Reviews (US)

How to apply for the Flare Account® by Pathward, N.A.?

Are you looking for a prepaid card that offers you more convenience on purchases? See how to apply for the Flare Account® by Pathward, N.A.!

Flare Account® by Pathward, N.A. application process.

The Flare Account® by Pathward, N.A. gives you the convenience of holding a Visa debit card while enjoying some features like 24/7 accessibility to the mobile app, $0 required for direct deposit, and overdraft protection.

But note that it charges a monthly service fee and foreign transaction fee.

Also, there is no sign-up bonus.

If you think that it fits your needs, learn how to apply for it right away!

Apply online

Access the Flare Account® by Pathward, N.A. website and click on Get Started. Fill in the form with your personal information.

Then, the institution verifies your identity and approves your credential.

Finally, you receive your Visa card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can download the app after opening your account.

Flare Account® by Pathward, N.A. and One Finance account comparison

The Flare Account® provides you with a Visa prepaid debit card and some features that can be activated through the mobile app.

On the other hand, One Finance account offers you a high APY on a saving account. Also, you can have both a checking and saving account at the same time.

| Flare Account® | One Finance Account | |

| Intro Balance Transfer APR | N/A | N/A |

| Regular Balance Transfer APR | N/A | N/A |

| Balance Transfer Fee | N/A | N/A |

How to apply One Finance hybrid Account?

The One Finance hybrid Account allows you to save money with a high APY. See how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How is Gen Z is investing for retirement?

How gen z is investing for retirement? Maybe you've wondered this many times. Well, you can read on to find out how to get tips!

Keep Reading

How to trade in the ZenGo crypto wallet?

Learn how to trade in the ZenGo crypto wallet, one of the best and safest wallets available on the market nowadays. Find out all about it!

Keep Reading

How to apply for PenFed Credit Union Personal Loans?

If you need a loan for personal purposes like a wedding or to pay off debt, read on to apply for PenFed Credit Union Personal Loans!

Keep ReadingYou may also like

Aeroplan® Credit Card review: Up to 60,000 bonus points

Get an Air Canada's Aeroplan® Credit Card review. Earn up to 3X points on all purchasesa and 500 bonus points for every $2k spent in a calendar month!

Keep Reading

Learn to apply easily for LoanPionner

Follow this guide to apply for LoanPionner in just 3 steps. Borrow up to $5K for any purpose. Keep reading to learn more!

Keep Reading

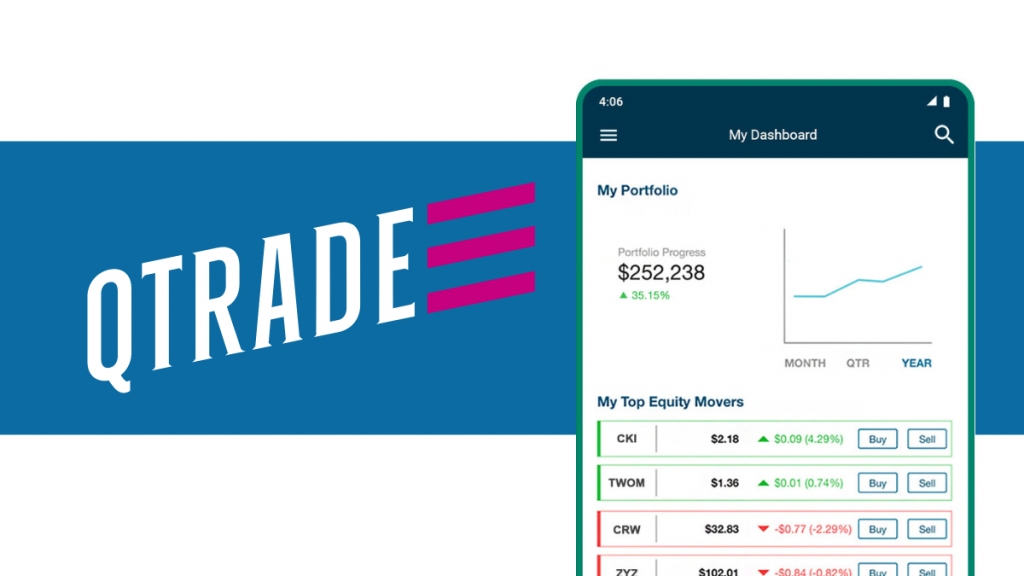

Qtrade Direct Investing Review: Build Your Wealth

Read our Qtrade Direct Investing review to learn about its top-notch customer service and intuitive trading platform. Ideal for both new and seasoned investors, Qtrade offers a streamlined experience for smart investment decisions.

Keep Reading