Debit Cards (US)

How to apply for the GO2bank Visa Debit card?

Check out how easy it is to apply for a GO2bank Visa Debit card and take advantage of all its benefits and perks!

GO2bank Visa Debit card application

GO2bank is a digital bank under the Green Dot flagship. To get the GO2bank Visa Debit card, you need to open an account.

However, you may enjoy all the perks and benefits you can get by doing it.

The account is a hybrid checking and savings account with a high-yield rate. Also, it offers overdraft protection, access to free ATM networks nationwide, cash back on eligible purchases at partnered retailers, the possibility to receive early pay, and many other advantages to make your financial life simpler.

You can pick up the card at various retail stores, such as Seven Eleven, CVS, Dollar General, Dollar Tree, Albertsons, Family Dollar, Kroger, Safeway, Walmart, Walgreens, and Rite Aid.

Furthermore, you can use the card to deposit cash at retails nearby you.

Check out how to apply for the card and open the account.

Disclaimer: *Terms and conditions apply. Cards issued by GO2bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Overdraft fees may apply. Click Apply Now to learn more.

Apply online

Access the GO2bank website and click on Open an account. If you already got the card, you can click on Activate your card.

Then, fill in your email address, personal information, and home address.

Verify your information and wait for approval.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After opening your account, you can download the mobile app to check your finances.

GO2bank Visa debit card vs. SmartAccess Visa debit card

A GO2bank Visa card is a fantastic option if you want to have profound control of your finances through a simple tool.

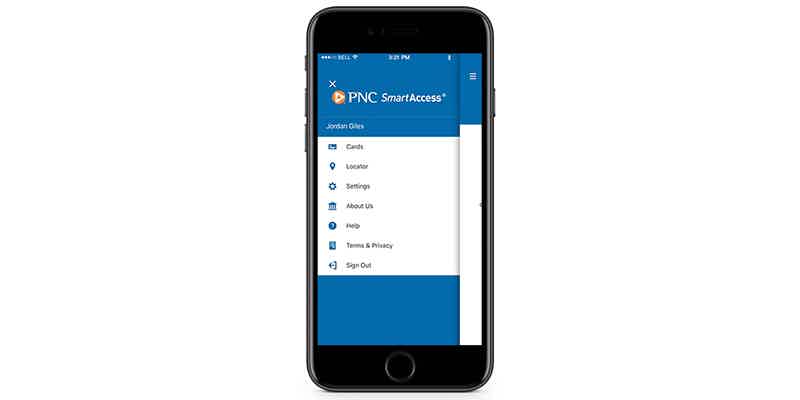

However, if you want another option for you, learn more about the SmartAccess Visa debit card.

| GO2bank Visa debit card | SmartAccess Visa debit card | |

| Credit Score | It does not apply | It does not apply |

| ATM Fees | $0 (through eligible direct deposit) | $5 monthly maintenance fee |

| Regular APR | It does not apply | It does not apply |

| Welcome bonus | None | None |

| Rewards | Up to 7% cash back by purchasing eGift Cards; 3% cash back by purchasing eGift Cards on Amazon. | None |

Learn how to apply for a SmartAccess Visa debit card.

How to apply for SmartAccess Visa debit card?

A SmartAccess Prepaid Visa Debit card offers convenience and security. Learn how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Acorns Visa™ Debit card review: Start investing!

Do you want to know how an incredible debit card with investment perks works? Then, read our Acorns Visa™ Debit card review!

Keep Reading

Funding Circle Business Loans review: find the loan you need!

If you need a hassle-free loan for your small business, read our Funding Circle Business Loans review to see this lender's perks!

Keep Reading

How to apply for the Mattress Firm Synchrony HOME™ Card ?

Learn how to apply for the Mattress Firm Synchrony HOME™ Card and get your bedding needs taken care of for life!

Keep ReadingYou may also like

Application for the Upgrade Bitcoin Rewards Visa®: how does it work?

Applying for an Upgrade Bitcoin Rewards Visa® is an excellent way to get your first Bitcoins or get more of them to your wallet. Learn how to apply for it and start benefiting.

Keep Reading

The most common myths about your credit score

Do you know what affects your credit score? Here are the most common credit score myths debunked to help you understand it and deal better with it. Keep reading!

Keep Reading

Types of investment accounts: learn the best for investors

Investing is essential, but there are many types of investment accounts. Want to learn more about them? So, read this article, and we'll tell you more about this topic.

Keep Reading