Finances (US)

First Internet Bank of Indiana full review: is it trustworthy?

Check out the First Internet Bank of Indiana review article to learn how this bank can be a helpful and powerful tool for your finances.

First Internet Bank of Indiana: many financial products and services to cover your needs

The First Internet Bank of Indiana is a digital bank and the first online bank FDIC-insured. Although it doesn’t offer physical branches, the bank provides humanly access to support and assistance. The financial institution offers a wide range of financial products and services, no matter if you are looking for tools for yourself or your business. All offerings are secure, simple, and accessible. Read our First Internet Bank of Indiana review to learn more about this fantastic institution.

Check out all the details right below!

| Financial products offered | Checking and savings accounts; accounts for kids; CDs; IRAs; Lending services; Credit cards; Mortgage; Services for businesses |

| Fees | Many accounts and other products have no fees, and others offer waivable-fee options based on some requirements |

| Minimum balance | Each account requires a minimum opening deposit, and a minimum balance is recommended to waive applied fees |

How to start banking with First Internet Bank?

Learn how to join the First Internet Bank of Indiana and feel peace of mind with complete coverage of your needs and goals.

How is banking with First Internet Bank of Indiana?

The First Internet Bank of Indiana or First Internet Bank offers many financial products and services for all kinds of needs and goals.

Even though the bank doesn’t offer physical branches, the customer is humanly attended by many ways of support, including email, chat, and telephone.

In general, the bank provides good products and services at competitive rates and fees. And it allows you to choose between free options and other waivable-fee options based on some criteria.

Also, the customer reviews are pretty good.

The bank is secure, accessible, and offers a vast ATM network for you to rely on.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First Internet Bank of Indiana experience: accounts, CDs, credit cards, and more

On the personal section, the bank features checking & savings accounts, as well as lending options and mortgages.

In summary, there are two options when it comes to checking accounts: a free checking and an interest checking account.

Firstly, the free checking option, even though it does not pay interest, doesn’t charge any monthly maintenance fee, and you can open it for only $25.

On the other hand, the Interest Checking pays interest based on a 0.30% rate. You can open it with a minimum deposit of $100.

Although it charges a $10 monthly maintenance fee, you can waive it by maintaining a minimum balance of $500.

All accounts come with a debit card, mobile access, and free first-order checks.

Also, in the savings section, you can choose between a free savings account and a Money Market Savings account.

The first option has no fees associated with it and pays interest on a 0.25% APY basis. The second option offers a 0.70% APY but requires a minimum $4,000 daily balance to avoid the $5 monthly fee.

Furthermore, the bank offers CDs ranging from 3 to 60 months and APY ranging from 0.35% to more than 2.70%, depending on the term chosen.

In addition, there are other services and products for both individual and business needs and goals, such as accounts for kids, IRAs, credit cards, loans, and much more.

Pros

- The bank offers a complete package of products and services with good rates at a low cost;

- It has a vast ATM network;

- Many accounts have no fees or allow you to waive fees;

- The credit card offers cash back with $0 annual fee.

Cons

- It doesn’t have physical branches.

Why should I choose First Internet Bank of Indiana?

If you want a vast range of financial products and services with competitive rates at a low cost, the First Internet Bank is definitely a powerful choice for you.

It offers options for all kinds of profiles, needs, and goals, whether you are looking for personal or business options.

How to start banking with First Internet Bank of Indiana?

Learn now how to start banking with First Internet Bank of Indiana by reading our step-by-step right on the next post!

How to start banking with First Internet Bank?

Learn how to join the First Internet Bank of Indiana and feel peace of mind with complete coverage of your needs and goals.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Three bank stocks worthy of your TFSA

Find out the best three bank stocks worthy of your TFSA among the Big Six Canadian bank stocks nowadays, and start buying to earn dividends.

Keep Reading

How to apply for the Capital One Quicksilver Rewards for Students card?

Capital One Quicksilver Rewards for Students card rewards all purchases and doesn’t charge you an annual fee. Check out how to apply for it!

Keep Reading

The Centurion® Card from American Express review

Ever wondered what it's like to have the world's best credit card? Read our The Centurion® Card from American Express review and find out!

Keep ReadingYou may also like

Home Depot Consumer Credit Card: Apply Now!

Get the full scoop on how to apply for the Home Depot Consumer Credit Card. Find out who is eligible and how this card stands against other options. Read on!

Keep Reading

How to start investing with Ally Invest?

Opening an account with Ally Invest is a simple process. In this article we’re going to show you how to do it. So read on and learn how to open your account!

Keep Reading

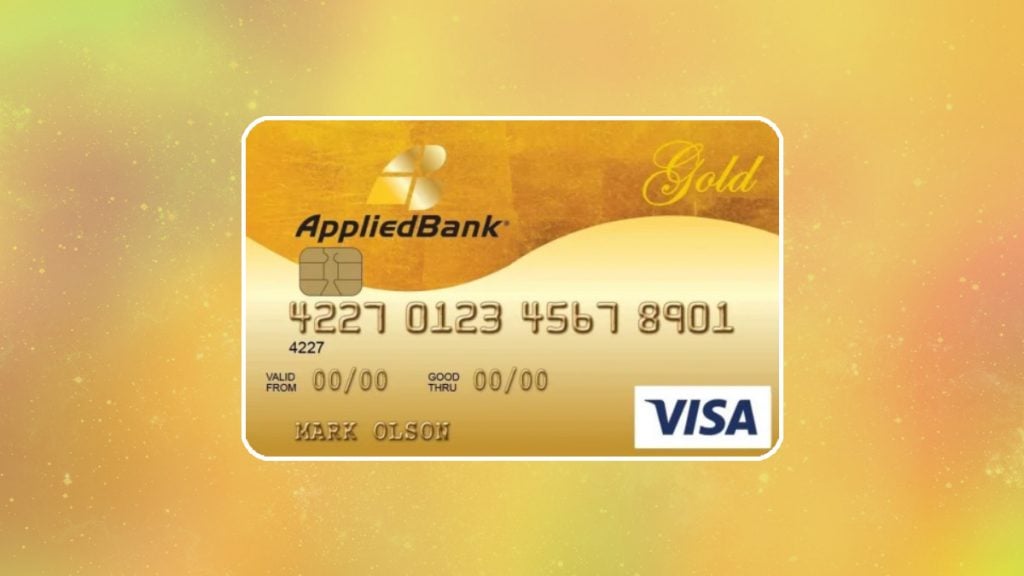

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Keep Reading