Debit Cards (US)

Free debit cards for kids

We have selected the best free debit cards for kids! Check out the list!

Choose the best debit card for your kids: 10 free options

Have you heard about free debit cards for kids? In the past, parents needed to give cash to their kids in order to give them some kind of financial freedom and independence.

It was not a bad thing. People who could afford to do it had in their minds a way of teaching kids how to save and spend wisely.

How to apply for a Current Visa debit card?

Give your teen financial freedom with a Current Visa debit card! Check out how apply for it!

However, the process was not the best. Can you imagine having to cash out as many times as needed to give your kid money?

Then, cards were created, and convenience took place.

Now, there are debit cards for children. They offer an easy way for parents to teach their kids how to manage their money they allow parenting control and flexibility. Also, they provide tools for financial education.

Before accessing the list of the best free debit cards for kids, learn a little bit more about a card with a debit function.

Free debit cards for kids overview

Unlike credit cards, debit ones can be powerful tools to teach people how to manage money. They are payment tools, and instead of using cash to pay for things you need or want, you use debit.

You need to have enough money in an account to be able to use a debit card. So, unlike credit cards, it is difficult to lose control.

Therefore, debit cards are great for kids, and you can even find some of them for free. But, you must open an account first to receive the card.

Also, there are prepaid options, in which you must reload the card before using it. Both prepaid and debit cards are fantastic for children. Some give extra perks, too.

Now, find out the best ten cards available for kids and teens with their respective accounts.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

1. Chase First Banking

Chase First Banking is an amazing option for kids. It offers a free Visa debit card and a powerful mobile app featured by Greenlight.

Regarding this app, it provides robust control for parents, savings goals, and other customizable features that help the whole family to achieve a sustainable financial situation.

There is no minimum deposit to open the account, and Chase offers a wide range of ATM networks so your kids will count on flexibility, convenience, and security.

2. Capital One Money Teen Checking

Capital One offers a Mastercard debit card and an account with interest earnings. Even though the rate is not high, it lets your kids understand the importance of choosing an account with compound interest.

Also, Capital One provides one of the widest ATM networks in the US.

The app features parental control and some basic settings, too.

3. Nationwide First Checking

On the other hand, if your kids are a little bit older than twelve, the Nationwide First Checking might be worth considering.

It offers a free debit card, a mobile app with parental monitoring, interest earnings, and more.

Also, the minimum deposit is $50, and it reimburses ATM fees of up to $12 per month.

