Account (US)

How to apply for the BlueVine checking account?

If you are a small business owner, you shouldn’t pay high fees or face banking barriers while managing your routine. So, learn how to open a BlueVine checking account.

BlueVine checking account application: open it for free and pay zero monthly fees

BlueVine offers banking solutions for small businesses. So, if you are an owner, you might enjoy all this BlueVine checking account has to offer.

Besides the fact that it doesn’t charge any monthly fees, the BlueVine account doesn’t require a minimum balance, there is no limit on transactions, and no ATM fees for over 37,000 MoneyPass® locations across the nation.

In addition, you can be eligible to earn interest. Also, the account allows you to add two sub-accounts, the same way it will enable you to share the access and delegate responsibilities.

You can access BlueVine through the app or web, and it can be a helpful tool for your business growth.

Therefore, check out how easy it is to open an account and start developing your business in the right direction.

Apply online

Access the official BlueVine website and select Business Checking tab. Then, click on Start Application.

The process is fast and free.

Then, select the entity type and fill in your personal information.

Also, you have to provide further information about your business.

Finally, conclude the process and submit the application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After signing up for the account, download the BlueVine app to log in to your newest account.

BlueVine checking account vs. First National Bank Freestyle checking account

Both accounts don’t charge any monthly fees and don’t require minimum balances. However, if you are a small business owner, you should consider a BlueVine checking account.

On the other hand, if you are looking for something personal, a First National Bank Lifestyle account might be worth checking.

If you want to go with a First National Bank Lifestyle checking account, check out how to apply for it in the next post.

How to apply for a FNB Lifestyle checking account?

Learn how to join the First National Bank Lifestyle checking account and enjoy the benefits.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Petal® 2 “Cash Back, No Fees” Visa® Credit Card?

The Petal® 2 "Cash Back, No Fees" Visa® Credit Card offers rewards and doesn't charge any kind of fees. So, check out how to apply!

Keep Reading

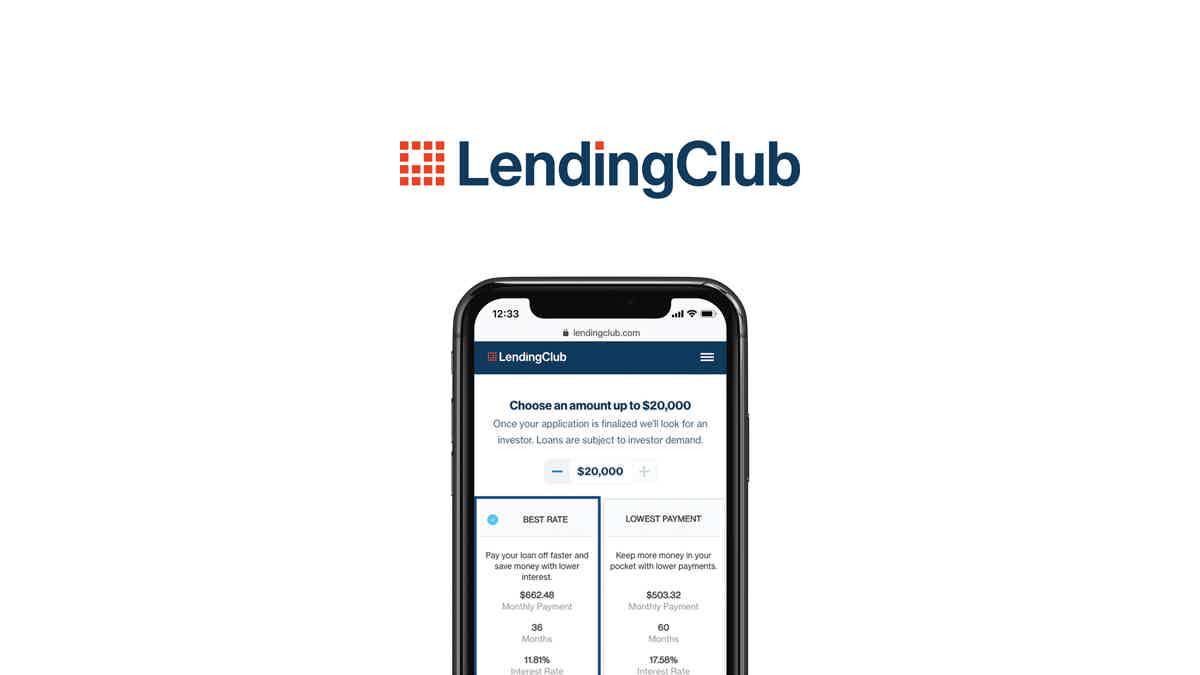

How to apply for the LendingClub Loan?

Applying for a LendingClub Loan is easy. Learn how to apply online and get your loan approved within a few minutes!

Keep ReadingThe Mister Finance recommendation – Marcus Personal Loans by Goldman Sachs review

Marcus Personal Loans by Goldman Sachs offers flexibility and affordability for those who need to consolidate debt. See the review and apply!

Keep ReadingYou may also like

LendingPoint Personal Loan review: how does it work and is it good?

Unsure if a personal loan is a right choice for your unexpected expenses? Read this LendingPoint Personal Loan review to learn how this product works, what rates you can expect, and more.

Keep Reading

Explore the steps to apply for My GM Rewards® Mastercard®

Maximize your GM loyalty benefits when you apply for the My GM Rewards® Mastercard® - ensure 0% intro APR for 12 months!

Keep Reading

How to buy cheap Breeze Airways flights

Planning a trip soon? Here's everything you need to know about finding cheap flights on Breeze Airways, from booking and loyalty programs to tips and tricks.

Keep Reading