airfare redemptions (2%) Cashback redemptions (1.5%) | 1 point for each dollar spent on all purchases Airfare redemptions (2%) Cashback redemptions (2%) |

How to apply for Mastercard® Luxury Gold card?

One point for each dollar spent on all purchases is just one of the benefits you can earn with the Mastercard® Luxury Gold credit card. Learn how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

QuicksilverOne Cash Rewards full review

Check out our QuicksilverOne Cash Rewards review and learn more about its benefits, such as cash back on all purchases and more!

Keep Reading

10 best cards that offer welcome bonuses

If you're looking for a new credit card, check out this list of the 10 best cards that offer welcome bonuses! Interested? Keep reading!

Keep Reading

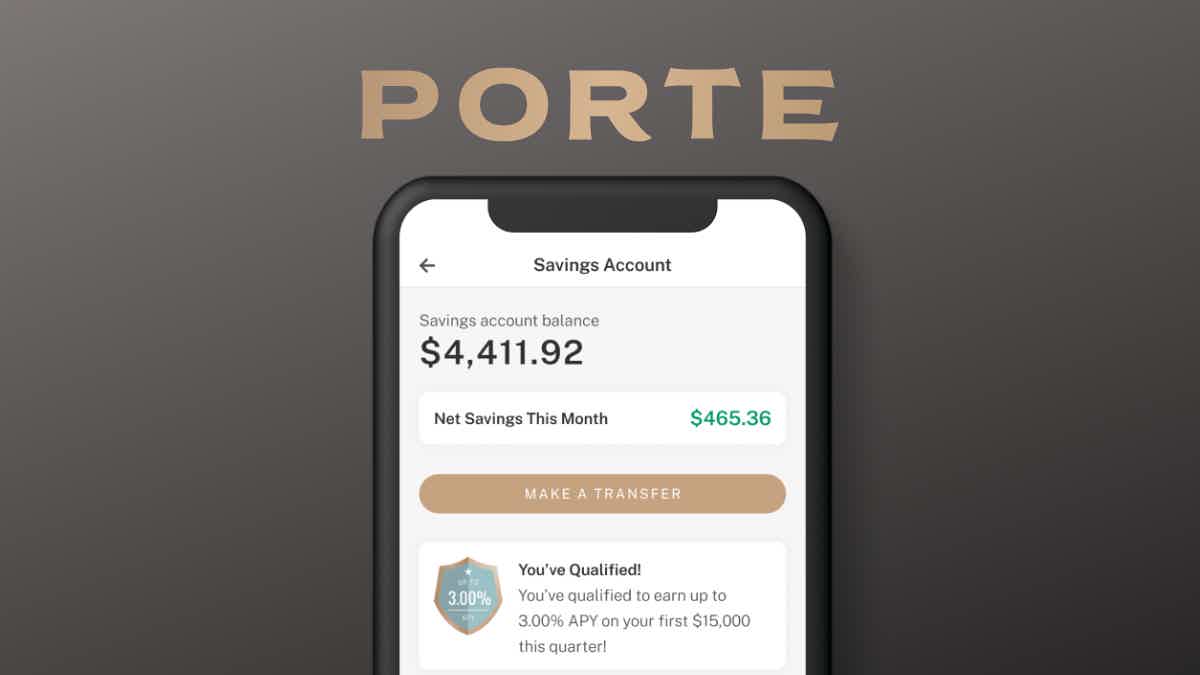

How to apply for the Porte Savings Account?

Find out how easy it is to apply for a Porte Savings Account and start earning up to 3.00% APY at no monthly service fees (conditions apply).

Keep ReadingYou may also like

Apply for SoFi Student Loans: up to 100% financing

Looking to secure your future with a SoFi Student Loan? Relax, we've got you covered. Read on and discover how to apply for this student loan - no fees!

Keep Reading

Bank of America Business Advantage Travel Rewards Card: apply today

Are you ready to earn points and travel more? Then apply for the Bank of America Business Advantage Travel Rewards Card today! Keep reading!

Keep Reading

How do travel credit cards work?

Have you ever asked yourself, "How do travel credit cards work"? If yes, you might want to check out this article. We will answer this question and tell you everything so you can make the most of your travels!

Keep Reading