US

FlexShopper Wallet review: Pay as you go!

Are you looking for a wallet to help you make your online purchases easily? If so, read our FlexShopper Wallet review to see the pros and cons!

FlexShopper Wallet: Shop online at your favorite stores!

If you’re looking for a convenient way to access your cash and shop online with confidence, then look no further than our FlexShopper Wallet review!

How to apply for the FlexShopper Wallet?

If you need a wallet to help you get a good spending limit for your purchases, read on to learn how to apply for the FlexShopper Wallet!

Moreover, this digital wallet offers the perfect solution to give you easy spending limits, lots of stored value options, and secure transactions while shopping at your favorite stores.

Also, whether you plan on buying items from big-box retailers or local boutiques, the flexibility offered by FlexShopper Wallet makes it one of the top choices!

In addition, you’ll not only be able to budget easily but also protect yourself from fraud.

Therefore, keep reading our FlexShopper Wallet review to learn more about how this wallet can be beneficial for online shoppers who are always on the go!

How does FlexShopper Wallet work?

The FlexShopper Wallet is a reliable and user-friendly electronic wallet and payment platform.

Moreover, the wallet may be used to shop at participating retailers, make and receive payments, and track spending.

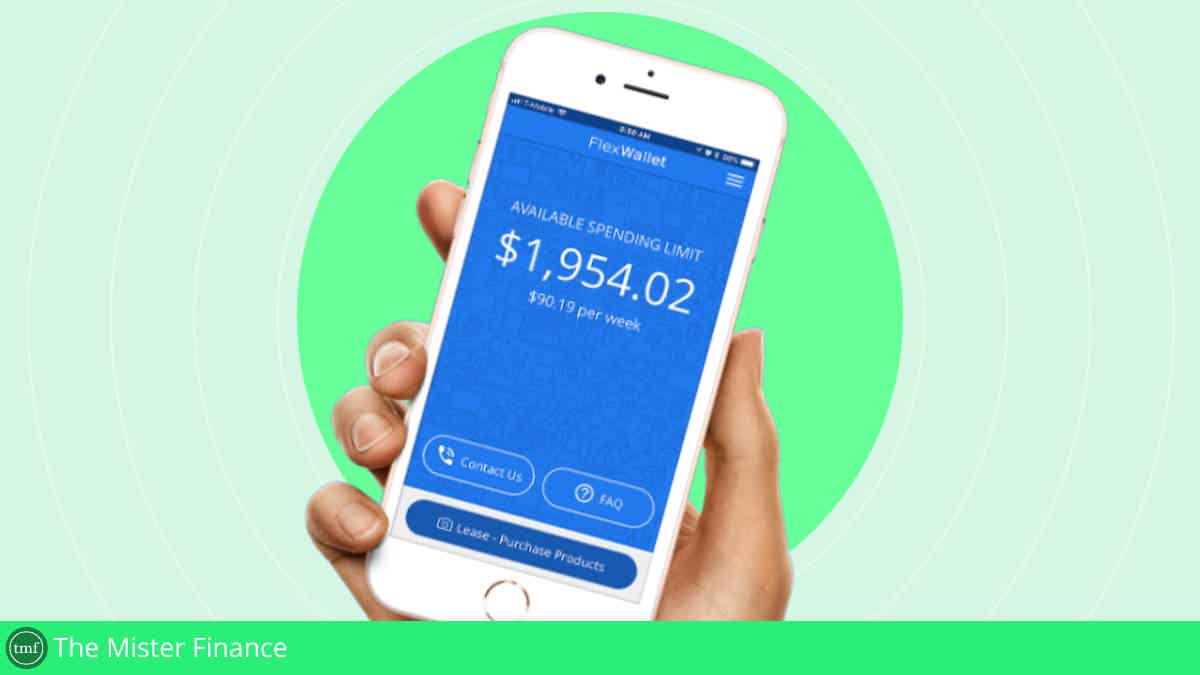

Also, after applying to use this platform, you’ll be able to get an instant decision! So, you’ll be able to see your spending limit if you’re approved!

In addition, this wallet offers an easy, secure way for you to buy your favorite products from hundreds of online stores without having to worry about spending limits.

Therefore, with just a few clicks, customers can buy what they need without having to worry about carrying cash or waiting in long lines at busy check-out counters.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

FlexShopper Wallet benefits

As you know, the FlexShopper Wallet can offer many good features for those who love to make purchases. Moreover, you can have a reasonable spending limit of up to $2,500.

Also, you’ll be able to make weekly payments, and there is no money down to apply!

However, as with any other product, there are some downsides. Therefore, read our pros and cons list below to learn more and see if this is the best choice for your finances!

Pros

- Relatively high spending limit of up to $2,500;

- You’ll be able to make weekly payments easily;

- You can download the app for free;

- Pay as you go feature;

- You can have the chance to qualify even with a not-so-good credit score.

Cons

- There s not much information about the fees you may need to pay to use this service.

How good does your credit score need to be?

One of the best perks about this product is that you don’t need to have a high credit score to have qualifying chances. Therefore, you’ll be able to have a chance to qualify even with a bad score.

However, not every applicant with a bad or poor score is accepted! Therefore, try to make sure you have a higher credit score to have more chances to qualify for this product!

How to apply for FlexShopper Wallet?

You can easily apply to start using this service! Also, you’ll be able to check the requirements on the official website!

However, you’ll need to download the app to complete your application and get an instant decision!

How to apply for the FlexShopper Wallet?

If you need a wallet to help you get a good spending limit for your purchases, read on to learn how to apply for the FlexShopper Wallet!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Marriott Bonvoy Bevy™ American Express® Card full review

This Marriott Bonvoy Bevy™ American Express® Card review gathers all you must know about this AMEX: costs, rewards, and more! Check it out!

Keep Reading

Lending For Bad Credit review: find a loan for bad credit

In this Lending For Bad Credit review article, you will learn how the online platform works and how to find a lender that accepts bad credit.

Keep Reading

Sable Account full review

Sable Account offers access to U.S. financial system regardless of your nationality. So, check out our Sable Account full review!

Keep ReadingYou may also like

The World of Hyatt Credit Card application: how does it work?

Learn how to apply for the World of Hyatt Credit Card. Earn points on every purchases! Up to 60,000 bonus points in the first 3 months! Read on!

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® application: how does it work?

You can make the application for a Citi® / AAdvantage® Executive World Elite Mastercard® with your cell phone. Discover who's eligible for this offer, and start earning miles as soon as possible. Read on!

Keep Reading

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Ready to level up your buying power? Apply for Marshland Visa® Credit Card and get rewarded for every purchase you make with cash back. Keep reading!

Keep Reading