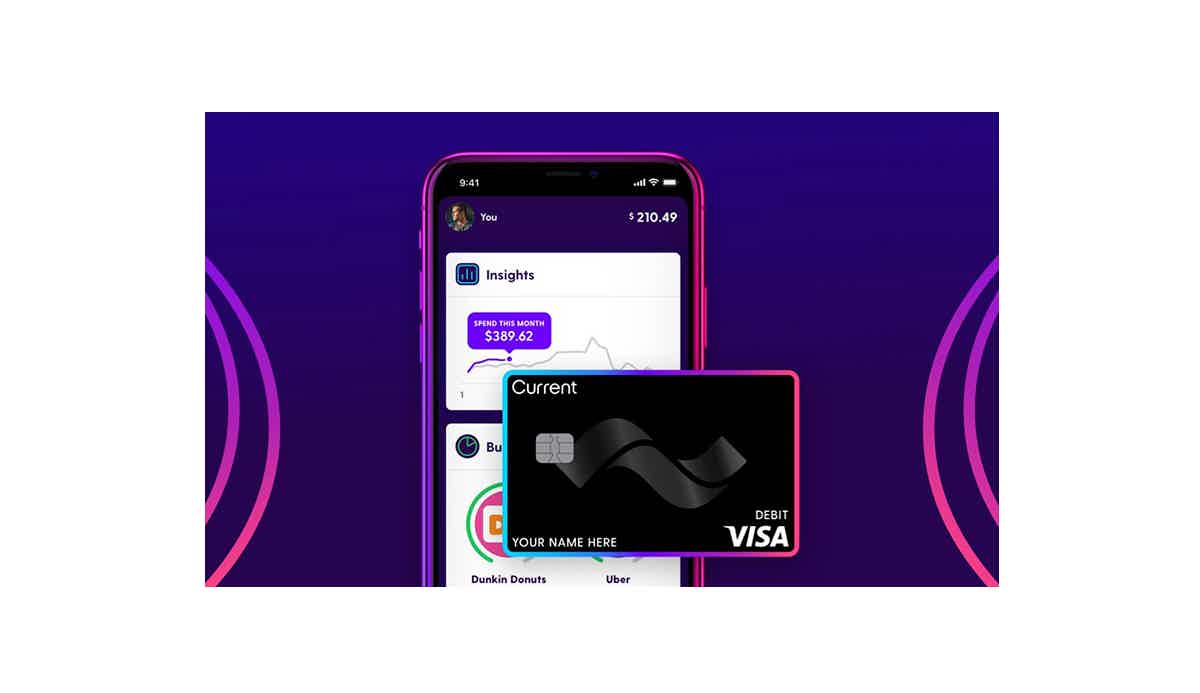

4. Current Teen Banking

Current Teen Banking offers a free prepaid Visa debit card with a mobile app full of features.

Besides parental monitoring, the app helps your kids to learn how to save money.

Furthermore, there are no fees associated with the account, and no minimum deposit is required to open it.

5. Copper Banking

Copper is one of the best overall. The account doesn’t require a minimum deposit to be opened, and it offers a free Mastercard debit card.

In addition, the app is fantastic.

It rewards kids for completing financial education videos and quizzes, and it encourages good habits regarding finances.

6. Axos First Checking

Axos offers a secure checking account for under seventeen’s.

Although it requires a minimum of $50 to open, it offers a free debit card and ATM fee reimbursement.

The app allows parental monitoring but not full control.

7. Step Banking

Step Banking offers a free Visa debit card that helps your kids safely build credit. It doesn’t require a minimum to open it.

The app lets the customer set savings goals, and the parents control it.

8. Jassby

However, if you are looking for a good reward program, Jassby is fantastic. It offers a virtual prepaid debit card, and there is no minimum deposit required.

Also, good financial habits lead to a score, and high scores lead to high rewards that can be redeemed for products.

9. Alliant Credit Union Teen Checking

Another good option is the Alliant Credit Union Teen Checking. It offers a free Visa debit card with a contactless option.

Plus, you can get access to more than 50,000 ATMs for free. The app allows parental monitoring, and the account is one of the best regarding interest earnings.

10. Famzoo

On the other hand, if you want an account that provides an excellent app, Famzoo might be worth considering.

Although the app is paid, it comes with a whole package of features to help your kids understand all about interest and finances. Plus, it allows parental control.

Also, the account comes with a free prepaid Mastercard debit card. But it requires a minimum of $5 to open.

What happens to your kids’ credit score when they turn 18 years old?

Financially speaking, it seems like we start existing when we turn 18 years old. Now we have responsibilities and have to respond for ourselves.

But what about our credit scores? What happens to it when we turn 18 years old? The following content has the answer. So, read on and find out!

What is your credit score when you turn 18?

When you turn 18, you can find out that your score is one of the most important things in your finances. So, read on to learn what your credit score is when turning 18!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Acorns Visa™ Debit card?

Are you looking for a debit card with more than a traditional account? Learn how to apply for the Acorns Visa™ Debit card to invest!

Keep Reading

How to apply for the Vernon First-time Buyers Mortgage?

Do you need a mortgage with good rates and terms? If so, read on to learn how to apply for the Vernon First-time Buyers Mortgage!

Keep Reading

10 best cards that offer welcome bonuses

If you're looking for a new credit card, check out this list of the 10 best cards that offer welcome bonuses! Interested? Keep reading!

Keep ReadingYou may also like

Costco Anywhere Visa® Card by Citi application: how does it work?

Do you want a credit Card to help you earn cash back at Costco? Read on to learn how you can make the application for the Costco Anywhere Visa® Card by Citi.

Keep Reading

Earn up to 4% back: Verizon Visa® Card Review

From earning cashback on everyday expenses to enjoying travel benefits, the Verizon Visa® Card has something for everyone. Have a look!

Keep Reading

Holiday shopping: 7 best credit card safety tips

Do you fear your money's safety while shopping online or even at stores? Read these tips to learn how to be safe when using your credit cards.

Keep Reading