Credit Cards (US)

First Progress Platinum Select Mastercard® Secured Credit Card full review

First Progress has great secured cards, and the First Progress Platinum Select MasterCard® Secured Credit Card is one of them. Read our full review to know more!

First Progress Platinum Select Mastercard® Secured Credit Card.

The First Progress Platinum Select Mastercard® Secured Credit Card is for those who need to build or rebuild their credit.

Also, this card is one of the three secured credit cards issued by First Progress. Moreover, if you apply for one of these three cards and get accepted, you will also be approved to get either of the other two cards.

In addition, either one of these credit cards requires a security deposit. Therefore, make sure that you can pay for the minimum deposit amount.

But even though there is a security deposit and an annual fee, this credit card sends your monthly payment reports to all three major credit bureaus.

And this can really help you build your damaged credit. So, if you want to learn more about the Select credit card by First Progress, keep reading this post!

| Credit Score | Poor, limited or no credit score. |

| Annual Fee | $39. |

| APR | Regular APR 18.74% (V); Cash Advance APR 24.74% (V). |

| Welcome bonus | This credit card does not offer a welcome bonus to its cardholders. |

| Rewards | 1% cash back rewards on your monthly payments. |

First Progress Select Mastercard®: how to apply?

Do you need to re-establish credit? If so, the First Progress Platinum Select Mastercard® Secured Credit Card is for you! Read more to know how to apply!

How does the First Progress Platinum Select Mastercard® Secured Credit Card work?

When you get approved to get this secured credit card, you have to pay a security deposit of at least $200. Also, this deposit is refundable and will be equal to your spending limit.

And even though you will have to pay an annual fee, there is no application fee, and it has a relatively low APR charge. Moreover, as this card has a Mastercard payment system, you can use it almost anywhere in the U.S.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First Progress Platinum Select Mastercard® Secured Credit Card benefits

Pros

- Earn 1% Cash Back Rewards on payments made to your First Progress Secured credit card account.

- No minimum credit history or credit score required!

- Imagine being rewarded for simply paying your bill each month.

- Accepted wherever Mastercard® is accepted, online and worldwide!

- Reports to all 3 major credit bureaus

- Manage your statements, transactions & rewards on-the-go with the First Progress Card Mobile App!

Cons

- This credit card does not offer any rewards or bonuses to its cardholders.

- This card charges a 3% foreign transaction fee.

How good does your credit score need to be?

As this is a secured credit card made for those with low or no credit score at all, you do not need a high score to apply. Also, if you have plans to build or rebuild your credit through a credit card, this card can really help you.

How to apply for a First Progress Platinum Select Mastercard® Secured Credit Card?

You can easily apply for this First Progress Platinum Select Mastercard® Secured Credit Card through the credit card company’s website.

So, if you want to know more information about how the application process works, check out our post below!

First Progress Select Mastercard®: how to apply?

Do you need to re-establish credit? If so, the First Progress Platinum Select Mastercard® Secured Credit Card is for you! Read more to know how to apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Chase College Checking Account review!

If you're a student looking for an account with benefits and no monthly fees, read our Chase Bank College Checking Account review!

Keep Reading

How to apply for CareCredit®: learn the application process

Find out how the CareCredit® application works, so you can have a great tool for you and your family to pay off your medical and pet bills.

Keep Reading

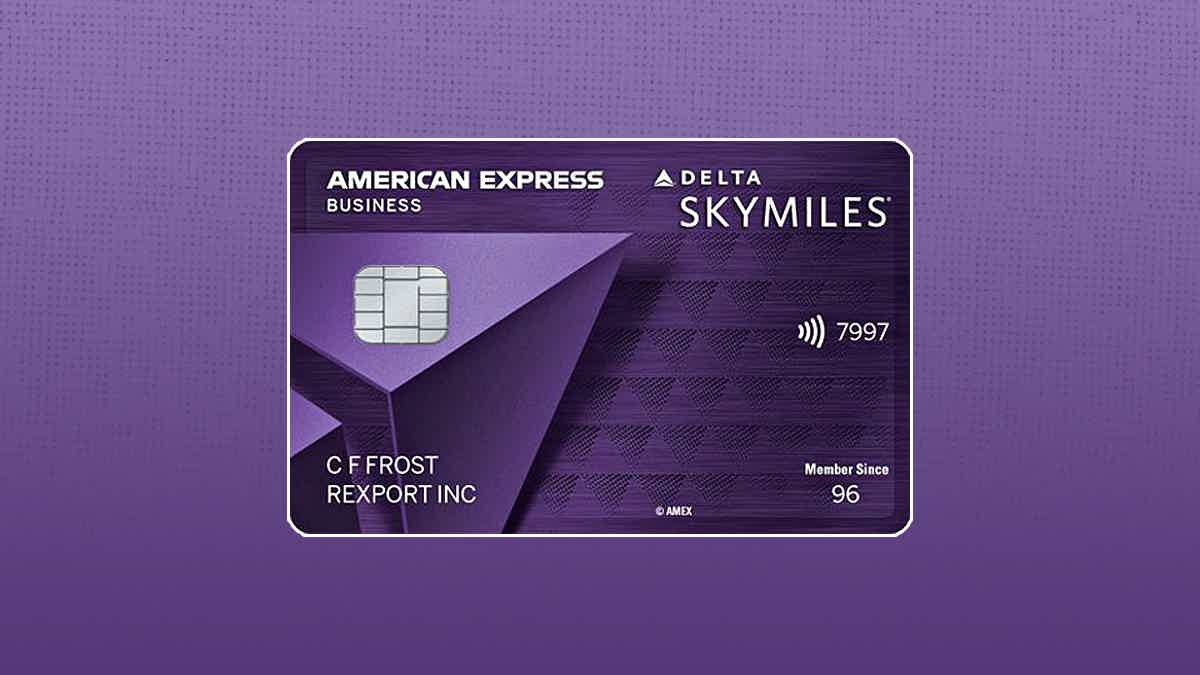

How do you get the Delta SkyMiles® Reserve Business American Express Card?

Do you want to know how to enjoy the amazing benefits of the Delta SkyMiles® Reserve Business American Express Card? Learn how to apply!

Keep ReadingYou may also like

Certificates of Deposit: what is and how does it work?

What is the best way to save your money for the future? Is it a savings account or a certificate of deposit? Read this article to find out if a certificate of deposit is the best for you.

Keep Reading

0% intro APR: Apply for the PNC Core® Visa® Credit Card

Get your PNC Core® Visa® Credit Card and apply hassle-free! Our streamlined explanation will walk you through every step, guaranteeing a successful application!

Keep Reading

How to start planning your retirement

Are you feeling overwhelmed when it comes to planning for retirement? Don't worry – with a little bit of effort, you can get on track for a fruitful future. In this article, we'll discuss some tips to make sure you’ll have a comfortable golden age . Keep reading to learn more!

Keep Reading